As the need for diverse product offerings continues, the solutions sometimes required can be that of combining aspects of several technologies to help achieve an end result. The latest such combination announced today is from UK-based Ariel Communications partnering with Gold-i. The resulting joint product created is the 'Ariel Gold-i Risk Suite'. Both companies have trading systems, integration experience and provide technology solutions for brokerages.

According to the official press release, this is the first time that Ariel’s advanced Dealer Suite tools will be available to brokers without them having to deploy the full iTrade Trading Platform .

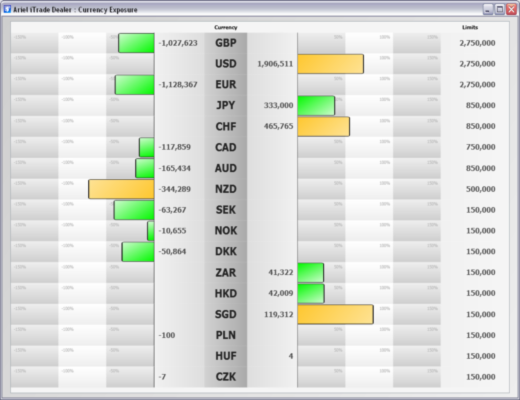

The new joint offering is aimed at MT4 brokers and provides a simple, graphical view of the dealers' position and currency exposure, enabling dealers to analyze client trading behavior and activity. The interface allows brokers to monitor and manage their risk by individual currency, currency pairs or CFD exposure, as per the release. The Ariel Gold-i Risk Suite provides a consolidated view of all clients' trading activities from one or more MT4 servers, by using the Gold-I Gate Link.

Tom Higgins, CEO of Gold-i

Tom Higgins, CEO of Gold-i highlighted his view of the partnership and interest already developing: “Ariel is one of the most established companies in the retail FX industry and we are delighted to partner with such an experienced and trusted organisation. We already have a number of clients who are interested in our joint offering and I believe that MT4 brokers will really benefit from the advanced features available with the Ariel Gold-i Risk Suite,” he said in the press release.

While the Ariel Gold-i Risk Suite isn't yet listed on the company's website (as at time publication), according to people close to the company and today's publication, the solution is currently available for brokers wishing to begin integration immediately.

Simon Cox, CEO of Ariel Communications

Ariel also plans to add further functionality to the Ariel Gold-i Risk Suite, which may include support for platforms other than MT4, hedge trade injection and Margin Monitor which is described as a sophisticated client Risk Management toolset.

Simon Cox, CEO of Ariel Communications, commented on the joint product offering. "“This is an exciting opportunity to broaden our client base. Our partnership with Gold-i maps onto our new strategy of providing marketing leading solutions by teaming up with key players in the industry. Gold-i leads the market in terms of MT4 integration and, like Ariel, always ensures that its innovative and highly reliable products are backed up by exemplary customer service,” he said in the written statement.

Ariel will also pursue strategic partnerships with key players in the industry as part of its new strategy, as can be seen by Mr. Cox's comments and as previously covered by Forex Magnates. This reminds us of the importance of networking, as strategic relationships in business can produce a combined better result - if done correctly.

Strategic Partnerships; A Component of Industry Networking

The importance of networking can be truer for IT companies in financial services. This is due to the technological complexities inherent in supporting the trade life cycle, and surrounding the execution of trading in general from an IT perspective, not just for the sake of convenience, partnerships can become a strategic means to achieve an end result.

This has been quite common in many industries where the role of vendor and supplier can be interchangeable or partnering with a competitor could result in a win-win for all. Of course there are also risks to this, the key is to look at the big picture (overall business strategy) how this could affect results over one, two or three years. Last but not least, the legalities of licensing/agreements and using and sharing intellectual property as it relates to future revisions and permissible ownership.

The concern for brokers to manage their counterparty risk is growing as creditworthiness is dependent on a firms' financial position, which is in turn affected by its risk exposure. Unlike agency business where the risk is mitigated, knowing at a glance what the exposure is across all currency pairs is important for dealers who internalize orders and thus have exposure to them (irrespective of any hedging strategies to offset such risk).

Some dealers prefer to look at a single amount representative of the consolidated exposures converted into a single currency (such as the sum of all risk converted into USD), while others may look at each currency pair respectively. Just one of many featured components of the new joint offering, a screenshot of the currency exposure window from the Ariel Gold-i Risk Suite has been provided below as an example.

- Currency Exposure Screenshot