Despite the fact it was summer, which is traditionally a slow period in the trading industry, the third quarter brought an improvement in volumes. Additionally, interesting changes were observed in the case of other Forex industry metrics. Finance Magnates Intelligence examines the latest July and August data from cPattern, highlighting key changes.

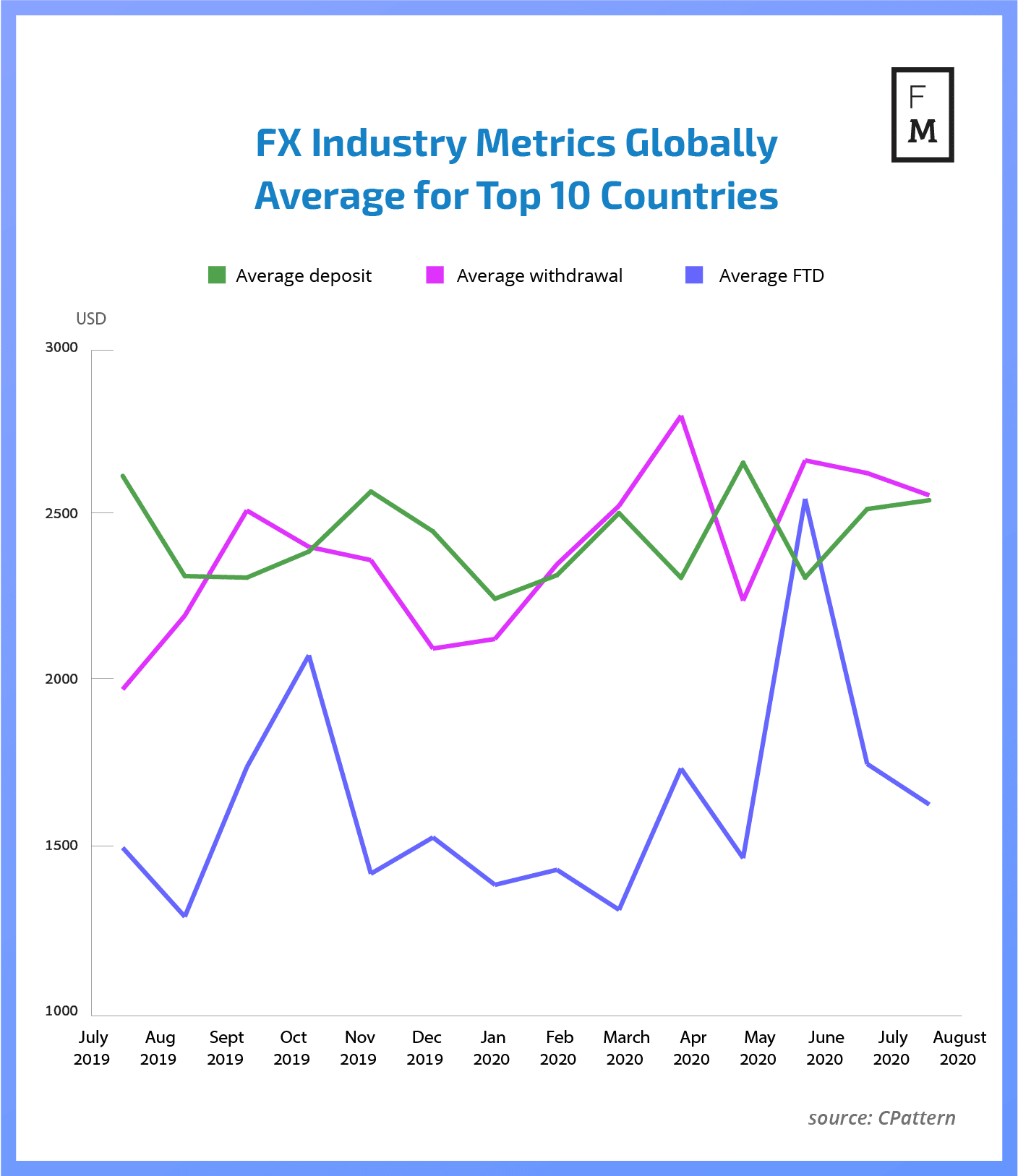

Throughout the whole year, the value of an average single deposit and a single withdrawal were close to each other. In August, we saw slightly bigger withdrawals, than deposits. An average withdrawal was $2,555, while an average sum of money being sent by clients to their trading accounts was equal to $2,540. At the same time, the value of an average first-time deposit(FTD) decreased from $1,746 to the amount of $1,624.

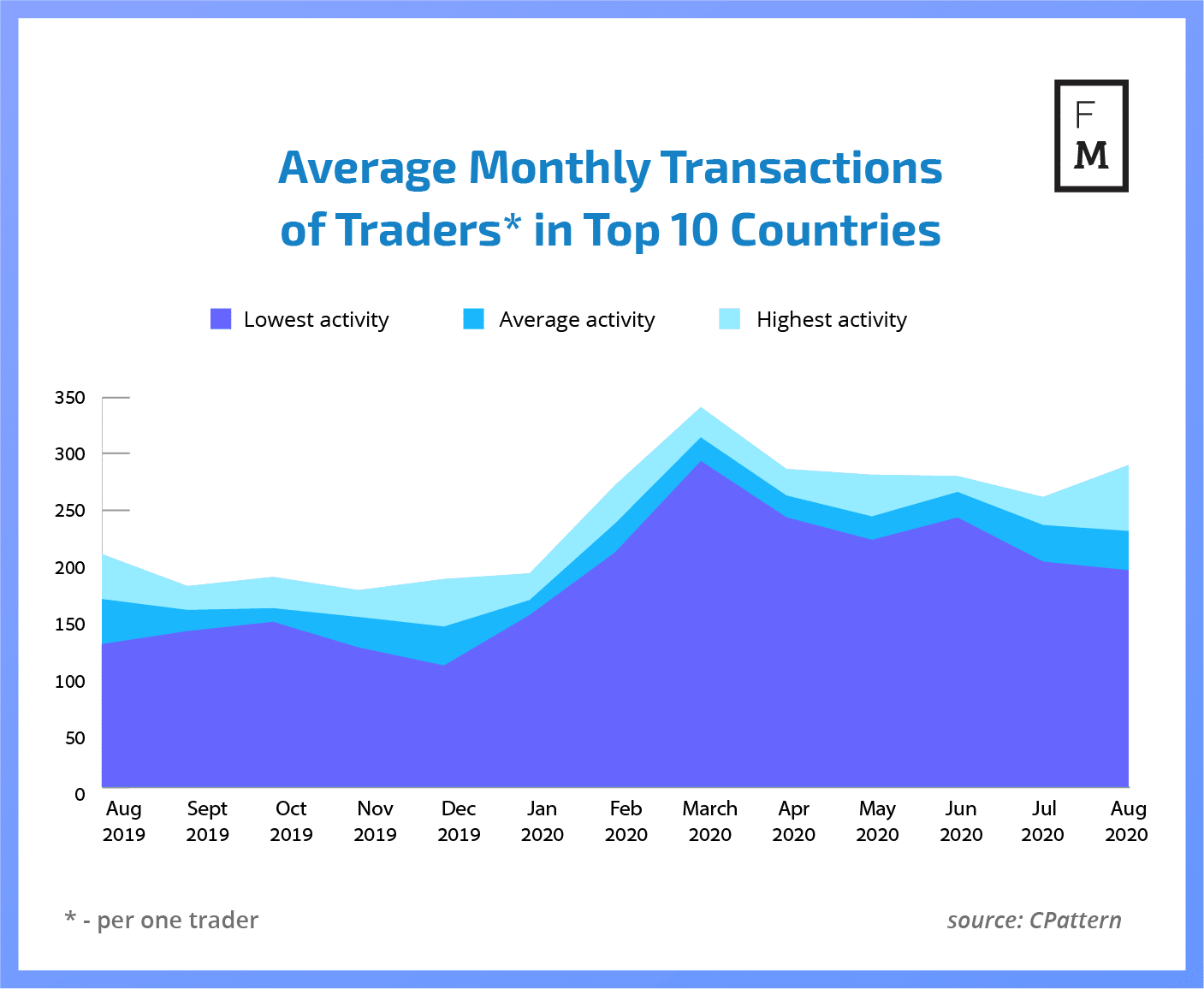

In recent months, we have also observed a widening gap between the biggest activity of traders and the lowest activity. Not surprisingly, the most active traders were again in China where an average trader made 241 transactions in July and 270 transactions in August. The average number of transactions for the top 10 countries in our activity rank was 201. However, the size of the transactions remains unknown.

Other Forex Industry Metrics

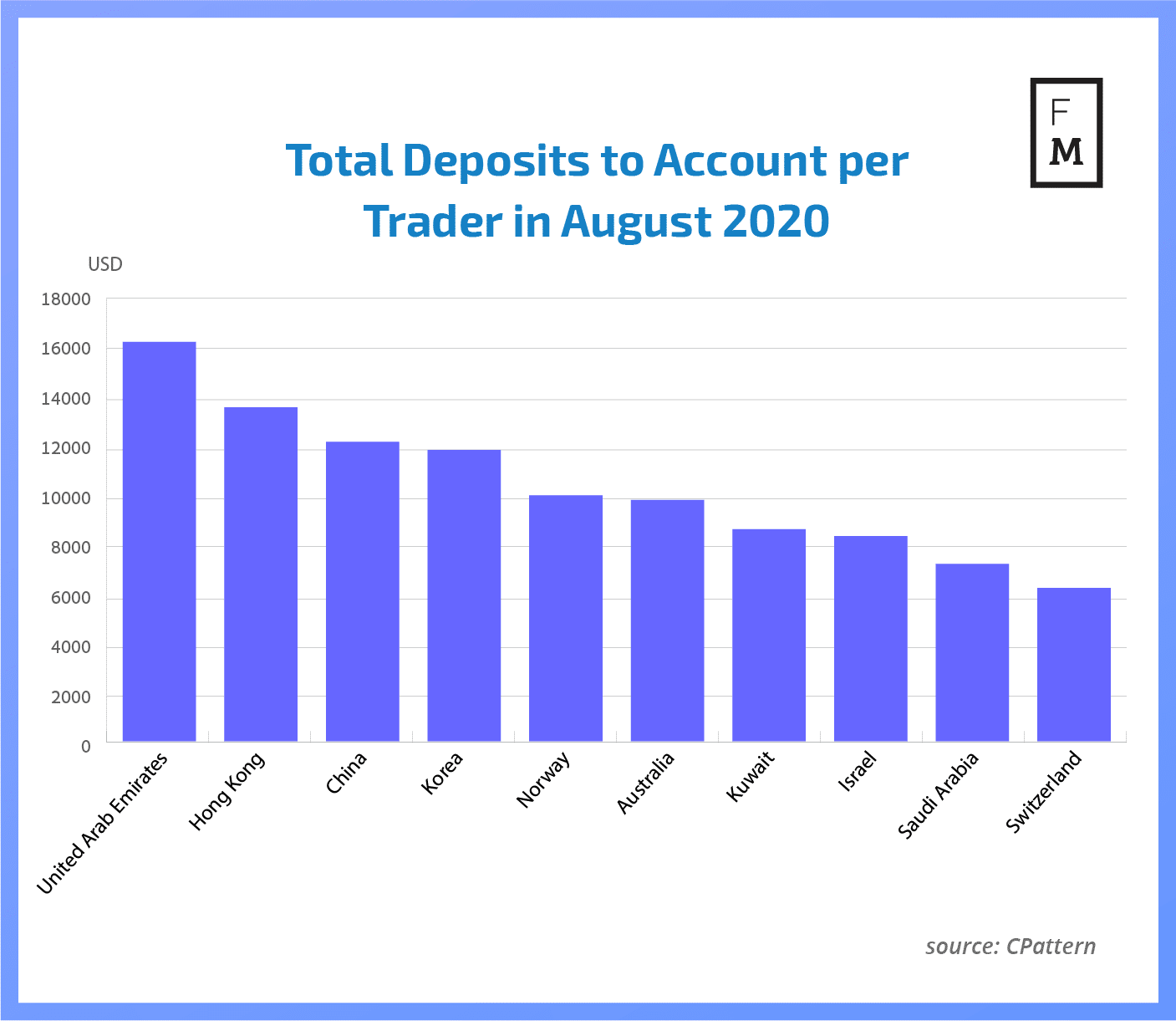

When it comes to the deposits made by traders on a monthly scale, once again the Middle East tops our rank. In August, an average retail FX trader from the United Arab Emirates sent to his trading account $16,309 in total. However, the next three positions belonged to Asian countries. Traders from Hong Kong deposited on average $13,536 in August, while traders from China deposited $12,498, as well as traders from Korea deposited $11,991.

We are observing a growing role of the United Arab Emirates in the financial world. Just recently, Ripple picked Dubai for a regional HQ, due to its innovative regulatory structure and reputation as the leading global financial hub in the Middle East, Africa, and South Asia, also known as the MEASA region.

This is the latest publication from the FM Indices – a new cross-industry benchmark. In today’s business world, big-data analysis and access to objective information sources are crucial for success. Unfortunately, until now, it has been challenging and costly, if possible at all, to find any reliable benchmarks for operations in social media, cryptocurrencies, Forex, and CFDs trading.

For this reason, the Finance Magnates Intelligence Department has launched a new project, creating a set of indices encompassing various aspects of the Online Trading industry. These indices will provide you with unique data points gathered by our analysts, which will serve as a valuable knowledge base for your decision making.