The spot Forex market has grown significantly from the early 2000s due, in part, to the influx of algorithmic platforms. The rapid proliferation of information, as reflected in market prices, can present multiple arbitrage opportunities. With the advent of MT4, retail traders gained an opportunity to trade the market algorithmically resulting in many investors getting involved in FX trading and hedging. However, the fragmented OTC nature of the FX market makes it difficult to implement some of the more sophisticated trading strategies due to lack of transparency from FX brokers and their limited supply of Liquidity (pricing that is mostly recycled). So what should you be looking for when searching for a broker that can accommodate your trading strategy? This article will cover the most common issues that arise when implementing different strategies and how to identify those brokers/liquidity providers that are suitable for your trading.

Automatic Trading in FX vs Equities Markets

According to Deutsche Bank, 90% of equity-futures trades are executed without any human input. Since the era of floating exchange rates began in the early 1970s, technical trading has become widespread in the foreign exchange markets as well.

A study in 2016 showed that over 80% of trading in the FOREX market was performed by trading algorithms rather than humans. However, there is a world of difference between equity markets and foreign exchange markets. In stocks, there are a myriad public and private trading venues in which to use algorithms – upwards of 40, while the Forex market is traded by, or on, major bank trading desks – also known as the principal bank trading market or spot forward market. Banks use algos to trade between themselves and often sell them to clients for fees. As a result, computer-driven trading has been far slower to catch on in FX than in stocks.

Types of auto-trading

Specifically in FX, we will dive into the following specialized strategies that are fairly common:

- Arbitrage

- High-Frequency Trading (HFT)

- Quantitative, or Quant trading

Arbitrage

Using arbitrage in algorithmic trading means that the system hunts for price imbalances across different markets and attempts to profit from those. Arbitrage opportunities are usually short-lived, so you need to act fast. Since the Forex price differences are in usually micropips a person would need to trade really large positions to make considerable profits. There are a few traditional arbitrage strategies in FX:

- Triangular arbitrage, which involves two currency pairs and a currency cross between the two, is also a popular strategy under this classification. An example would be GBP/USD, USD/JPY and GBP/JPY. Triangular arb is based on the geometric relationship between three currency pairs.

- Covered interest arbitrage uses a strategy of arbitraging the interest rate differentials between spot and forward contract markets in order to hedge interest rate risk in currency markets. These traditional arbitrage strategies have been known since the 80's and it is largely agreed that they rarely work in today’s market as, over time, markets move towards greater efficiency.

Some of the more popular margin FX-specific arbitrage strategies are:

- Latency arbitrage (LA) is a high-frequency trading strategy used to front-run trading orders in equities trading. In equity markets, these strategies are often labeled as predatory due to the front-running of orders and rebate arbitrage strategies. In FX, latency arbitrage typically is price latency arbitrage where a trader finds delayed prices on one broker’s platforms and exploits that deficiency.

- Cross-broker Arbitrage: To use this technique you need at least two separate broker accounts, and ideally, some software to monitor the quotes and alert you when there is a discrepancy between your price feeds. You can also use software to back-test your feeds for possible arbitrage opportunities. Variances can come about for a few reasons: Timing differences, software, positioning, as well as different quotes between price makers.

- Technology Arbitrage: When a broker’s quotes momentarily diverge from the broader market, a trader can arbitrage these events. This will allow a risk-free profit. In truth, there are challenges. Some institutional traders may exploit deficiencies in retail FX platforms while having access to primary FX markets on EBS or Reuters.

- Event arbitrage refers to the group of trading strategies that place trades on the basis of the market's reaction to events. The events may be economic or industry-specific occurrences that consistently affect the securities of interest time and time again. For example, many FX strategies are centered around arbitraging on major news announcements before the market reacts to it.

All of these price discrepancies might not last very long, because there are other traders out there watching prices and looking for the same opportunities, so you need to be quick.

Arbitrage strategies implementation challenge

- Co-location and speed - arbitrage strategies are also known as grabbing pennies on the railroad track, so speed is of the essence. These require investment in technology and infrastructure, co-location with trading venues.

- Transaction costs - since profits are very small, depending on a brokerage, one needs to fully estimate transaction costs.

- Some strategies are not sustainable; the need to manage many accounts and the fact that many brokers do not allow any form of arbitrage and may suspend an account at any time.

HFT, or High Frequency Trading

As the name suggests, this kind of trading system operates at lightning-fast speeds, executing buy or sell signals and closing trades in a matter of milliseconds. These typically use arbitrage or scalping strategies based on quick price fluctuations and involve high trading volumes. High-frequency traders rely on extremely low latency and use high-speed connections in conjunction with trading algorithms to exploit inefficiencies created by these exchanges.

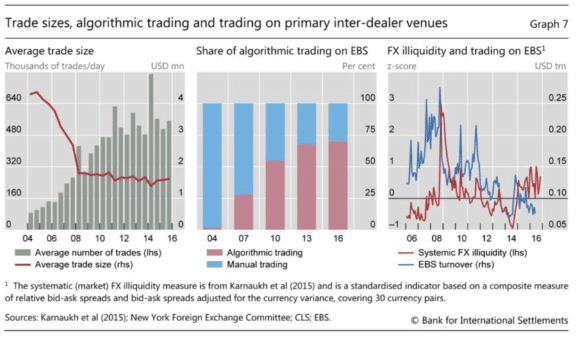

All of these price discrepancies might not last very long, because there are other traders out there watching prices and looking for the same opportunities, so you need to be quick. High-frequency traders in Forex generate revenue from attempting to capture small changes in, or the difference between, the bid/offer spreads in another location. As you can see from the graphs provided by the bank of international settlement (BIS), the share of HFT trading in FX has been steadily growing.

HFT strategies implementation challenges

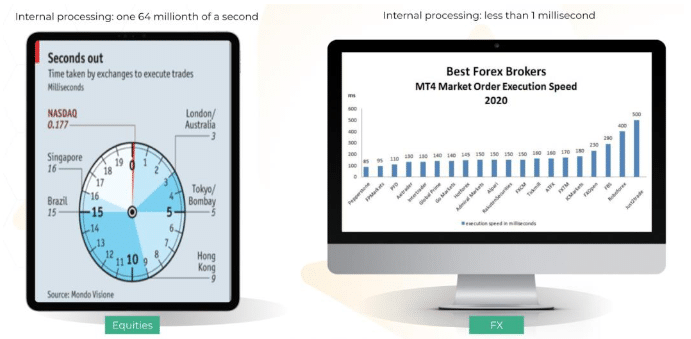

● Speed At the time of writing, market contacts suggest that some HFT participants in FX can operate with latency of less than one millisecond, compared with 10–30 milliseconds for most upper-tier, non-HFT participants. In equities, this Internal processing time is one 64 millionth of a second. Execution speed in FX is also far behind equities trading. As you can see, Nasdaq can execute orders in less than a millisecond, while the fastest margin FX broker is at 85 ms.

Advanced Markets, for example, is an institutional broker and offers higher execution speed averaging at around 50ms with internal processing time of less than 3 milliseconds. Market data delivered in 500ms packets will likely be unsuited for HFT strategy, so you need to find venues that can price faster (for some its technical limitation). For example, Advanced Markets is expanding platform capability and can push 26-100 updates into MT4 in a second.

There are other limiting factors to HFT strategy like fill ratio, as the consequences of missing a large number of trades due to unfilled orders are likely to be catastrophic for any HFT strategy.

Scalping

Scalping is another sub-type of HFT. It involves entering trades and closing them after a short time in order to make profits from small price changes. If you watch a chart for any liquid asset, you’ll see the price moving constantly. Scalpers profit from this movement. Scalping implementation challenges

- Risky in volatile markets

- Some brokers don’t allow this as it doesn't fit in with their risk management strategies

- Diligent cost controls need to be applied - spreads and other cost factors need to be carefully examined

- Fill rates can destroy strategy profits if trades are rejected or slipped.

Quant Trading

Quantitative trading is a type of market strategy that relies on mathematical and statistical models to identify – and often execute – opportunities. The models are driven by quantitative analysis, which is where the strategy gets its name from. It's frequently referred to as ‘quant trading’, or sometimes just 'quant'. Quantitative trading works by using data-based models to determine the probability of a certain outcome happening. Unlike other forms of trading, it relies solely on statistical methods and programming to do this.

Challenges when implementing quant strategies in FX

- Lack of data availability in foreign exchange trading, when compared to equities, is one of the major obstacles in implementing quant strategies in FX. Since the Forex market is regarded as an over-the-counter (OTC) market and does not transact on a centralized exchange, there is little uniform data available.

The FX ECNs only publish approximately 15% of their data while the rest of the market trades "in the dark". Only an estimated 6% of the market is covered by good quality data, and algos need to have data, such as volume traded per unit of time, in order to properly slice a large order into smaller pieces.

- Also, many traders underestimate the cost for quality data. You can get some of the historical tick by tick data dating back to 1992, but it will cost you tens of thousands of dollars.

How to implement auto trading strategies on margin FX brokers’ platforms?

So is it possible to implement alpha generation algorithms with retail margin FX brokers? The answer is yes, but your algorithm needs to have an adaptive reinforcement learning layer that will optimize trailing stop-loss levels, trading thresholds, trading cost, learning rate and auto-shutdown critical loss parameter. Another important part of the strategy is risk management. One of the major upsides of automated trading is also it’s Achille’s heel. If computers can make winning trades very quickly, they can make losing trades just as quickly. If the system starts to enter into losing positions, it will do so very quickly, and you might stack up substantial losses before you know what happened. Algorithmic trading is largely blamed for creating market anomalies known as flash crashes. When a trade goes bad, a psychological tendency exists to keep the position open in the hope that the market will reverse itself and the trade will again turn profitable. This implies a risk-seeking attitude towards losses as opposed to risk-aversion with regard to profits. However, the possibility always exists that the market may not reverse itself and eventually could force the close out of the position at a huge loss. This characteristic of human psychology needs to be avoided by a successful automated trading system. Risk management avoids this pitfall by building in a trailing stop-loss for every trade. A stop-loss is set and adjusted so that it is always X basis points under or above the best price ever reached during the life of the position.

Typical Mistakes when implementing algo strategies in currency markets

So what are the typical mistakes made by traders when designing automatic trading systems in FX?

- They presume ideal conditions, such as no hidden costs, quality data, a broker’s honesty and integrity and no catastrophic Black Swan events. These conditions simply do not exist in a fragmented OTC FX market that lacks a great deal of transparency.

- All-in trading costs not factored in. Apart from commissions, market spreads, slippage, rejects, requotes, missed quotes, system downtime all need to be considered and factored into the model.

- Execution speeds and liquidity largely differ from broker to broker

- Slippage underestimated by many models back-tested in ideal conditions or tested on demo. Slippage, market impact and other factors play a huge role in the success of your strategy.

If you want to learn more about algorithmic trading and how to implement the strategies in currency markets, Advanced Markets had discussed it in more details in this Virtual Workshop.