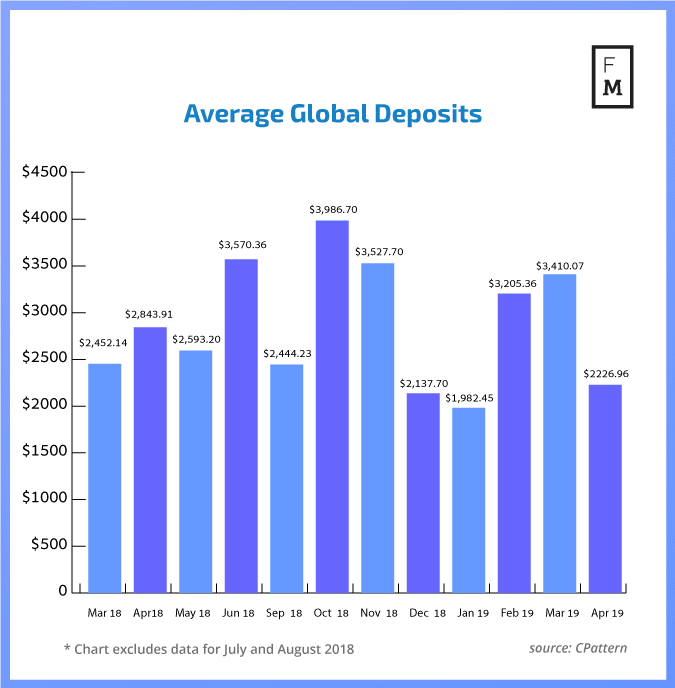

The first quarter of the year is far behind us. April data from CPattern revealed by Finance Magnates Intelligence show some further improvement but also signal the upcoming summer period. Asian traders remain most active so far.

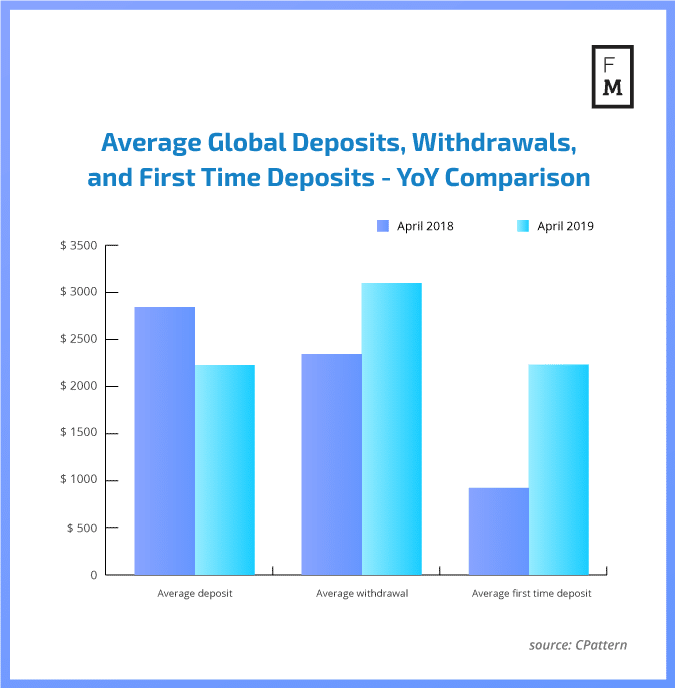

Most recent data reveal that the average global deposit value being sent to trading accounts decreased to $2,226 from $3,410 in March. That is a visible change and may signal that the upcoming summer period will mean lower deposits and lower activity.

April data was, however, better than last year's when it comes to first-time deposits. Despite the average deposit being lower, the value of the average first-time deposit grew in April 2019 to $2,232 from $923 seen in April 2018.

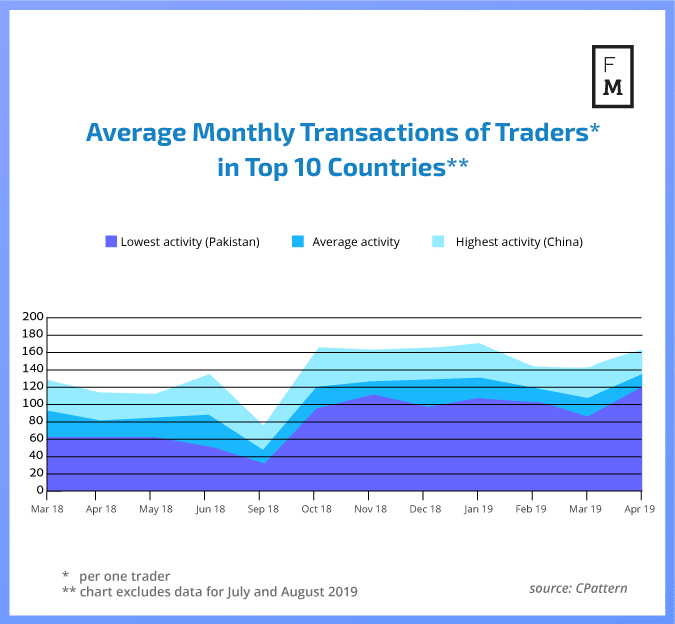

When it comes to traders activity, we saw an overall improvement. The average global activity rate for one trader increased to 134.7 transactions per month, from 107.7 in March. Also, the highest activity recorded by China surged to 163.8 transactions from 146.4.

Asian traders leading

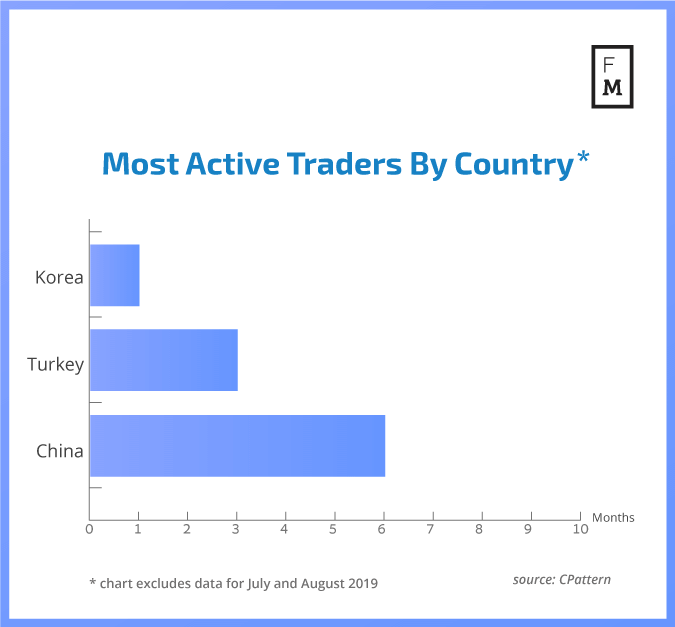

Interesting conclusions can be drawn when we analyze the last ten months of trading activity. The last chart shows in how many months any given country was in the first position in our activity ranking. Chinese traders dominated the rankings and registered the highest monthly activity 60 percent of the time during the last ten months. Turkey was second in the rankings, taking first place 30 percent of the time.

This is the latest publication from the FM Indices – a new cross-industry benchmark. In today’s business world, big-data analysis and access to objective information sources are crucial for success. Unfortunately, until now, it has been challenging and costly, if possible at all, to find any reliable benchmarks for operations in social media, Cryptocurrencies , Forex , and CFDs trading.

For this reason, the Finance Magnates Intelligence Department has launched a new project, creating a set of indices encompassing various aspects of the online trading industry. These indices will provide you with unique data points gathered by our analysts, that will serve as a valuable knowledge base for your decision making.