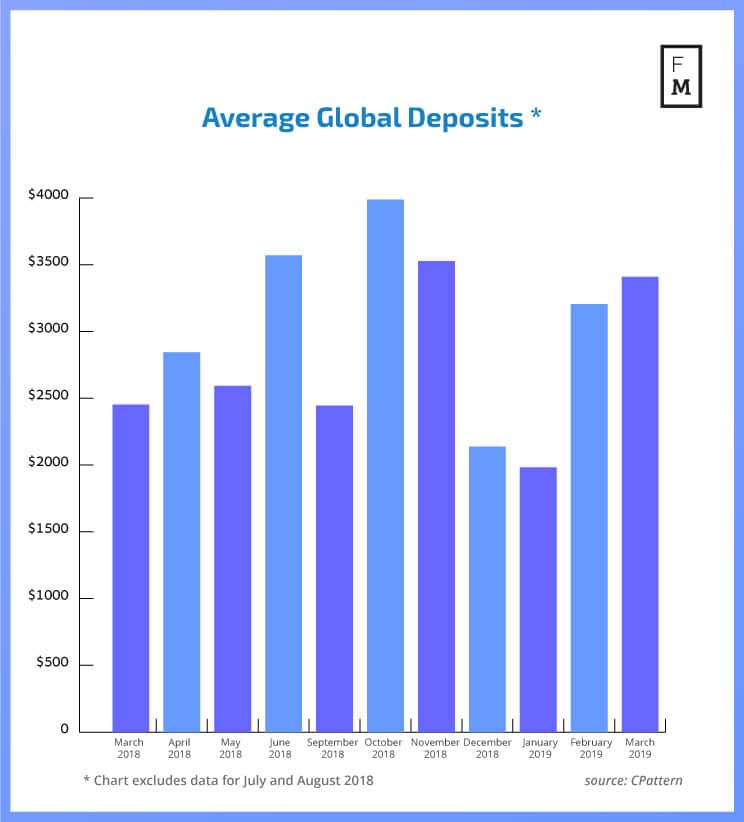

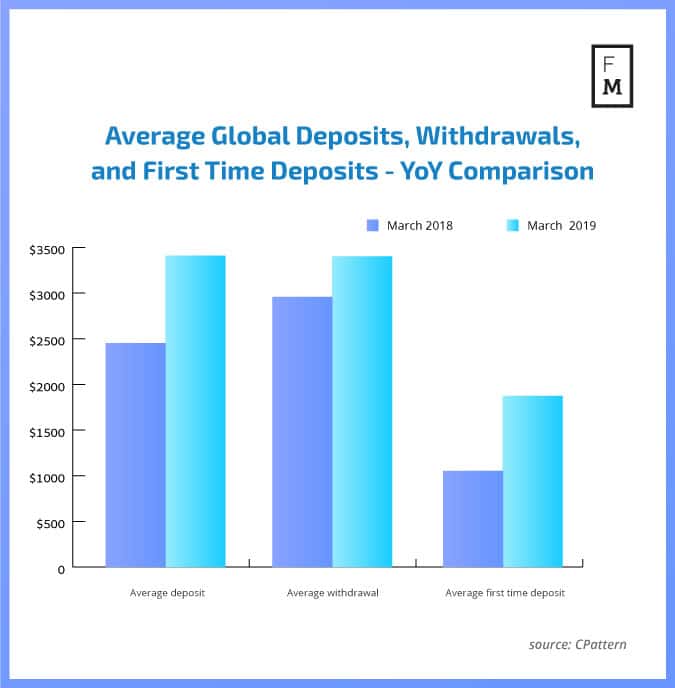

After solid February data, the industry remains in good condition in March. Most recent data from CPattern revealed by Finance Magnates Intelligence shows improvements in both the size of average monthly deposits and initial first-time deposits.

According to March data, the value of the average global deposit grew to $3,410 from $3,205. While the growth rate is relatively small, it reaffirms the positive sentiment left by February data, which makes this development more than just a one time spike in value.

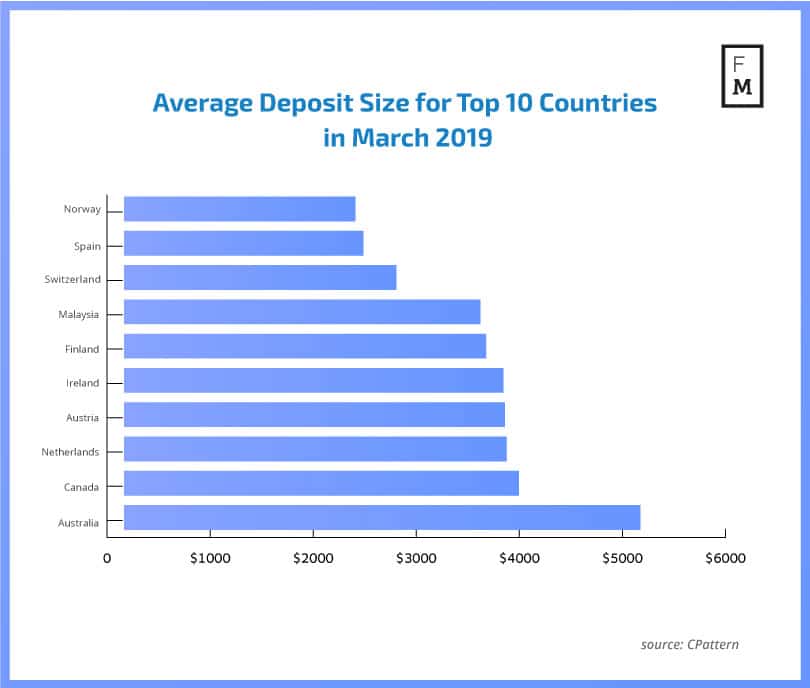

The best-performing country in this regard was Australia, with an average deposit size of $5,009 in March. That put Down Under far ahead of Canada in second place, which saw an average deposit size at $3,829. Norway closed top 10 Rank with a result of $2,242.

That is not the only good news for Australia. In recent quarters the Australian market profited on the back of European brokers, who have been registering weaker performances due to ESMA restrictions. Back in March, Finance Magnates informed you, our dear reader, about growing volumes among Australian brokers.

Apart from the higher deposit sizes, March also brought an increase in terms of first-time deposit and withdrawal size. Compared to March 2018, the average deposit size grew to $3,410.1 from $2,452.1. Meanwhile, the value of the first time deposit grew from $1,054.4 to $1,875.5. That was an impressive increase of 77 percent.

Australia preparing for changes

How long the current positive atmosphere will last for Australia remains to be seen. In April, Finance Magnates reported that the Australian parliament passed the Product Intervention Law. The ASIC is getting the same powers that ESMA has in Europe, but firms may have up to two years for implementation.

This is the latest publication from the FM Indices – a new cross-industry benchmark. In today’s business world, big-data analysis and access to objective information sources are crucial for success. Unfortunately, until now, it has been challenging and costly, if possible at all, to find any reliable benchmarks for operations in social media, Cryptocurrencies , Forex , and CFDs trading.

For this reason, the Finance Magnates Intelligence Department has launched a new project, creating a set of indices encompassing various aspects of the online trading industry. These indices will provide you with unique data points gathered by our analysts, that will serve as a valuable knowledge base for your decision making.