Just hours before the final tally of the Brexit /Bremain referendum hits the wires, we are taking a look at the positioning of clients across some major brokerages that are regularly updating the sentiment of clients. The data should help us determine whether there is any disproportionate market sentiment which could negatively affect clients and their brokers.

According to data from 3 major brokerages, the balance of the positioning is much less extreme when compared to the Swiss National Bank event. At the time, the positioning ratios in the EUR/CHF pair were heavily biased towards a rally in the pair from near 1.2000. With over 90 per cent of the traders betting on a drop in the value of the Swiss franc, the post-SNB rally was massive.

Safe and Sound, "Normal" Turbulence Expected

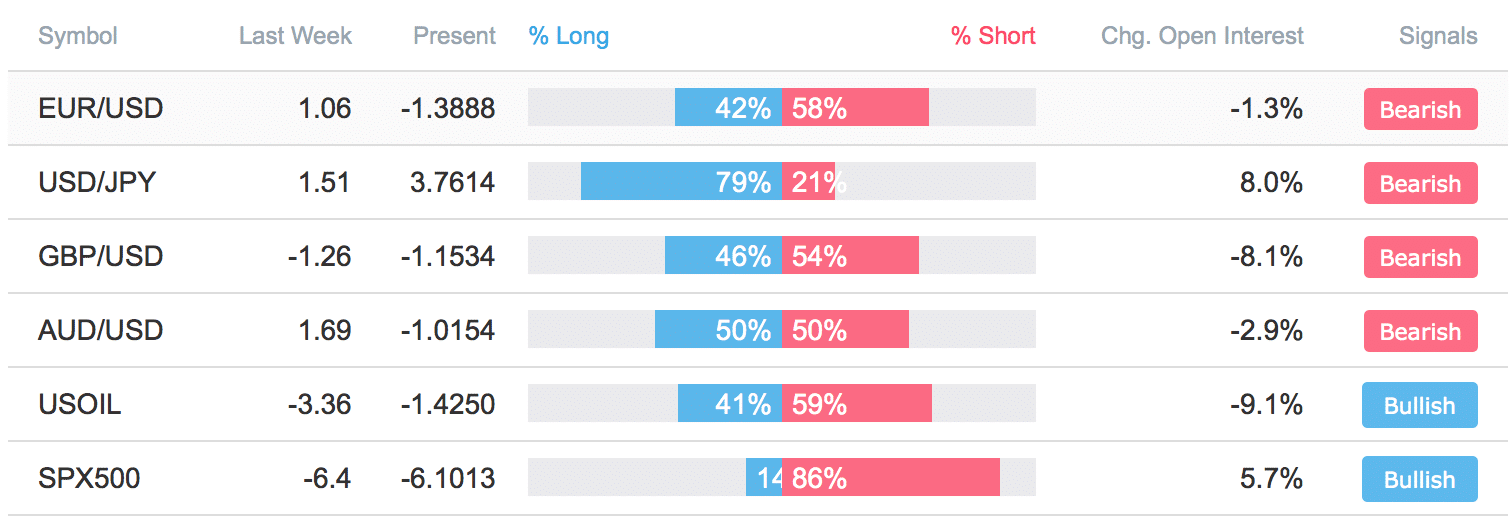

Looking at the British pound positioning today, we are seeing a much less skewed market with merely 54 per cent of traders at FXCM betting on a decline of the British pound against the U.S. dollar, and hence in a way betting on a Brexit.

FXCM's Speculative Sentiment Index Shows a more or less even balance of risks in GBP

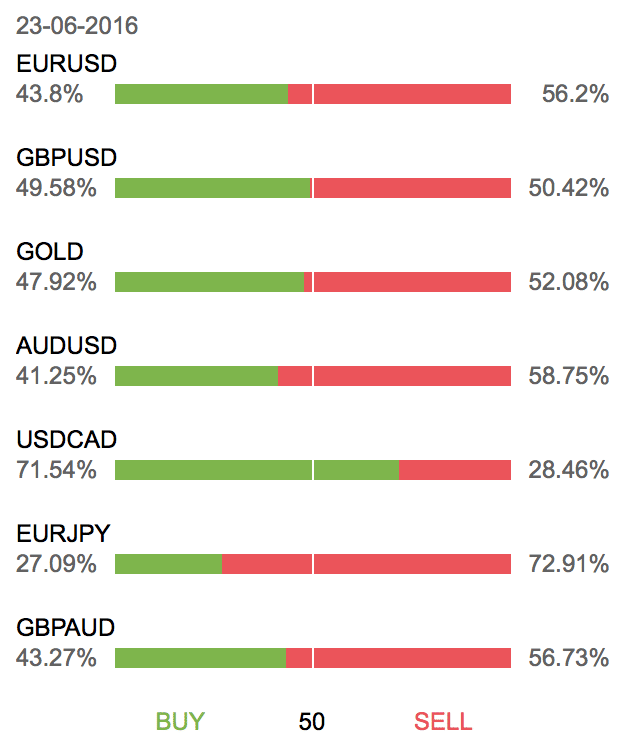

Data from traders at FxPro is even less skewed with a more or less evenly balanced portfolio amongst the clients of the brokerage: 50.42 per cent shorts is a virtual tie in the tug of war between the bulls and the bears on the British pound.

The FxPro Trader's Dashboard shows risks evenly balanced

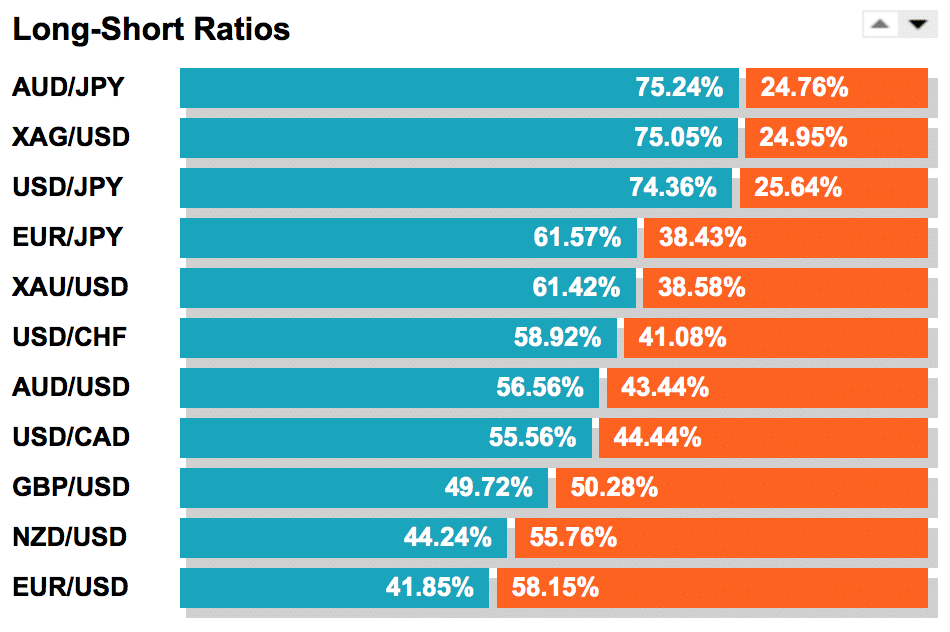

OANDA is another brokerage that is publicly publishing the open positions ratio of its clients and we see no news here either. Just above 50 per cent of the open positions of clients are shorting the GBP/USD pair, with the other 50 taking the other side.

Long-Short Position Ratios at OANDA are no different when it comes to the GBP

As long as a brokerage has enough clients in both directions, the risks for it as a market maker are limited. The same goes for the straight through processing (STP) brokers, because if the market is evenly balanced the risks of a very sharp move are much lower.

While there might be a lot of volatility in the market, a prospect which can influence Liquidity conditions substantially, the final outcome of the referendum is being priced into the market. In the meantime, for those of our readers who still haven't seen John Oliver's views on Brexit, the video below might make your day brighter (or grumpier), regardless of the outcome today.