In a rare appearance before the Committee on Financial Affairs and the House of Counsellors, the Bank of Japan’s Governor, Haruhiko Kuroda, presented the authorities with the central bank’s outlook for future price developments in Japan and the monetary policy which the BoJ is intending to conduct.

While his assessment of the economy wasn't a big surprise with another proclamation in a similar fashion from recent speeches proclaiming “moderate” wage growth, when in fact the country’s wages have been barely in positive and real wages have been falling due to high inflation figures.

As the Bank of Japan's governor confirmed, the intentions of the central bank are to deliver on its inflation promise despite the recent sharp drop in energy prices, in Forex Magnates' opinion the central bank will continue with its resolve to depreciate the Japanese currency through its Quantitative and Qualitative Easing policy.

There is an incoming threat to the economic recovery in Japan, with falling real wages being only partly offset by a higher number of jobs created. However, the Japanese population is very likely to be far away from further endorsing the Abenomics “miracle”.

Wages continue to fail in keeping up with the pace of price increases, despite this, retail sales in the country have been recovering over the past three months, with the latest number marking an increase totaling 2.3% in September, signaling that the notorious Japanese savings are now being spent.

This is not good news in the long run, especially in a country where a demographic crisis is around the corner with a rapidly aging population and the Japanese government has been relying on on the country's savings to finance its huge government debt - the biggest in the world in debt-to-GDP terms - now more than 250%.

Mr. Kuroda stated, “Japan's economy has continued to recover moderately as a trend with a virtuous cycle from income to spending being maintained steadily in both the household and corporate sectors, although some weakness, particularly on the production side, has been observed due mainly to the effects of the decline in demand following the front-loaded increase prior to the consumption tax hike.”

Production capacity has been diminishing with manufacturing companies leaving Japan ever since the sharp appreciation of the Japanese yen in the aftermath of the financial crisis and the unwinding of the carry trades which was triggered.

While we may be seeing tightening labor market conditions reach the Bank of Japan’s structural unemployment estimate of 3.5%, and according to the September Tankan (Short-Term Economic Survey of Enterprises in Japan), employment conditions were "insufficient," despite what the Bank of Japan calls “moderate increase in wages," in reality there is a substantial drop in purchasing power.

An Anxious FX Market in the Japanese Yen Is Still Ahead

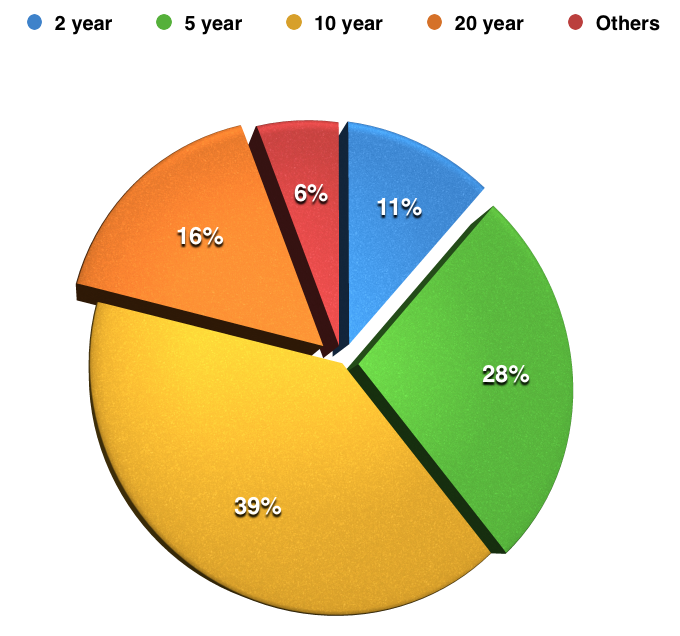

As the Bank of Japan is now holding ¥180 trillion, which is $1.66 trillion of government paper ranging in maturity from 2-40 years. As demonstrated last week, the Japanese yen has been nowhere near the beneficent it was in big stock market selloffs. For now it appears as if the only way for the Japanese currency is lower, as the Bank of Japan has gone more than all in with its QQE policy.

As of 2013, Japan's government debt has exceeded one quadrillion Japanese yen ($9.26 trillion). Perversely in dollar terms, the number has dropped quite substantially over recent years, signaling how the Japanese policymakers intend to reduce the country's monstrous 250% debt to GDP ratio.

Composition of JGBs held by BOJ, Source: Bank of Japan

While the Bank of Japan has been happily conducting its Quantitative and Qualitative Easing (QQE) policy, Mr. Kuroda stated, “QQE has been exerting its intended effects and Japan's economy has been on a path that suggests that the 2 percent price stability target will be achieved as expected."

"However, we are only halfway along the path toward achieving the price stability target of 2 percent,” he added.

Mr. Kuroda re-committed to “continue with the QQE, aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner.”

“If the outlook changes due to the manifestation of risk factors and it is judged necessary for achieving the price stability target, the Bank will make adjustments without hesitation,” concluded the Bank of Japan’s governor.