One of the leading providers of foreign exchange and CFD trading services worldwide, FXCM, has announced that its US subsidiary, Forex Capital Markets LLC is introducing a new retail FX pricing model.

Clients of FXCM in the US will get lower spreads across the board, with markups which were previously included in the spread, now displayed as commission.

The move will optimize the cost structure of the trades and will effective immediately result in cheaper trading costs for clients of the US subsidiary of FXCM.

The company’s CEO, Drew Niv commented, ”FXCM is excited to offer raw spreads with no mark-ups on all currency pairs as it will provide clients with a superior and transparent Forex trading experience.”

He elaborated on the move explaining, "As part of FXCM's commitment to its clients, we are taking pricing and broker service transparency to a new level and bringing greater opportunities to clients."

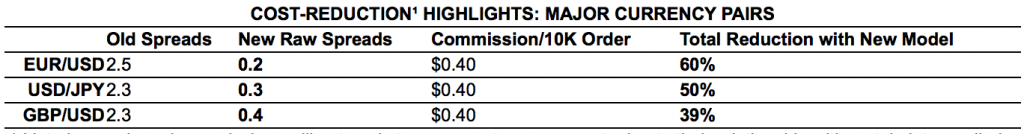

“The FXCM platforms will now display raw spreads from one of our 15 different Liquidity providers streaming prices into the FXCM no dealing desk execution system. On average we reduced trading cost on the top 14 currency pairs by 50%," concluded Mr. Niv.

After the recent batch of record low volatility across the foreign exchange markets, FXCM is adopting a commission pricing model to increase transparency and stay competitive even in those tough market conditions.

According to the company's announcement, the US is the fifth region to begin migrating new and existing clients to the new pricing model after having raised the minimum deposit for account opening from $50 to $2,000.

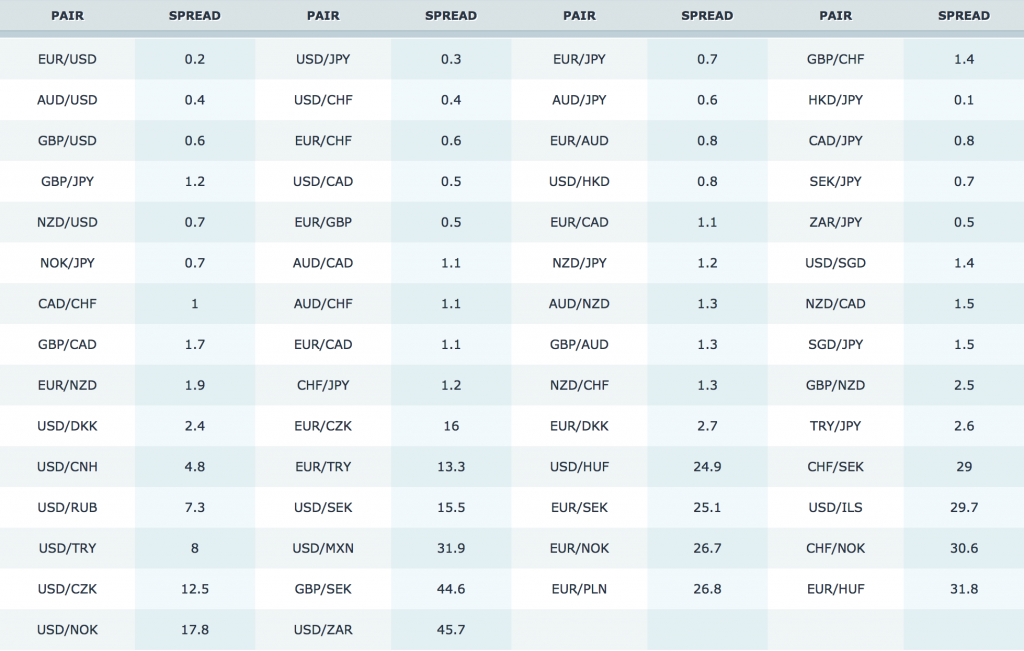

Raw Spreads

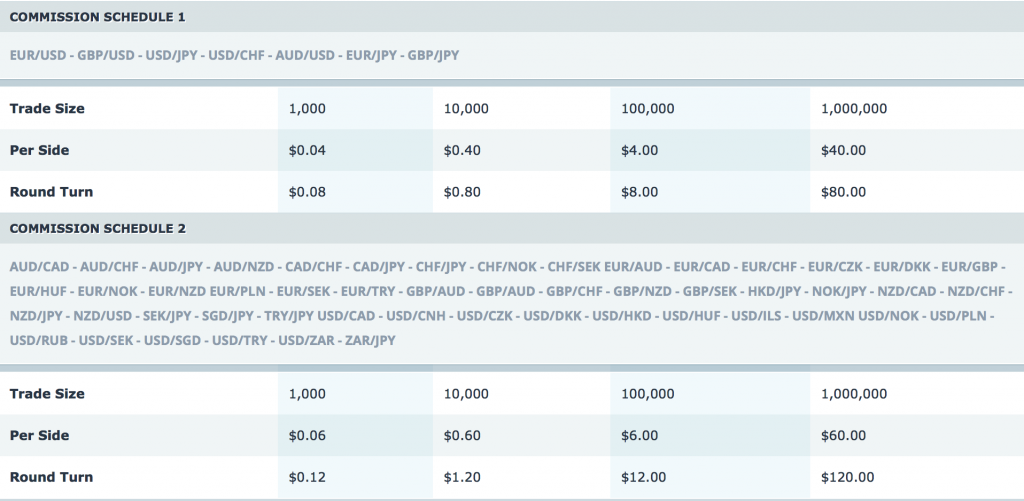

Both new and existing clients will start trading with the new conditions only after FXCM notifies them about the transition. Commissions start from $0.40/per side or $0.80 round turn for every $10,000 traded ($40/$80 per million) on FX majors up to $0.60/per side or $1.20 round turn even on exotic pairs such as the USD/RUB.

Commission Schedule Per Amount Traded, Source: FXCM