Markets will remain vulnerable to sharp moves unless the U.S. Federal Reserve clarifies its policy intentions, according to the Chief Executive Officer (CEO) of the world’s largest asset management company, BlackRock Inc (NYSE:BLK).

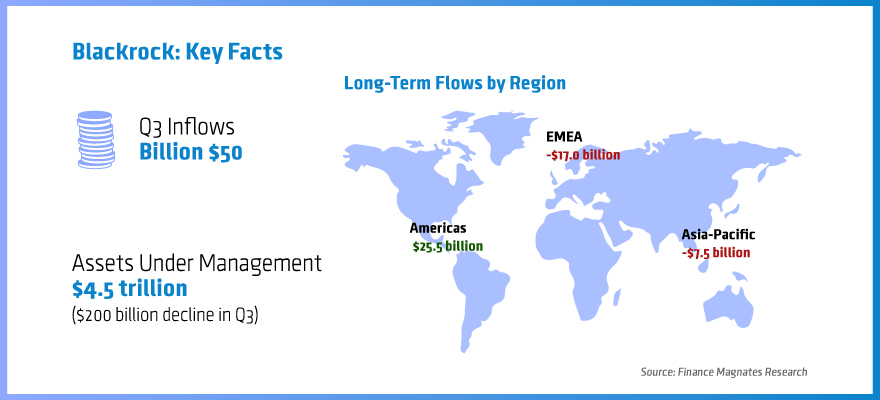

The company has posted its latest metrics which highlighted a decline in assets under management by about $200 billion at the end of September when compared to the end of June. The third quarter has proven to be a challenge despite the $50 billion of inflows into BlackRock Inc (NYSE:BLK).

Currently BlackRock Inc is managing just a touch above $4.5 trillion, which is lower by 5 per cent when compared to the end of the second quarter of 2015 and about flat when compared to the same period last year.

Persistent and possibly rising Volatility

Brokers in the industry could be interested in what the leader of the biggest asset management company in the world had to say about volatility patterns in the coming weeks.

The CEO of the company, Larry Fink, has shed light on the biggest factors affecting current market moves. According to him, the official monetary policy makers in the U.S. should take the blame for ‘inflaming the markets’.

The third quarter has been somewhat challenging for long term asset managers as global stocks have fallen by just under 10 per cent. Volatility will be the name of the game according to the CEO of BlackRock Inc as he stated, “We are in a new paradigm where there will be big winners and big losers.”

Most brokers in the industry are thriving in times of volatility, so keeping track of the wording of the Federal Reserve in the coming quarters could provide a more accurate representation of future growth numbers.

global retail business raised $7 billion of net inflows in the third quarter

BlackRock’s retail metrics continue to impress

The company’s CEO explained in an official statement: “Our global retail business raised $7 billion of net inflows, as BlackRock’s strategy to expand our distribution footprint and enhance performance enabled growth in the quarter.”

“BlackRock saw US retail net inflows of $2 billion despite industry headwinds in the quarter, and maintained its leading market share of total year-to-date international cross-border flows,” he said.

Apparently retail investors in the U.S. are not losing any time committing new funds to investing, however if we look at the regional breakdown an interesting shift could be starting. According to the official figures which BlackRock released, long-term net inflows totaled $25.5 billion and $17.0 billion in the Americas and EMEA, respectively.

The interesting part is that these numbers have been somewhat offset by net outflows from Asia-Pacific based clients, which pulled $7.5 billion. As of the last day of the third quarter, BlackRock Inc managed 62% of its long-term Assets Under Management (AUM) for investors in the Americas and 38% for clients in EMEA and Asia-Pacific.