France’s financial market regulator, the Autorité des Marchés Financiers (AMF), has updated its periodic list of websites that “offer binary options trading, for which no authorized investment services provider could be clearly identified." The new list cancels and supersedes the previously published iteration on July 2nd, 2014.

The AMF recommends binary options customers to open accounts “only with financial institutions authorized to do business in France." The AMF also warns market participants that “any unauthorized intermediaries run the risk of criminal sanctions” and advises against “responding to offers from any broker on the published lists." Any financial intermediary offering or recommending investments must be on the list of financial institutions authorized to do business in France, as can be verified via www.regafi.fr.

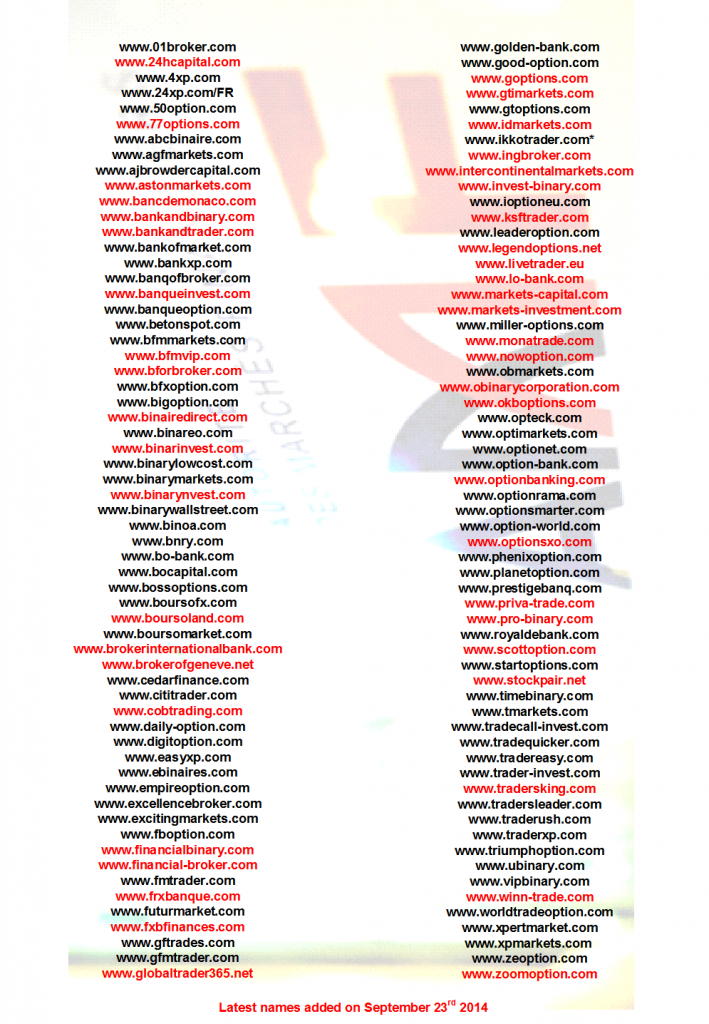

Full list of binary websites without authorized investment services provider | Source: AMF

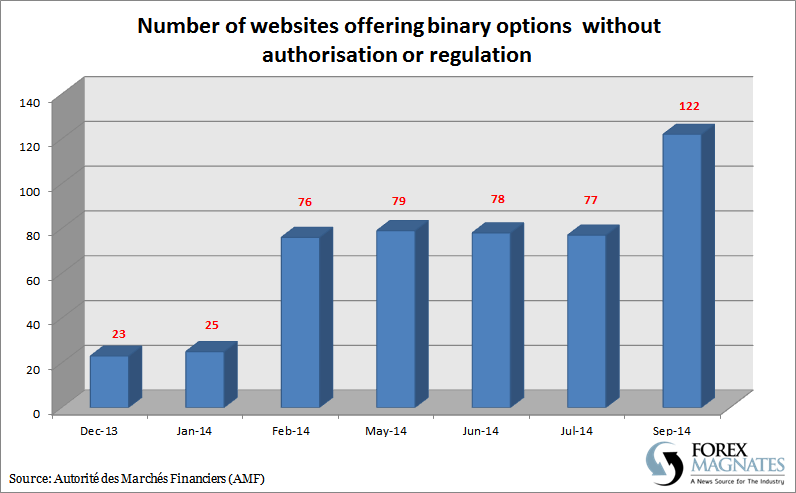

The number of websites listed has grown steadily since the AMF began maintaining periodic lists in late 2013, with sharp jumps in February 2014 and August-September 2014.

Since the previous publication in July this year, 45 new names have been added to the AMF list.

It’s clear that both aspiring binary options providers are not deterred from entering the financial market arena without Regulation or oversight, which underlines the frailties in the patchwork of global regulation that continues to incentivise regulatory arbitrage. Regulators can do very little aside from making public warnings, as many binary options websites and the firms operating them are based around the globe in territories that are not subject to rules or regulations.

Earlier this year in August, The Financial Services and Markets Authority (FSMA), the Belgian Watchdog, issued a public warning against the unauthorized activity of nine Forex and binary options providers, each of which had failed to comply with Belgian regulation. At the same time, a dozen Cypriot brokers were reportedly being closed down backed by a number of client complaints.

As recently as July this year, the AMF published a report on “mapping of risk and trends in the financial markets.” The regulator highlighted risks likely to weigh on financial stability, market organization and financing of the French economy. In a key finding, the AMF reported, “Financial institutions facing an economic environment that remains fragile face stronger prudential requirements and/or whose lack of coordination favors regulatory arbitrage."

In other words, when times are tough for brokers, applying for regulatory licenses may not be cost effective if clients are happy to open accounts regardless of whether regulation is present.