October retail trading metrics brought an impressive turnaround. After a dull September, this time key metrics skyrocketed. Finance Magnates’ Intelligence Department reviews industry changes based on the latest data from CPattern.

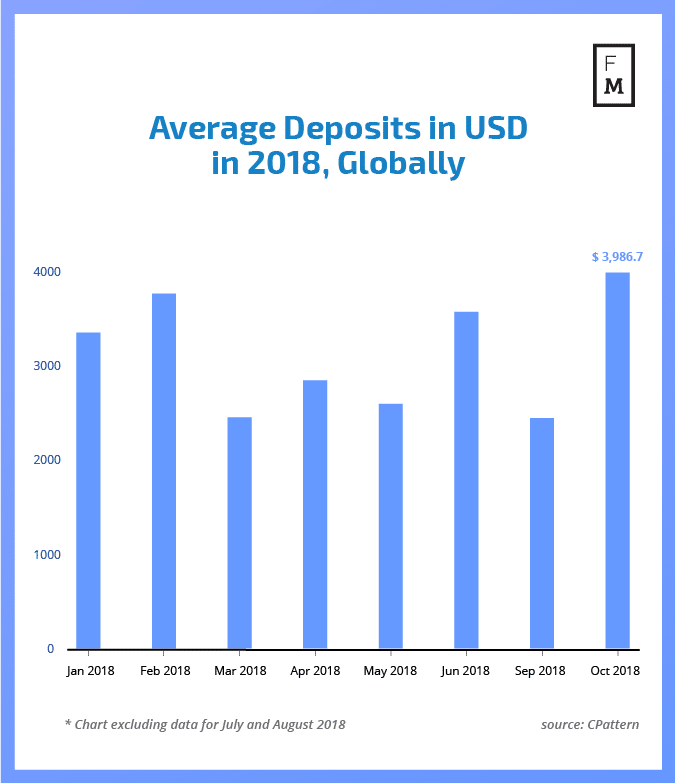

In our previous analysis of September data, we noticed unusually low overall activity of retail traders. Much to everyone's surprise, October data showed a revival of some of the key metrics. The size of the average deposit being sent by traders to accounts grew to $3,986.70. This marks an increase of 63 percent over the low September numbers.

The turnaround in October saw the average deposit value surpass February's high of $3,763.90. This year’s third-best month in terms of deposit size was June with an average of $3,570.40. Since the final quarter of the year usually brings about a slowdown in numbers, it will be interesting to observe the trend in the coming months.

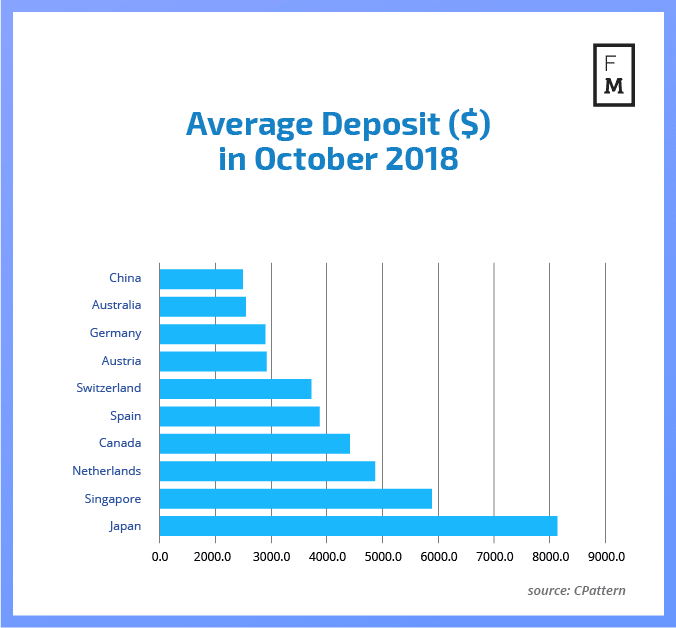

Asia Leads the Pack

Interestingly, the biggest growth in terms of deposits was registered in Asia. Japan was leading the rankings in October with the average size of deposited funds standing at $8,973.20. Following in second place was Singapore with average deposits of $6,135.70. China was the backmarker of October’s top 10 with an average deposit of $1,868.68.

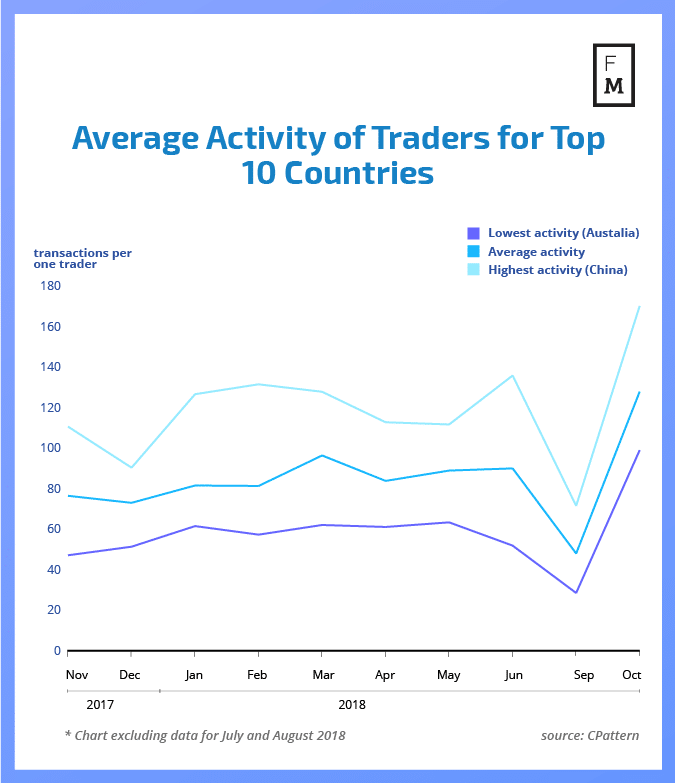

The change in mood in the retail industry could also be observed in the activity of traders. The average number of transactions being conducted grew to the highest levels this year. The most active traders could be found in China, where the average trader performed an astonishing 166 trades. Among the ten most active countries, Australian traders held the last place in our activity ranking with a mere 95 trades.

This growing dominance of the Asian market in the global Forex landscape will be one of the topics discussed at the upcoming IFX Expo Asia 2019. The event, taking place in Hong Kong on January 22-24, is one of Asia's largest financial conferences, will cater to all elements of the forex industry, as well as banks, affiliates, introducing brokers, and white label partners

This is the latest publication from the FM Indices – a new cross-industry benchmark. In today’s business world, big-data analysis and access to objective information sources are crucial for success. Unfortunately, until now, it has been challenging and costly, if possible at all, to find any reliable benchmarks for operations in social media, Cryptocurrencies , Forex, and CFDs trading.

For this reason, the Finance Magnates Intelligence Department has launched a new project, creating a set of indices encompassing various aspects of the online trading industry. These indices will provide you with unique data points gathered by our analysts, that will serve as a valuable knowledge base for your decision making.