After initially being excluded from the $3.3 billion settlement regulators have reached with major banks in their Forex market probe, Barclay’s Plc has allocated £500 million to settle future allegations. Now it turns out that this figure may not be sufficient. "My expectation is it will be a bigger number than that," the Bank’s Chief Executive Officer Anthony Jenkins said in an interview on Sky News.

Last month, the London-based bank had explained that it was not part of the agreement because “it is in the interests of the company to seek a more general coordinated settlement.”

According to Reuters, the reason is to be found in complications with the New York State Department of Financial Services, the state's regulator. The Financial Conduct Authority (FCA) ) has also said in a statement last month that it is still investigating the company’s G10 spot FX trading business and “also wider FX business areas.”

In yesterday’s interview, however, Jenkins was hopeful that all probes into the bank’s involvement in the forex market will be settled "in the course of next year."

Risking the System's Integrity

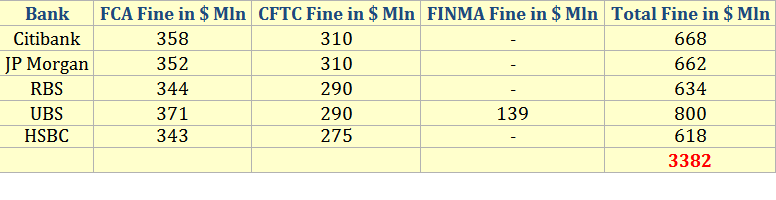

The global investigation has found that some of the world's biggest banks have been colluding on FX prices during the key 4PM GMT London Fix. Citibank, JP Morgan, HSBC, UBS and the Bank of Scotland have all been hit with substantial fines, and a blow to their credibility and reputation.

For a period of three years, in chat groups with names such as ”The Cartel” and “The Bandits’ Club,” bank traders shared information with competitors, allowing them to execute their own trades before filling client orders. Bankers in a number of countries have already been suspended or fired as the investigations continue to expand over time.

"The banks undermined confidence in the UK financial system and put its integrity at risk,” as the FCA had said at the time.

A breakdown of the fines imposed in the forex market manipulation scandal settlement