The market capitalization of CMC Markets (LON:CMCX) has increased by 13.6 per cent since the company went public in the beginning of February 2016. The company's shares have risen to 270 pence per share after debuting at around 240 pence per share. The recent rally in the company's shares can be attributed to the upcoming season of trading updates which companies are issuing to guide the market about their operations.

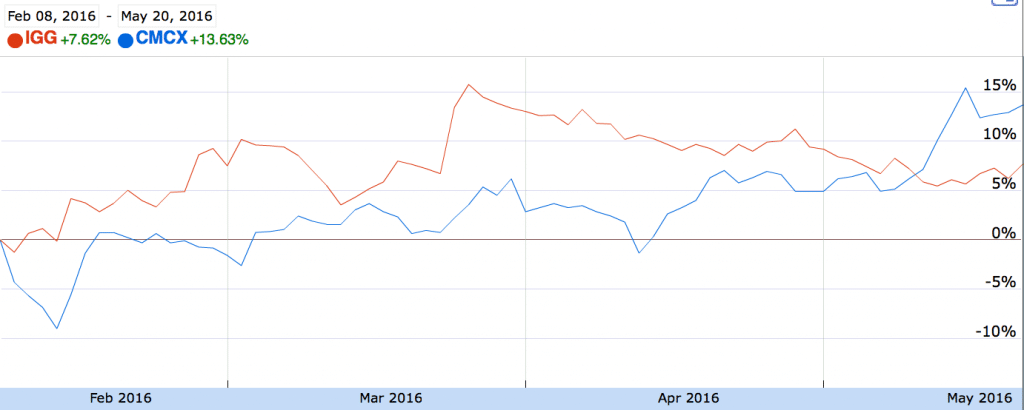

The growth of the market cap of CMC Markets (LON:CMCX) in recent weeks has been surpassing that of its direct competitor IG Group. The company has been actively marketing the results from its initial public offering (IPO) with the brand gaining more prominence amongst its prospective clients.

Shares of CMC Markets have been growing faster than those of IG Group in the past couple of weeks, Source: Google Finance

CMC Markets (LON:CMCX) has been actively targeting retail investors since the founding of the company, however in the aftermath of its IPO it is also expected to broaden its scope. The brokerage is offering a wide set of contracts for difference (CFDs) to its retail clients including stocks, indices, futures, commodities and treasuries.

The first quarter of the year has been fairly volatile with the momentum moderating into the second quarter of the year. Foreign Exchange , indices and commodities Volatility has been moderating somewhat despite the rising risks related to the U.K. referendum on whether the country will remain a member of the European Union or not.

With the expectations that the U.S. Federal Reserve will increase interest rates for a second time in the past six months more volatility across multiple asset classes could further boost the earnings power of CMC Markets (LON:CMCX) in the coming weeks.