The final month of 2021 brought an awaited slowdown in raising forex deposits. Finance Magnates Intelligence took a look at the December 2021 data, provided by cPattern. What are the conclusions and the annual summary?

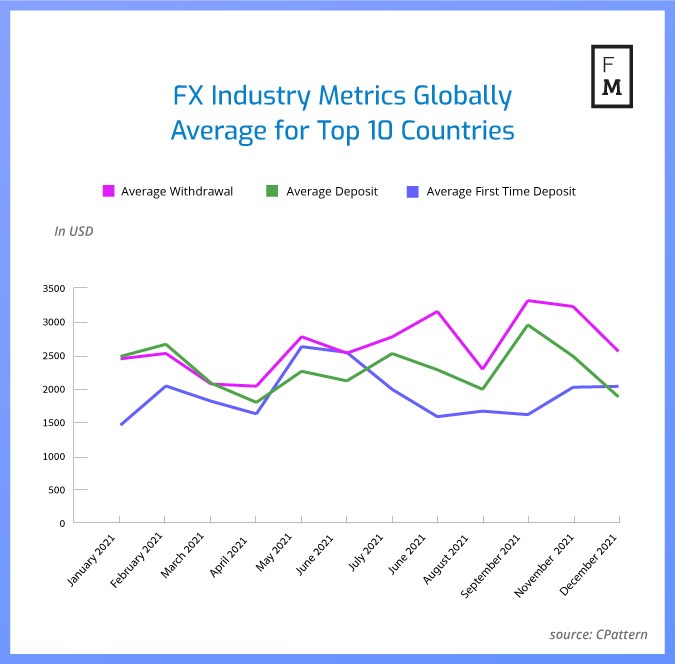

First of all, December was the second straight month of decline for the average total deposits made in a month by average retail traders (for the top 10 countries in each category). This time it was $13,257 on average, which is down from $13,668 deposited in November. Still, it was the 3rd highest result in 2021.

A similar trend was observed throughout the year for withdrawals. However, here December brought further growth to a level of $9,341 from $8,234, which was seen in November. This means that the average sum of withdrawals per trader in a whole month was the highest in the whole of 2021. At the same time, it was almost twice the amount of a total monthly withdrawal in February 2021 at $4,919.

Net Forex Deposits in 2021

When we look at the annual numbers for NET deposits in 2021, we can see that the net deposit has been fluctuating from over $3,000 to $6,000. In December, the net deposit value was lower at $3,916. This probably means that the first few months of 2022 brought a rebound, resulting in higher deposits and lower withdrawals.

When it comes to the trading activity of retail traders, it was China again leading the market. On average, each Chinese trader made 272 transactions in December 2021. Throughout the entire year, traders from China were the most active in nine months. Only on three occasions last year, traders from other countries were more active. A large number of transactions seems to be a never-changing characteristic of Chinese retail FX traders.

Finance Magnates Intelligence will be monitoring industry activity in the upcoming months. Stay tuned for more industry-related research, or reach us directly for additional research requests.