The latest report from the Finance Magnates Intelligence Department reveals that USD pairs comprised the largest share of trading during the fourth quarter of 2016, with cable (GBP/USD) leading the pack.

To unlock the Asian market, register now to the iFX EXPO in Hong Kong. [gptAdvertisement]

As we last reported, retail Forex traders were drawn to the high volatility offered by the British currency in September 2016 due to the turmoil around the Brexit . The new analysis shows this situation continued during the last three months of the year as GBP/USD remained the most popular pair during the period.

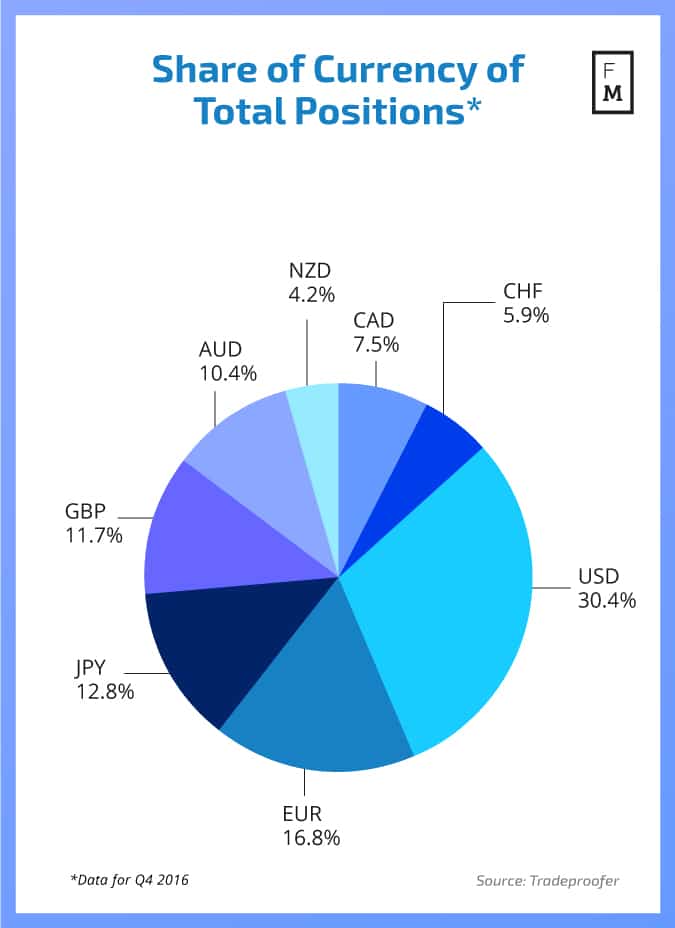

The data also shows that in total, pairs involving GBP made up 11.7% of trading volumes (most of it the cable volume of course), just beneath JPY pairs at 12.8%. The leading currency in all trades was the USD with 30.4% and the EUR was in second place with 16.8%.

Working for you

This research is based on analysis of data from thousands of positions, powered by trader consulting service firm Tradeproofer.

This is the latest publication from the FM Indices – a new cross-industry benchmark created with a methodological formula that matriculates data from three main sources: insider information, our unique database and technological BI tools.

In today’s business world, big-data analysis and access to objective information sources are crucial to success. Unfortunately, until now it has been very difficult and costly, if possible at all, to find any reliable benchmarks for operations in social, FX, binary options and CFDs trading.

For this reason, the Finance Magnates Intelligence Department has launched a new project, creating a set of indices encompassing various aspects of the online trading industry. These indices will provide you with unique data points gathered by our analysts that will serve as a valuable knowledge base for your decision making.