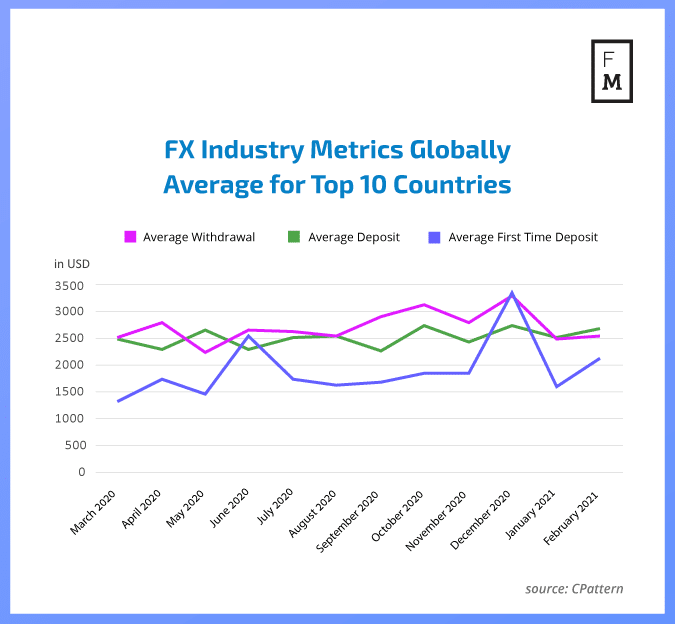

Most of the main account metrics did not change much in February. However, we have seen that one important metric is growing again as Finance Magnates Intelligence examines the latest data from cPattern.

Both average single deposits and single withdrawals from FX accounts in February were close to the values from the previous month. The only metric which experienced a meaningful change was the average first-time deposit (FTD), which grew from $1,593.82 to $2,115.83.

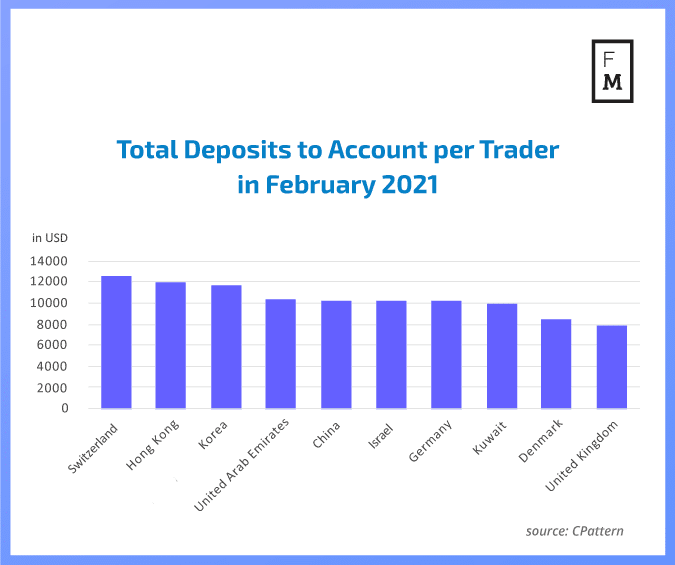

In the meantime, retail Forex traders from Switzerland topped the February total monthly deposits rankings. The average Swiss trader deposited $12,617 last month. However, not far away from those numbers were two Asian countries, Hong Kong and South Korea, with an average monthly deposit of $11,988 and $11,690, respectively.

Finance Magnates recently reported on the situation in Korea. Growing deposits for FX trading is a positive sign, but the strongest trading sector in this country is crypto trading, which surpasses stock trading.

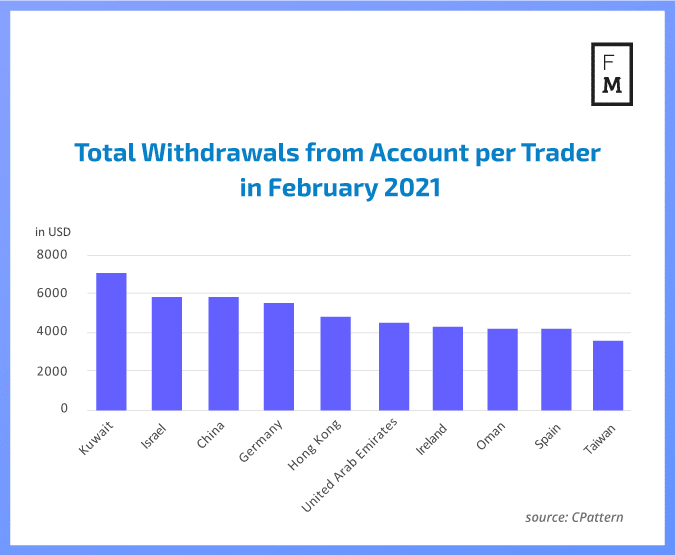

Total Forex Withdrawals from Accounts

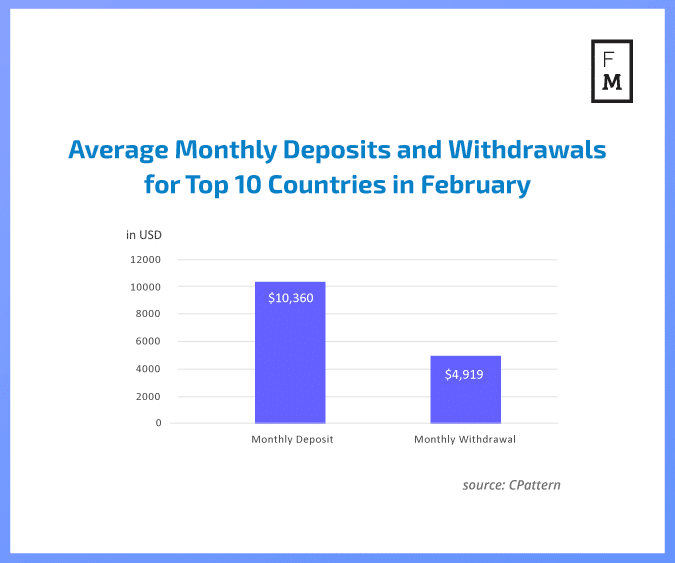

For the first time, we are introducing the 'total monthly withdrawal' value to our analysis. In February, the average trader from Kuwait removed $6,998 from his trading account. Just slightly behind in the second position was Israel, with total monthly withdrawals of $5,815. The average monthly withdrawal for the top 10 countries in this ranking was equal to $4,919.

If we compare average total withdrawals to the average total deposit for the top 10 countries, we will see a positive ratio. In February, it was $10,360, which is well above the $4,919 level for an average monthly withdrawal, in the top 10 countries. The average inflow to FX accounts was almost twice as large as the average outflow. How this will change in March? Stay tuned for more crucial analysis from Finance Magnates.

This is the latest publication from Finance Magnates Intelligence on key customer-related data. In today’s business world, Big Data analysis and access to objective information sources are crucial for success. Are you trying to understand the industry? Do you plan to expand your business in new markets? To get the bigger picture of the FX/CFD industry in chosen countries and metrics, contact our intelligence department.