The decisive day for Plus500 Ltd (LON:PLUS) and Playtech PLC (LON:PTEC) is knocking on the door and the market still displays doubts about the prospects for the successful conclusion of the takeover deal between the companies.

At the time of writing, the shares of the company are trading at a 3.7 percent discount to the offer which the gaming company made for the foreign exchange and CFDs broker several of weeks ago.

The story begins in the middle of May, just as the shares of Plus500 were hitting yet another all-time high. An investigation by the U.K. Financial Conduct Authority (FCA) into the client on-boarding practices of Plus500 triggered substantial downside pressure on shares of the company.

Within days, the share price fell from 781 pence totaling a market cap of almost £900 million ($1.4 billion) to 198 pence, or just below £230 million ($360 million).

Odey Asset Management, founded and partially run by the veteran hedge fund manager Crispin Odey, has actively engaged in buying the dip and started purchasing the company’s shares.

At the same time, Plus500's management held discussions with Teddy Sagi’s Playtech, contemplating a deal between the companies which would secure shareholders a price of 400 pence per share, valuing the company at £460 million ($720 million).

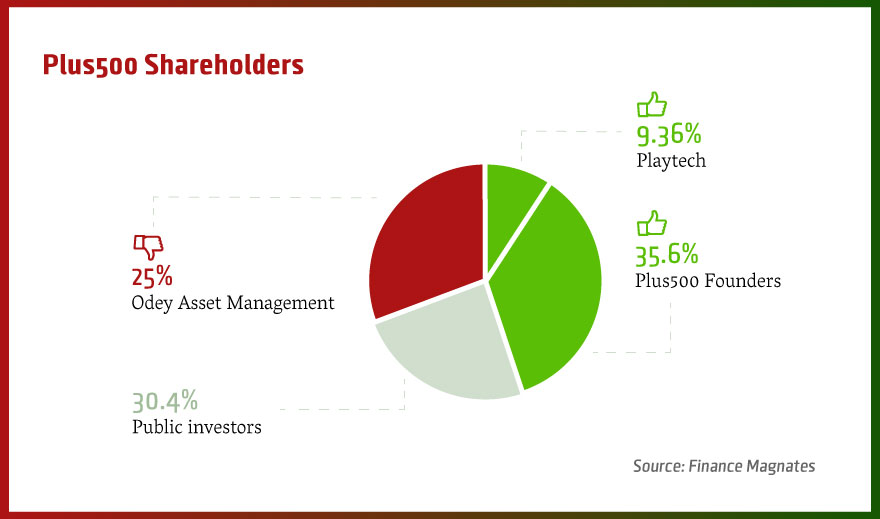

Breakdown of Plus500's shareholders towards the Acquisition voting

The value of 5%

After the announcement of the takeover bid was published, Odey Asset Management, which has gradually increased its share in recent months to 25%, deemed the offer "opportunistic".

Since the asset management firm believed that the regulatory issues and near term risks to the company’s operations were temporary, it continued buying the shares of Plus500 and stated, “We believe the intrinsic value of the business on a longer term view is materially higher than 400p.”

Further to that, it welcomed a level playing field, knowing that the management of Plus500 was missing 15 percent worth of shareholder votes by stating, “We welcome Plus500 management's approach to Playtech's proposed cash acquisition, which allows other potential bidders the opportunity to appraise Plus500 with the same information as Playtech, and which allows management to cease its commitment to Playtech's proposed cash acquisition should another bidder present a higher offer.”

What followed was not a big surprise: Playtech has taken advantage of the discounted price and reported in a regulatory filing that it owns 9.36 percent of the shares of Plus500 Ltd (LON:PLUS).

As Plus500's founders represent a 35.6% of shareholders, support rate for the deal stands at a substantial 45%. With both Plus500 and Playtech subjected to Israeli legislation, a takeover bid is approved when the collective voting power of supporting shareholders surpasses 50.1%. This means that tomorrow's results will hinge on a mere 5% worth of votes.

While the market discounts some uncertainty before the vote with the share prices trading 3.7 percent below the takeover bid value, the deal is almost secure. The likelihood that Playtech or Teddy Sagi himself haven’t secured enough votes for the offer to go through in about a month and a half is very slim. In fact, the financial resources of the parties involved would have been sufficient to buy the remaining five percent from the market weeks ago.

Breaking into Retail Forex

The pending deal is the latest move in Teddy Sagi's aggressive foray into the retail forex industry. These include buying TradeFX, the holding company behind markets.com, for $224, and AvaTrade for $105 million.

Finance Magnates has also learned that Playtech put down a $90 million proposition to buy growing binary option brand 24Option, to be unequivocally rejected, and tested the waters with IronFX and UFX.com.

The company told Finance Magnates that it sees the deal with Ava as a milestone for its global trading business: "It will expand our geographical market reach, creating access to additional regulatory licenses in desirable markets and enhance our customer offering."

Specifically, it cited significant "revenue synergies through our expertise in technology and marketing and our CRM capabilities." Both of which are offered by Plus500, whose "marketing machine" was a source of envy and inspiration for many in the industry.

With Sagi's buying power remaining substantial, we may yet see more deals after the pending approval of the Plus500 takeover bid. While it remains to be seen how Teddy Sagi’s foray into the forex and binary options industry continues, it seems that tomorrow's expected consent will not mark its ending.