Last week Swissquote announced its H1 2015 financials. For the period, bottom line profits swung to a loss of $10.97 million (CHF10.6M) compared to a profit of over $11.38 million (CHF11M) in the same period in 2014. The culprit was a $21.2 million (CHF20.5M) one-off loss attributed to covering negative balances following the January 15th Swiss franc Volatility .

Today we take a closer look at the broker’s Forex unit which contributed a large part to the firm’s realized losses. Since acquiring MIG Bank in September 2013, Swissquote’s forex business has become a greater part of the overall broker’s business, composing 36.1% of the firm’s revenues in H1 2015. In addition, with a strong end of the year, Swissquote was able to surpass $100 billion in monthly volumes during Q4 2014.

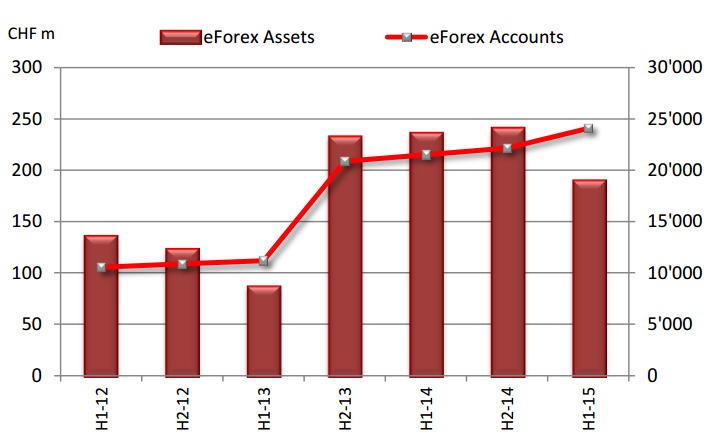

Accounts and clients assets

Source: Swissquote H1 2015 Presentation

As seen in the chart above, Swissquote experienced a steep decline in client assets within its forex division. During the half year, client assets ended at CHF189.9 million versus CHF 241 million at the end of 2014. The 21% decline can be attributed in part to client losses suffered on January 15th. In addition any client accounts denominated in currencies other saw their value depreciate against the Swiss franc during the quarter. Overall, the decline in client assets was specific to Swissquote’s forex division.

With client assets falling to their lowest level since Swissquote’s acquisition of MIG Bank, number of accounts added grew by the highest amount in that same period. During H1 2015, 1,926 new accounts were added compared to less than 1000 during both H1 2014 and H2 2014.

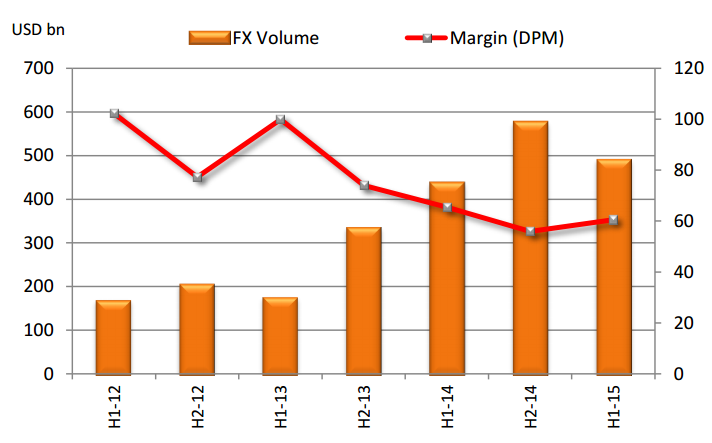

Volumes and revenue capture

Source: Swissquote H1 2015 Presentation

One the downside, trading volumes fell during H1 2015 compared to H2 2014. During the period, Swissquote averaged $81.7 billion in monthly volumes. The figure was well offer the $110 billion mark for Q4 2014, and the $96.1 billion monthly average for all of H2 2015.

On the bright side, according to Swissquote, revenue capture per million dollars traded (DPM) increased to $60.5. As seen in the chart above, DPM had been decreasing in the aftermath of Swissquote’s acquisition of MIG Bank. The decline isn’t surprising given the low revenue capture MIG Bank had experienced in 2012 and 2013, which ultimately led them to become a takeover candidate. Looking ahead, it will be interesting to see how much improvement in DPM Swissquote is able to achieve and whether it can climb back to the $70 to $100 level recorded prior to the acquisition of MIG Bank.