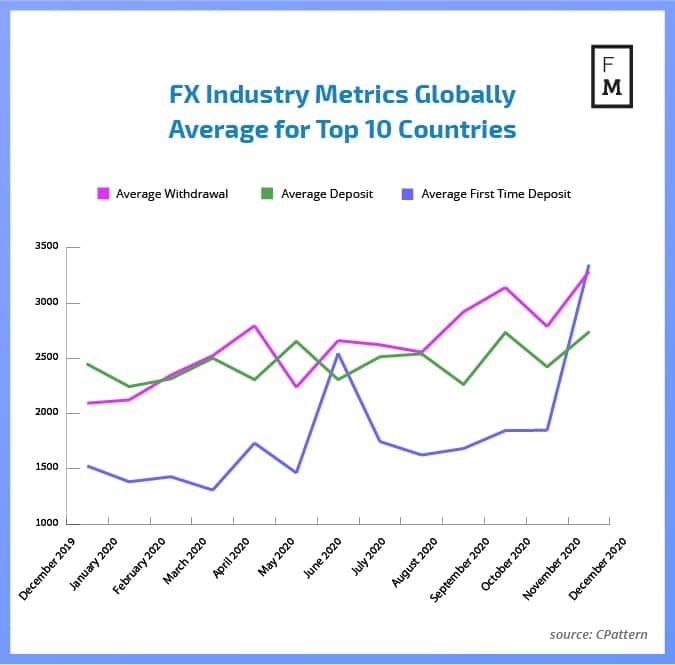

In December 2020, the retail Forex industry witnessed solid growth in all three major areas of customer-related operations covered by our cyclical analysis. At the same time, 2020 came to an end marking an overall annual improvement over 2019.

The first thing that stands out in the December data, shared with Finance Magnates Intelligence by cPattern, is growth in account funding values. The average single deposit to accounts grew from $2,423.14 to $2,738.20. Even bigger growth was registered in the case of withdrawals where single pay-outs from accounts grew from $2,788.60 to a level of $3,286.34.

However, the most impressive improvement was seen in the First Time Deposits(FTD) value, which in December skyrocketed from $1,849.03 to $3,348.30. What is interesting is that the first two places in the FTD rank were taken by Asian countries, Hong Kong and Taiwan, with results of $4,755.00 and $4,384.70, respectively. Maybe even more interesting is the fact that Brazil, the country with a challenging regulatory situation, was third with an average FTD at $4,311.80.

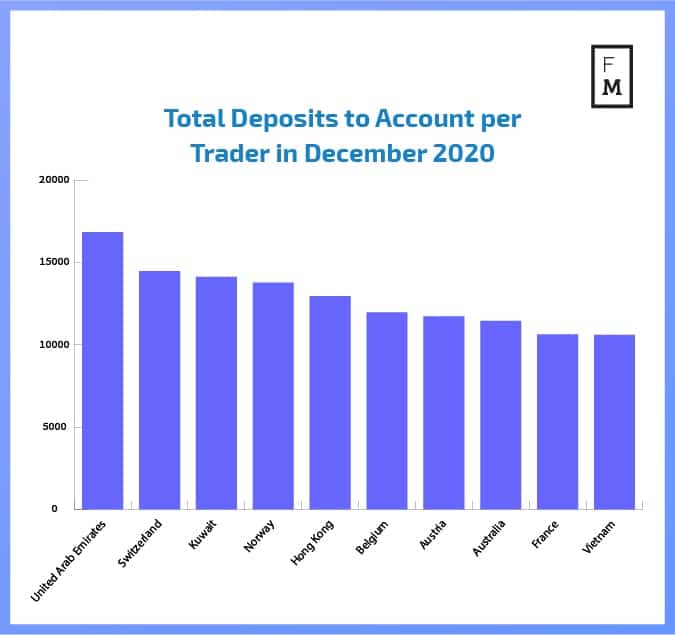

Traditionally, the biggest total deposits made throughout the whole of December were made by traders from the United Arab Emirates. On average, these traders left $16,844.00 in their accounts and were closely followed by Swiss traders. Retail FX accounts in Switzerland were found with an average amount of $14,479.00 in December.

Swiss Retail Forex Industry Rebounds

It is good to see retail Forex Trading improving in Switzerland. Recently, this country has caught the attention of the financial industry with developments in new technologies. Local broker Swissquote announced in December that it has partnered with the world’s largest electric car manufacturer, Tesla to increase its services in the credit sector. The broker said it was launching a new digital leasing offering in cooperation with Tesla to help Swiss clients interested in purchasing new cars.

This is the latest publication from the Finance Magnates Intelligence on key customer-related data. In today’s business world, big-data analysis and access to objective information sources are crucial for success. Are you trying to understand the industry? Do you plan to expand your business to new markets? To get the bigger picture of the FX/CFD industry in chosen countries and metrics, contact our Intelligence Department.