The British pound hit a fresh 13-month low against the US dollar in New York trading today after the Bank of England’s (BoE) Monetary Policy Committee (MPC) published its latest detailed outlook for the UK economy going forward.

Outlining the risks posed by a protracted slowdown in the European economy, which remains the biggest trading partner of the UK, the BoE’s November 2014 Inflation Report asserted that while prospects for above trend growth of the UK economy remained intact, the rates of growth are likely to be slower than previously thought.

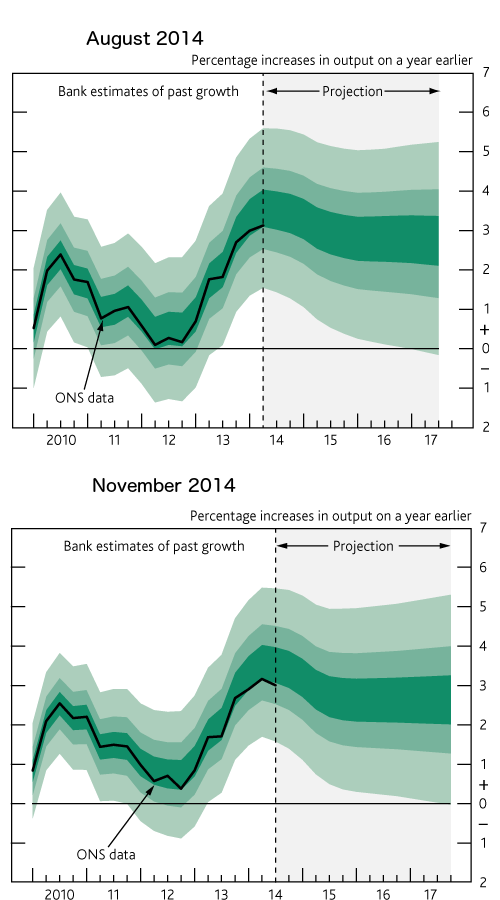

BoE UK Growth Projection, Source: Bank of England

Projected rates of GDP growth outlined by the MPC were 3.5% for this year, 2.9% for 2015, and 2.6% for each of the following two years.

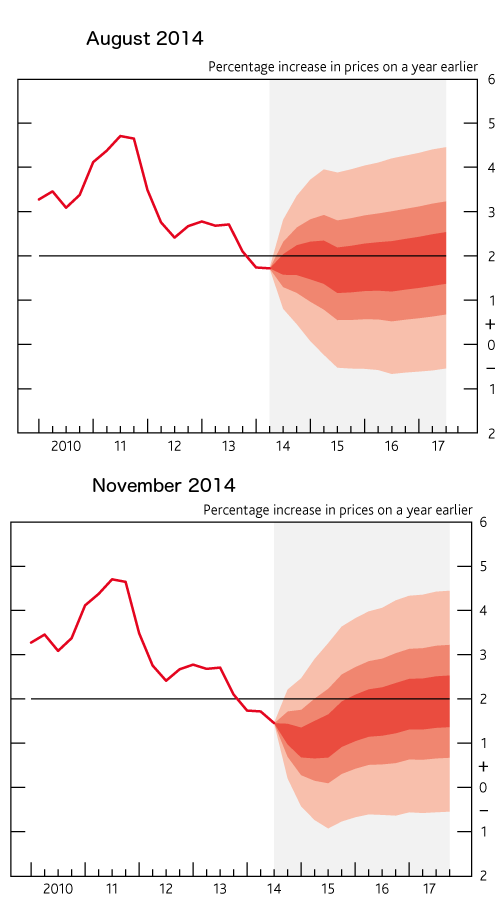

At the same time, the Bank of England downgraded its inflation rate forecasts too, implying that the 2% target inflation rate could only be hit towards the end of the forecast period.

BoE UK Inflation Projection, Source: Bank of England

Additionally, the Bank of England has implied that it can start raising interest rates only in late 2015, which is substantial backtracking from a couple of months ago when the BoE Governor, Mark Carney, implied at a press conference that raising interest rates in the first quarter of 2015 is a possibility.

That market perception has been completely disseminated along with the prospects for higher inflation in the UK after the Bank of England’s governor stated that the MPC views the possibility of hitting the lower bound of the inflation target rate (1%) in the near future, as much more likely than before.

In Mr Carney's words, “The near-term weakness means that it is more likely than not that I will have to write an open letter to the Chancellor in the next six months on account of the inflation rate falling below 1%.”

This was the news which pound traders did not expect to hear at all - while the growth forecasts pummelled prices lower to test the support levels below 1.59, throughout the afternoon trading in London the British pound was testing the recent 13-month just below 1.58.

British Pound against the US Dollar as the News Unfolded, Source: NetDania

There is not much more scope for the British pound to decline against the US dollar in the medium term, however, we could see a test of the key support level around 1.57 in the coming days.

While the U.S. Federal Reserve maintains its hawkish rhetoric, if history is any guide, the Fed will take its time before embarking on a rate hiking cycle.

Previous attempts by the Federal Reserve’s Open Market Committee (FOMC) to hint at rate hikes have notoriously failed and have led to nothing more but yet another round of quantitative easing. Should this worry materialize, the US dollar is likely to start giving back ground across the board and the British pound is likely to be one of the biggest beneficiaries.