India, a model growth story for emerging and frontier markets throughout the last thirty years, has come to a bleak standing point with the country about to face major economic crisis. The fundamentals aren't looking too good with the list of issues growing day by day, inflation, contracting growth and the widening current account deficit - to name but a few.

India's central bank will be appointing a new chief who comes in at a difficult time. The currency has plunged 20%, economic growth is at a 30 year low, and the latest inflation figures have gone from bad to worse, nearing the 6% mark. Change is always good, and we have seen a new sergeant at both the Bank of Japan and the Bank of England, both of whom were swift in implementing new measures and gearing their troops.

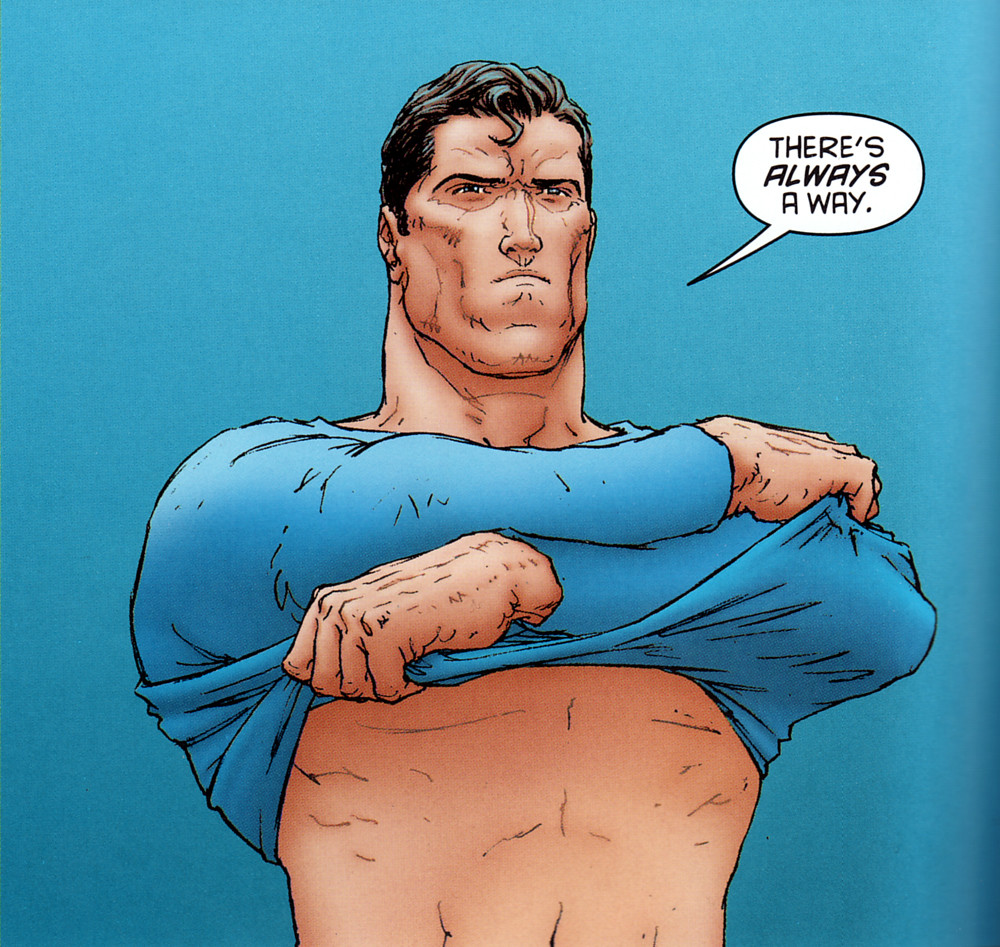

The answer is…

Raghuram Govinda Rajan, a renowned economist will be sworn in as the 23rd RBI governor today. Rajan has served in several high profile roles and is most known for his prediction of the 2008 crisis whilst serving at the IMF. The Indian government has made a decision to appoint him as the next chief of Asia's third largest economy. On the 6th of August, he will supersede Dr D Subbarao, whose five year term comes to a disappointing end on September 4, 2013.

Is there a quick fix and what can the new governor do to rectify the situation? Just some of the questions on the minds of several onlookers of the state of India's economy. Analysts believe that the former IMF chief economist will start clearing up the rupee mess before he dwells on inflation and economic growth. “We have already seen foreign investors withdraw investments, last month alone over $2 billion was withdrawn, this has had an impact on major stocks and indices, and the rupee needs to recover.” explained Iftekhar Abidi, Director of Marketing at Indo Jatalia.

Rajan has been affiliated with the Indian government and has worked on several projects including; Planning Commission-appointed committee on financial reforms, and as honorary economic adviser to Prime Minister Manmohan Singh.

Worry never stops, commodity volumes drop

Adding to the overall doom and gloom are India's popular commodity markets, the regulator published half monthly trading volumes for August (1st to 15th) this week. The markets have dipped dramatically with overall volumes dropping 43% at all trading venues. The report showed that the total value of trades reached Rs 3,52,873 crore ($52 billion USD) in the first 15 days of last month. The exchanges reported trading values worth Rs 6,19,730 crore in the August 1-15 period last year, according to the Forward Markets Commission (FMC) the main regulator.

Amar Ambani

MCX, the main commodities bourse, which holds approximately 80% market share in the commodity futures market saw volumes dip by 40 per cent to Rs 3,07,704 crore as against Rs 5,17,020 crore in the year ago period.

Turnover of the country's second biggest commodity bourse NCDEX, also declined by 57 percent to Rs 35,479 crore in the August 1-15 period from Rs 82,674 crore in the same period last year.

The main factor behind the commodity shortfalls is blamed on the government's recent tax on commodities, the CTT. Amar Ambani, Head of Research at IIFL, an Indian brokerage firm, explained about the shortfalls in a comment to Forex Magnates: "Levy of 0.01% CTT has definitely dampened the volumes on the commodity bourses, with MCX average daily turnover down by a drastic 40%. This can be explained by the fact that jobbers (speculators) who contributed 40-50% of the MCX volumes are out of business. Jobbers survived on wafer- thin margins and proportionately paid very low transaction costs. After the advent of CTT, the costs have dramatically increased, which has made it difficult for the price sensitive jobbers to sustain.

However, the bigger culprit, apart from the CTT which has led to the sharp fall in volumes seems to be NSEL fiasco. Systemic risk has eroded market confidence and in the process dissuaded commodity brokers and retail investors to participate on the derivatives segment. Debacle in the spot Exchange is going to have a prolonged cascading effect on the derivative business, and the situation will not restore to normalcy unless, the dust settles down as far as NSEL obligations are concerned."

As expected, the CTT has been the key driver between a sharp slowdown in commodities related activity. Market participants were lobbying against the charge, however, the combined forces from all the major exchanges were unsuccessful. India has positioned itself as one of the most liquid markets for major commodity trading, including gold, silver and oil. The country is home to five commodity exchanges, with two more set to gain regulatory approval and come into action in the next 18 months. Mohd Naved, a Delhi based professional trader said in a comment to Forex Magnates: "I hate to say I told you so, but the CTT is not something that can assist our markets, and I know of several traders who are looking at alternative markets."

Change now

In order for India to go back to the golden days of the mid 2000's when everything was looking bright for the 1 billion plus nation, then things need to change, and they need to change dramatically. Mr Ambani concludes: "Our economy is enduring turbulent times and such sorry state of affairs demand incisive measures. The government cannot dwell on past laurels and the need of the hour is to invigorate growth and instill investor confidence. A difficult situation calls for tough decisions, whereby the government has to bite the bullet and grasp the nettle."

Raghuram Govinda Rajan

Since Rajan was announced as Duvvuri Subbarao's replacement, the rupee has continued to dive and it has dropped 10% over the last month, again crossing record lows. The rupee has been ploying near the 69 mark, and is currently trading at 67.63 against the dollar.

Carney, Kuroda and now Rajan, the state of the global economy lies in the hands of the new kids on the job.

Rajan steps in with the anguish and cry of 1.2 billion people, and all eyes will be on the rupee, the Reserve Bank of India and Rajan.