ABOUT THE AUTHOR: Andy Waldock is from COTSignals.com. The company's research focuses on the application of the Commodity Futures Trading Commission’s weekly Commitment of Traders report.

The coffee futures market has approached the commercial traders’ value area. Based on price projections over the last three years and the commercial long-hedgers’ recent purchases, we expect this area to find support and move back towards $2 per pound.

Coffee futures have declined in price and Volatility over the last few years along with the rest of the commodity complex. This type of orderly meandering is exactly the type of activity in which the commercial hedgers thrive. Commercial traders are mean-reversion value traders. They use their valuation models to determine broad value areas that they see as neutral prices. When the market moves far beyond their value areas, commercial hedgers step in to lock in their forward sales or guarantee their forward production costs.

Either way, their actions are based on the expectation that the market’s price will move back towards their value targets thus, allowing them to lift the hedge and capture the accrued profits in their futures trading account.

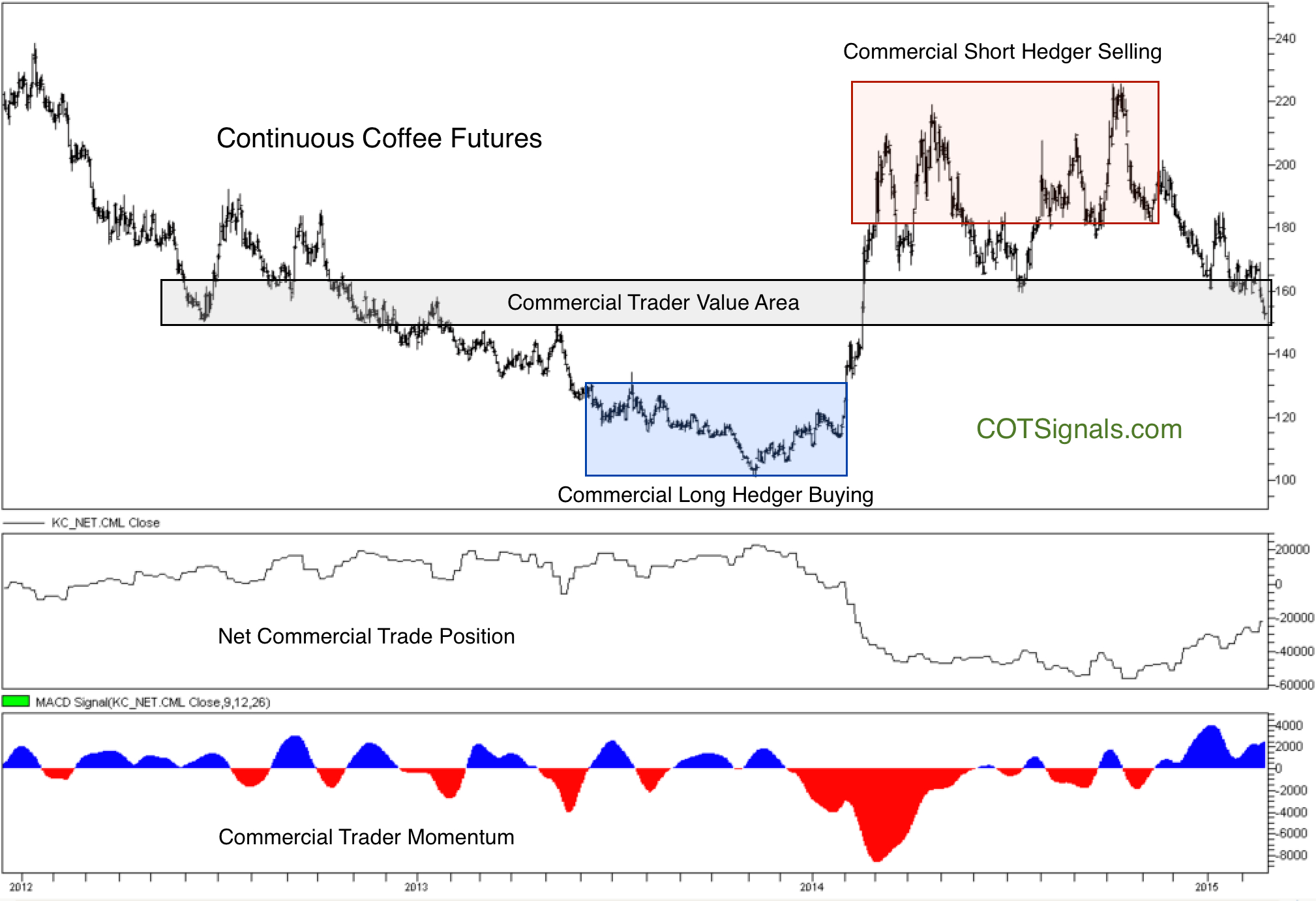

Looking at the long-term chart below, you can see the commercial traders’ net position changes with respect to the market, trading above or below the value area over the last three years.

Long Term Coffee Chart

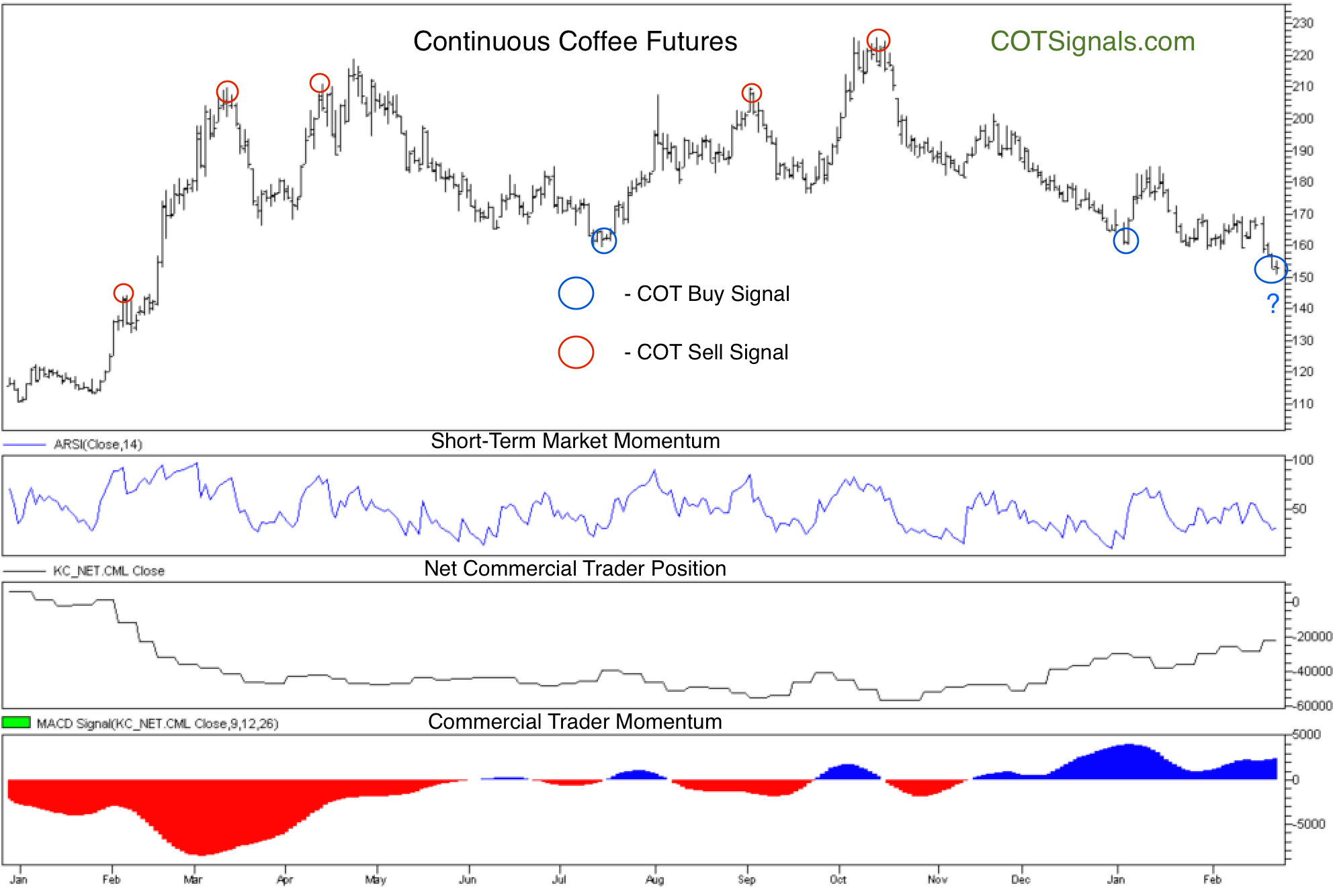

Moving to the current situation you’ll notice that another pane has been added to the chart labeled “Short-Term Market Momentum.” This is a proprietary version of RSI and is read the same way. There are two statements that must be true to create a COT Buy set-up.

Short Term Coffee Chart

Commercial trader momentum must be positive (we want to trade in line with the commercial traders). Short-term market momentum must be oversold (we want to buy when small speculators are selling against the commercial traders).

The long trade is then triggered when the short-term momentum indicator crosses back above the oversold threshold. This also creates the swing-low that will be used as the protective stop point for this trade. Once, and only once, this indicator bounces back will the buy signal be sent. Finally, whatever the low for this move ends up being will be the price at which point the protective sell stop will be placed.

This article is part of the Forex Magnates Community project. If you wish to become a guest contributor, please apply here: UGC Form.