Starting from Wednesday evening, the United Kingdom is set to have a new Prime Minister - Theresa May. David Cameron has announced that he will be relinquishing his position later this week as Mrs May has clinched the Conservative party elections after Andrea Leadsom announced this morning that she is out of the race.

The leadership position of Theresa May is welcomed by the markets and the period of uncertainty which was set to continue into September was avoided for now. But what has really changed for the United Kingdom with the election of the new Conservative leader? How is the country aiming to negotiate its exit from the European Union?

Theresa May’s Negotiating Points

Across her various media appearances in recent weeks we have managed to get a glimpse of the positions of Theresa May on a number of issues. Despite being a supporter of the Remain camp just like David Cameron, she is fully committed to adhering to the popular vote at the referendum on the U.K.’s membership in the E.U..

That said, she has been more balanced in her views on a number of issues - the timing of the invoking of Article 50, which is the key decision which the U.K. has to make in order to start the exit process has been one of the main points. According to Theresa May, the formal procedure should be started not before the end of 2016.

While Mrs May has excluded the option of another referendum or a snap general election, there is plenty of time until the end of the year. The fiscal stance of Theresa May is to avoid raising taxes, and to end the government's commitment to a fiscal surplus.

Theresa May is likely to want to flesh out the UK’s objectives for exit negotiations before invoking Article 50

Looking at the key points about the negotiating strategy of the soon-to-become British Prime Minister we can identify some key points. Mrs May is for ending the free movement of people, she wants to maintain free trade of goods and services between the UK and the member states of the European Union.

Commenting in a recent research note, Barclays analysts have stated: “In our view, she is likely to still want to flesh out the UK’s objectives for exit negotiations before invoking Article 50.”

In addition Mrs May has stated that her government would not commit to guaranteeing the rights of EU citizens in the UK, unless rights of UK citizens in the EU are guaranteed.

With the new government in place by the end of the month, a swift move towards a comprehensive strategy, which has been of May’s key points, could lead to stabilization of equity markets in the short term. The latter doesn’t mean that the British pound will be somehow magically stabilized, this task rather hinges on the policy decisions of the Bank of England.

Key Free Trade Deal Challenges for the New UK PM

Theresa May is strongly committing to two key points - maintaining free trade of goods and services between the UK and the EU, and the “non-negotiable” ending of free movement of people.

If the existing agreements between the European non-EU member countries and the EU are any cue however, the value of a free trade agreement is free movement of people and budgetary contributions.

Norway is depending on its exports to the EU and pays to the European Union budget 85 per cent of what a member country of its size would. Switzerland is only contributing 40 per cent, however it has a free trade agreements only when it comes to goods.

What about the Financial Industry?

Looking at the financial services industry which is instrumental to the UK economy, Theresa May’s position that a full goods and services free trade deal is a must makes sense. That said however, Switzerland’s financial sector which doesn’t have a free EU trade deal has not been impaired in any way by the lack of a free trade deal in the service sector.

In fact, the Swiss banking sector is still vibrant despite the headaches that the country’s industry has faced in recent decades as its banking secrecy laws came under international scrutiny.

The main strength of the U.K. and Switzerland is the financial regulatory framework which these countries have. The U.K. Financial Conduct Authority and the Swiss Financial Market Supervisory Authority are two of the most respected regulators in the world, with no European challenger in sight.

Negotiations with Brussels are likely to be very tough. While the free movement of people is non-negotiable, unlike Norway and Switzerland, the United Kingdom has a negative trade balance, and a big one at that.

The UK is the 5th largest importer in the world with a total of $420 billion worth of goods being imported from the European Union annually. One doesn’t want to lose such a big customer this quickly, so Brussels may have to rethink its tough line against the United Kingdom.

Theresa May and the 'Art of The Deal'

As funny as it may sound, Theresa May is facing a Donald Trump moment - she simply needs to somehow negotiate a better deal. While Mr Trump goes far with his promises about Mexico paying for a border wall, Theresa May will 'simply' have to convince the European Union that free trade with the United Kingdom will be equally beneficial for both parties.

The United Kingdom is likely to continue having a negative trade balance with the European Union for the foreseeable future. This status quo has lasted for years, and the negotiations could go well.

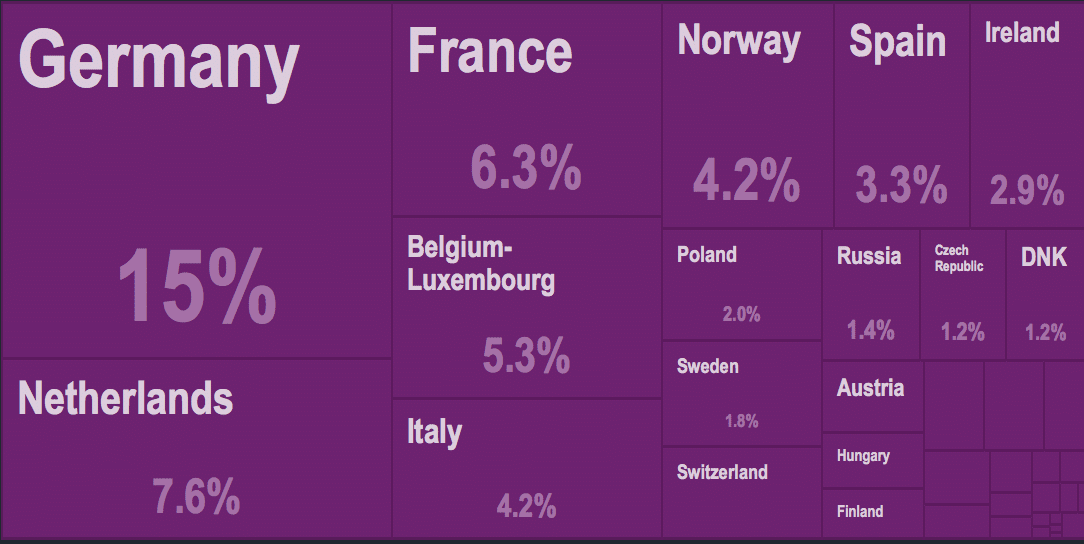

The main question, how tough are European leaders willing to be on the secessionists from U.K? The answer could be lying in the trade flow numbers of some major European economies with the United Kingdom on the chart below.

Countries with the biggest share of exports to the UK, the total figure is $420 billion, Source: MIT