200 Swiss Francs, SPECIMEN

As the US labor day holiday is nearing, the foreign exchange market is gearing up for the first full scale trading week after the normally slow July and August months, usually the slowest months of the year. With a lot of Liquidity taken away from FX trading desks, we still witnessed some ranges broken during the past couple of weeks.

This year might have been a touch different in this respect, as many major G7 Forex ranges were broken during the “summer break,” and while there is no unanimity nor certainty on the matter, we could see August trading volumes being reported higher than July's at some brokerages.

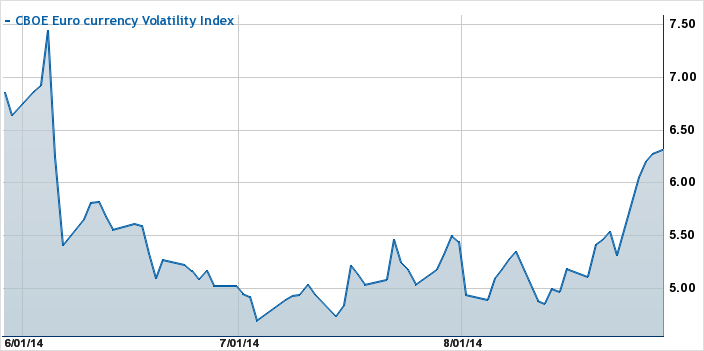

Starting on our analysis we will have a look at the trends over the past five years of the foreign exchange market's volatility, namely the EUR/USD pair, which is the most traded currency pair and then focus on the much less traded EUR/CHF.

EuroCurrency Volatility Index (EVZ), 5 Year Chart, Source: CBOE

This summer was quite different when compared to previous periods of calm across the financial markets spectrum. While the forex market volatility, namely involving G7 counterparts, has been mildly continuing its downward trajectory, we are seeing some signs of a turnaround in recent weeks.

EuroCurrency Volatility Index (EVZ), 3 Months Chart, Source: CBOE

As the S&P 500 reaches previously unseen levels and having closed at above 2,000 points for the first time in history on Wednesday, alarm bells are starting to ring across multiple- asset classes. While gold prices and stocks have been ignoring the rise of geopolitical tensions over the last couple of months, during the final week of August they have somewhat stabilized.

Tensions Between Russia and Ukraine Are Escalating

Focusing on the escalating geopolitical tensions, we should outline the sharp change in tone in statements made by officials today regarding the Ukrainian-Russian conflict. According to NATO, Russian troops have entered Western Ukraine - an increased likelihood of yet another round of sanctions has markets worried.

Polish Foreign Minister Sikorski called Russian troops movement “aggression,” and qualified the situation as “the most serious security crisis in decades." At the same time, speaking in Paris, German Finance Minister Wolfgang Schaeuble said, “Geopolitical risks are playing an important factor now.”

We can only agree with Mr. Schaeuble on this point, and according to the latest moves on the foreign exchange market, some flows are showing a shift in one of the important indicators of stability across the forex market.

The deep pockets of European savers are shuffling once more and resorting to one of their all-time favorite safe havens.

The Euro Swiss Franc Exchange Rate at Its Lowest Since December 2012

The EUR/CHF exchange rate has been a favorite risk metric among FX traders ever since the financial crisis erupted in 2008. At the time, safe haven demand boosted the Swiss currency to all-time highs, forcing the Swiss National Bank to commit to a floor exchange rate against the euro.

Euro to the Swiss Franc, August 2014, Source: NetDania

Brussels-based economist at ING, Julien Manceaux, said, “Tensions have re-appeared and they must be more on alert than nine or twelve months ago. If things were to deteriorate further, other types of unconventional policies may be taken by the SNB.”

Zurich Bank J Safra Saracen economist, Alessandro Bee, commented, “The situation isn’t comparable to 2012. If there is QE, the Swiss won’t be so much in the center of it all- investors will be able to look for assets like the US dollar and the British pound that offer safety and yields.”

Commerzbank's analytic team said, “The likelihood of the ECB taking further measures is increasing, this is exerting downward pressure on the Euro/Swiss franc.”

Historically, the Swiss franc has been one of the ultimate safe havens due to the unique position of the country as a banking center and the relatively large share of gold reserves on the SNB’s balance sheet. However, the pressure on the exchange rate grows every time European savers lose confidence in the soundness of the European financial system.

According to a Reuters poll published on Thursday, the majority of economists say the ECB is likely to conduct QE (quantitative easing) by March 2015, and there is a 75% chance of the ECB using ABSs (Asset-Backed Securities) to exercise it.

Oil & Gold Prices Stop Falling This Week

Another indication that there is scope for a reversal in risk sentiment is that oil prices have ceased to fall. Commerzbank’s Corporates & Markets highlights, “Oil prices appear to have bottomed out now following the sharp falls in recent weeks.”

While the German bank stated that one of the major contributing factors could have been the pull back of financial investors from the market, it concluded, “The pessimistic sentiment in the oil markets can also shift quickly again given the numerous sources of geopolitical crisis."

Gold Price Chart, August 2014, Source: NetDania

The same source addresses gold price developments stating, “Numerous sources of geopolitical crisis are preventing the gold price from slumping.” Last week, the precious metal did hit its lowest level since the middle of July - an event which supports the case that investors have been looking for riskier assets.

Looking Ahead to a Vibrant Forex Market

Mr. Market has long been ignoring the rising geopolitical tensions - for how long can this continue? Mr. Market delivered the lowest FX volatility in 21 years, is marking new lows sustainable in the long run? Mr. Market is slowly waking up to the reality of divergent monetary policies across the Atlantic, finally…

In the opinion of the author of this article, we are preparing for one hell of a market in the final quarter of 2014. Buckle your seat belts, spring-summer 2014 is over next Tuesday.