Victor Golovtchenko contributed to this article.

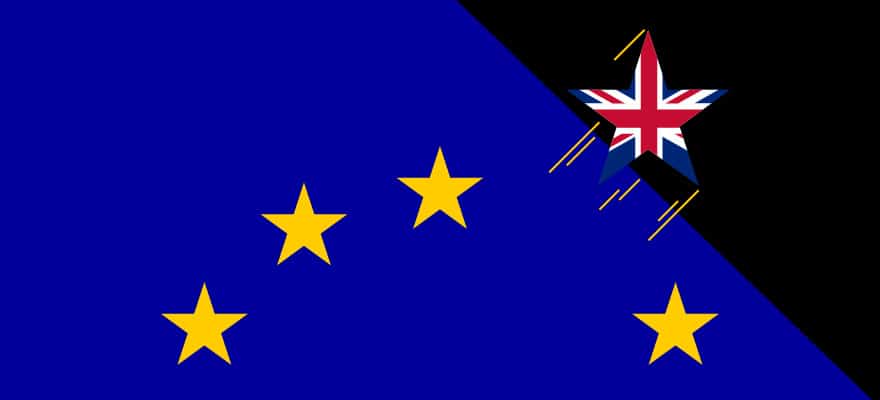

Apparently every year a mega event is bound to happen – January 2015 saw the SNB bomb hit the markets, while June 23rd 2016 is going to be remembered as the day that the Brexit happened. The Brexit, however, is not at all similar to the SNB crisis - it’s a lot more challenging.

In 2015 the SNB unexpectedly removed the peg for the Swiss franc, sending shock waves across the financial industry and especially across currency trading, with the EUR/CHF pair being affected the most.

Most of the firms involved in FX trading were caught off guard with our analysis indicating that the industry lost over a billion dollars within minutes – and this excluded changes in market caps for firms such as FXCM which due to major losses went from a valuation of over a billion dollars to less than 100 million dollars almost overnight.

Most severely affected were banks and STP brokers that had to hedge positions with counterparties which either refrained from pricing or priced aggressively off-market, thus exacerbating losses for those brokers.

the SNB event ‘started’ and ‘ended’ within minutes, Brexit is a completely different animal

Michael Greenberg, founder and CEO of Finance Magnates

Ironically it was the market makers, which are usually characterized as 'unfair' by traders for taking sides against them, that actually finished that day in profit. Beyond the massive losses to some brokers and banks, the industry as a whole was largely unaffected with just a handful of brokers going out of business or taking emergency capital injections.

While the SNB event ‘started’ and ‘ended’ within minutes, Brexit is a completely different animal. Its consequences are much more long term and a lot less clear. The timing of the event was known well in advance and most banks and brokers had thoroughly prepared for it.

Whether the outcome was to be in or out, brokers took different measures to hedge themselves against either outcome. Up to this point we have not received any information about any broker taking a big hit; on the contrary, we are bombarded by company announcements mostly sharing that everything went smoothly. This could indeed be the case.

Brexit industry implications:

The market however is missing a crucial point – Brexit has two sides to it. The first and the easiest to analyze is the market impact: changes in rates, Volatility and potential gains/losses for brokers and traders.

This would be the end of the story were Brexit to fail, however it didn’t, and the aftermath is much harder to analyze from the financial industry’s perspective as a whole. With the UK poised to leave the EU, a large number of questions are set to arise concerning the future of EU regulation.

For instance – will London continue to be Europe’s main financial hub and what is the alternative, if any? Will British brokers be allowed to market to EU customers or vice versa? Will European brokers be allowed to acquire British customers? Will the FCA break free from MIFID or continue with a MiFID-like framework emulating its main points?

There are myriad other issues to consider and there’s really just one legit answer - only time will tell. I will however offer my perspective on the matter.

London was, is and quite likely will still be Europe’s main financial hub for the foreseeable future. The main reason however is not its tradition and infrastructure, but simply the lack of a suitable runner up.

FCA has been and still is the model for any other financial regulator in the world

In financial services London was the winner that took it all in Europe. It has by far the largest concentration of financial institutions, arguably the best and most agile regulatory framework with the FCA being the model regulator for any other regulator in the world.

There is also no doubt that London has the best infrastructure including the biggest trading data centers. It’s home to Europe’s largest or 2nd largest stock exchange, depending on how you measure it. The city is also home to myriad regional and global banks and of course it has one of the most skilled workforces worldwide, with hundreds of years of tradition and experience.

In addition to that, let's not forget the English language which is a second language for pretty much anyone dealing with finances. While all of the above could be rivaled separately by Paris, Berlin, Frankfurt, Brussels, Luxembourg, Geneva, Zurich and a few more, none of those could offer anything near the complete package that London does.

Last but not least, London is 7 hours away from New York by plane. In the longer term all of the above could be replicated in another location with the right focus and investments, but this would take years, if not decades – something the EU currently doesn’t have and London wouldn’t be happy to find out either. Clearly there is a reason why the City of London was one of the few regions that strongly voted in.

Financial regulatory framework to get a major update:

What is the biggest risk then? I would say it’s financial regulation. I’ve set some of the questions above, and the main one would be – could the UK really exit the EU in terms of financial regulation? I think it would be immensely difficult and wrong for both parties to do that. In the case of full separation, both the UK and the EU are set to lose a lot.

That said, I believe this to be the less likely scenario – the FCA has been heavily involved in drafting MiFID II and it is Europe’s leading regulator which means that basically FCA helped shape MiFID II in wake of its own regulation – meaning the framework is quite similar.

The ideal scenario would be if the UK and the EU work out a harmonized financial regulatory framework

Here is the right moment to mention that Norway, Iceland and Lichtenstein are also members of MiFID, and they are not members of the European Union. That said, these countries are also maintaining an open border policy and contributing to the EU’s budget about 85 per cent of what a regular member country does.

The ideal scenario would then be that the UK and EU work out a harmonized financial regulation for the benefit of both parties, passporting to be replaced with a new but similar mechanism and so forth.

I’m sure however that the FCA would now have a much stronger say on who can market to British citizens and what instruments/offers they could make. One of the bigger faults of the EU’s financial regulation was that licensing in any state would open the gates to all other states – without them being able to oppose the issue.

Having said that, there are bigger forces at play here which have less rational considerations in mind, and just as with any theory or analysis, only time will tell who’s wrong or right. But there is no doubt that the Brexit is going to have a much more profound impact on the financial and trading industries than the SNB crisis ever did.