Heightened Volatility has brought a wave of new traders into the trading markets, as well as revived interest in previously dormant investors. However, when the threat of COVID-19 subsides and volatility leaves the major currency pairs, could emerging market currencies keep traders in FX for longer?

Emerging market currencies are known for their volatile nature, regardless of COVID-19, and although the smaller currencies have Liquidity issues and other unique traits, for traders who are looking for volatility, are EM currencies the answer?

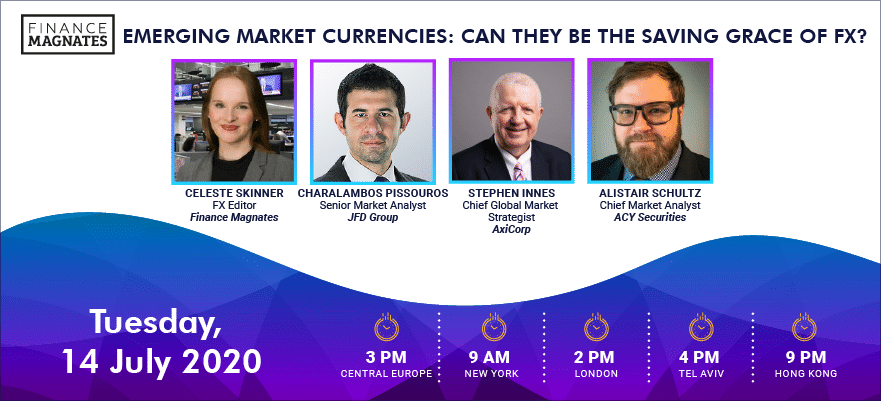

On Tuesday, July 14th, Finance Magnates caught up with Alistair Schultz, Charalambos Pissouros and Stephen Innes, who are all top market analysts from a range of brokers, spanning Australia, Asia and Europe.

During the webinar we discussed a range of topics - how has COVID-19 impacted emerging market economies, which ones have been hit the hardest, and will the pandemic cause lasting change, among other topics. The following is an excerpt of the discussion that has been edited for clarity and length.

To listen to the full panel discussion, which was titled “Emerging Market Currencies: Can They be the Saving Grace of FX?”, click the SoundCloud or YouTube links.

COVID-19 impact on Emerging Markets

The coronavirus pandemic has had far-reaching implications, with the global economy suffering. Large economies have been feeling the strain, but even more so are the less developed emerging market countries.

Charalambos Pissouros, Senior Market Analyst at JFD Group

According to Charalambos Pissouros, the Senior Market Analyst at JFD Group, the coronavirus pandemic has hit many emerging markets hard.

“Advanced economies as a whole are forecast to tumble 8 per cent and although emerging markets are expected to contract only 3 per cent, we have some economies that stand out, like Brazil, Mexico and South Africa and Russia, which are forecast to tumble 9.1 per cent, 10.5, 8 per cent, and 6.6 per cent respectively,” he outlined.

“On top of that, Brazil, Russia, Mexico and India, Peru and Chile are among the top 10 nations on the board with the most infected cases from coronavirus worldwide, with Turkey and South Africa taking the 15th and 16th place, respectively. So we have several emerging markets on the top of that board which is worrisome in regards to their respective economies.”

Strength in Asia

Stephen Innes, Chief Global Market Strategist at AxiCorp

Source: LinkedIn

Stephen Innes, Chief Global Market Strategist at AxiCorp, however, pointed out that whilst some emerging economies have been negatively impacted by COVID-19, not all regions are suffering. In fact, Asia as a whole appears to be benefiting from the pandemic, with the consensus being that Asian countries have contained the virus better than other regions.

“Really what the key is here is the low-interest rate volatility from the US, and the low volatility on the US equities markets," he explained. "It’s allowing a lot of investors that reach for yield and also reach for currency carry throughout Asia, whether that’s the Indian rupee, whether that’s the Indonesia rupiah, even the Malaysian ringgit or the Philippines peso are benefitting from that reach for yield, and that seems to be the sentiment with volatility and interest rates quite low and low volatility in the stock markets, investors are opening up their horizons.”

Turkey’s crisis continues

Before the onset of the coronavirus pandemic. Turkey’s local currency, the Lira (TRY) was already under a lot of pressure, however, the pandemic has only made things worse.

As Finance Magnates reported, Turkey’s currency has been struggling as rising inflation, slow economic growth, and growing unemployment have been weighing heavily on the country.

Since Turkey’s BDDK bank regulator lifted the trading ban imposed earlier this year in May, after a solid drop in price, on UBS, Citigroup, and BNP Paribas, the TRY has made up some ground against the USD. Nonetheless, analysts expect that the currency will weaken further. In fact, at the moment, the Lira is currently the worst-performing currency among developing currencies.

Alistair Schultz, Chief Market Analyst at ACY Securities

Speaking on the currency, Alistair Schultz, Chief Market Analyst at ACY Securities detailed: “We’ve seen unemployment at about 14 per cent, we’ve seen dwindling foreign exchange reserves, growing unemployment, and there’s been really two years of it having negative data and macroeconomically being quite vulnerable before COVID.

“So now we’ve got tourism all but evaporating, we’ve seen the IMF offer support and the President there has basically rejected that as well, and at this point, the central bank has been fighting like crazy to keep the dollar versus the Lira below that 7 line, which is a significant barrier for it but it feels like a losing battle on the Turkish side.

“From there you’re really looking at potential rate cuts to happen, but it’s been a constant state of the current President there putting in place his own understanding and idea of his own economics. Usually, you would see a central bank acting independently from politicians, and that’s not been the case, unfortunately. Because of that, we’re now looking at an area where the economics of the country are entirely political instead of being actually where you want them to be… it’s certainly not a situation I would want to be in and certainly not a currency I am interested in trading myself at the moment.”

Staying away from the Lira

Adding to this, Stephen Innes continued: “It’s one of those currencies that I absolutely hated trading and trying to collect nickels in front of a steam roller, so to speak, is what traders refer to the carry trade.

“Even trying to market make that currency is a nightmare in Asia, simply because there is such a huge demand from Japan for the carry trade. Given the amounts of political risk every day we were worried about on a Monday open where the currency was going to be… That’s enough to keep me away from the Lira.”

US Elections

Looking to the future, one event that is likely to have an impact on emerging market currencies is the United States election, namely against the Mexican peso. The Mexican peso was particularly sensitive to the elections in 2016, often referred to as the Trump barometer. Will we see MXN volatility in the lead-up and during the elections?

“In my opinion, we will get the same pattern as in 2016. If there’s anything that points to Trump being re-elected, it would be bad for the Mexican peso. Anything pointing otherwise will be good for the Mexican peso.

“I remember during Trump’s election campaign in 2016 his blatant attacks against Mexico resulted in the Mexican peso being the third-worst performing emerging market currency against the dollar that year. It fell by nearly 21 per cent… I don’t believe Trump is the President of choice for Mexican peso traders.”

This is an excerpt of a panel discussion that has been edited for clarity and length. To view the whole discussion, visit us on Soundcloud or Youtube.