This does not often happen, but it looks like the summer of 2021 is going to be hotter than usual. Finance Magnates Intelligence looked into the May data from cPattern, finding an unusual rebound. Will the FX industry see more activity from the retail traders or the opposite?

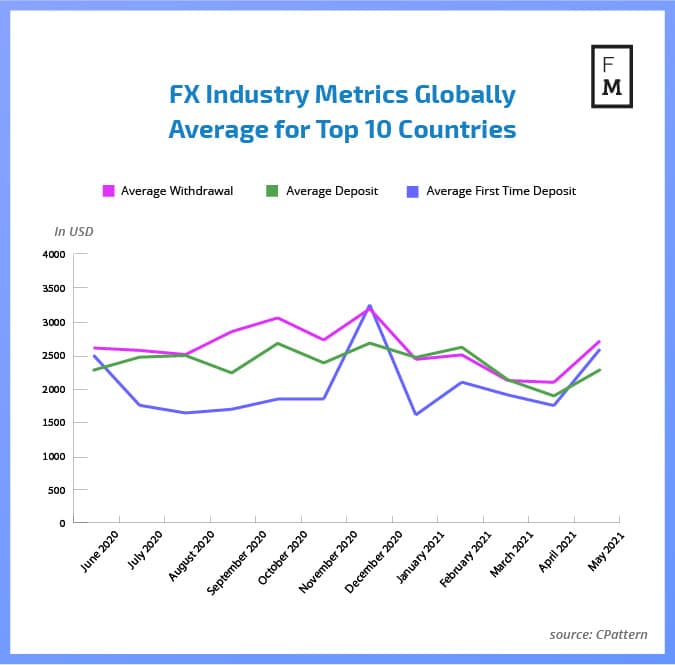

The Key industry metrics analyzed by us periodically showed an increase in all three indicators. In May, the average deposit, withdrawal and first-time deposit (FTD) grew to the highest levels in recent months. The average single deposit size was $2312, which was the highest value since February 2021. The average single withdrawal also increased to $2773 from $2112 seen in April. At the same time, it was the highest value since December 2020.

Even bigger growth was registered in ‘first-time deposit section’ (FTD), where FTDs grew from $1,743 to $2,641. This is all interesting. It is true, that the value of a single withdrawal was bigger than the value of a single deposit. That could suggest an outflow from FX retail accounts. On the other hand, new customers are opening new accounts with the largest FTD value since December 2020.

FX Industry See More Activity in Monthly Data

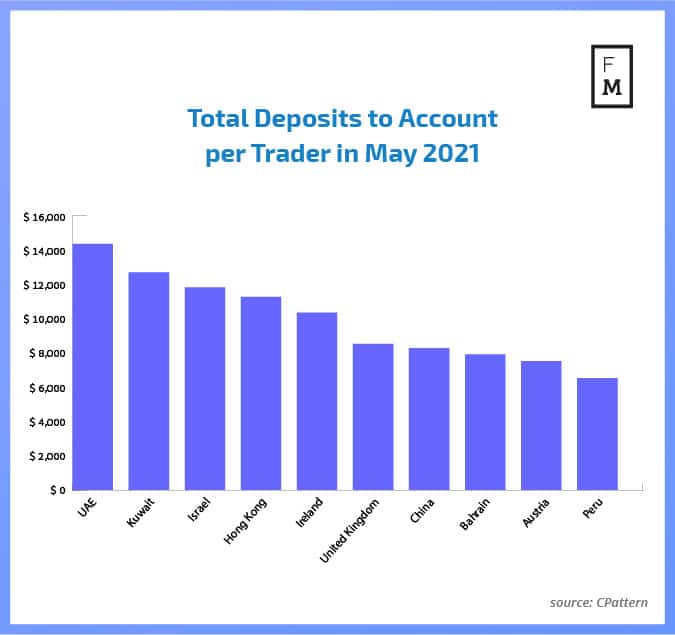

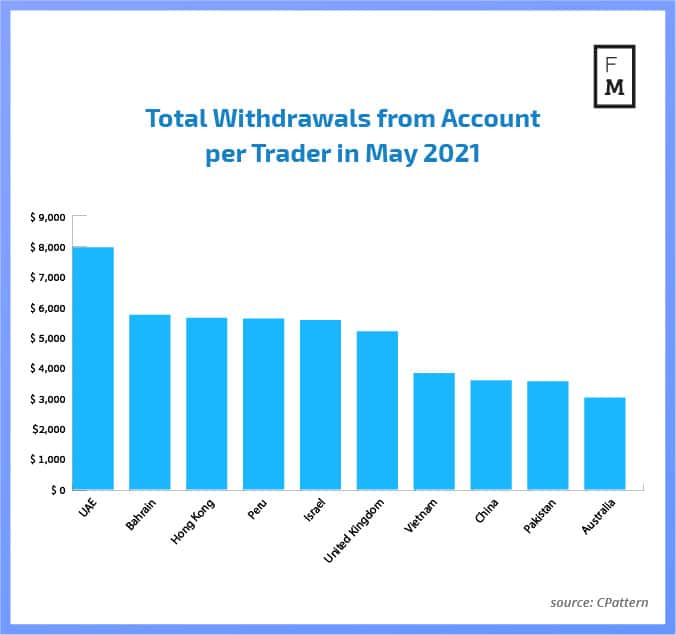

Moving forward, we can find an optimistic suggestion in the next set of data. The average total monthly withdrawal for one trader was $4,977 in May. At the same time, the average total deposit made by the average retail FX trader was $9,884. It was twice as much as the size of monthly withdrawals.

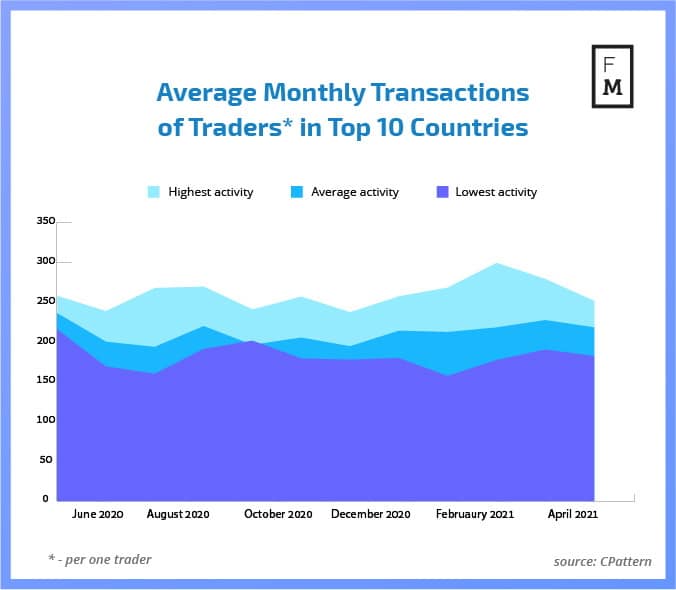

Retail FX traders activity came back to levels seen in January 2021. In May, the average trader was executing 219.7 transactions monthly. It was lower than the 226.3 transactions seen in April. Also, the highest and lowest activity for the top 10 countries was lower than the previous month. Thus, we return to the levels seen for whole of 2020.

Finance Magnates Intelligence will be monitoring industry activity in the upcoming months. Stay tuned for more industry-related research.