Vladimir Petropoljac

ABOUT THE AUTHOR: Vladimir Petropoljac is the Head of Business Development at Sensus Capital Markets and the author of "Rallied! The Alternative Guide to Becoming a Trader." His background is in asset management where he spent many happy years.

Timber as a resource is used widely in a number of industrial applications and is a widely-traded commodity. This resource is most important to the construction industry, as it is a raw material used heavily by home-builders.

Timber is attractive to some investors because it has been shown to smooth overall Volatility when added to a stock-and-bond portfolio.

Lumber futures are traded on major exchanges, and certain exchange-traded funds offer exposure to companies engaged in the production of this commodity. The value of timber trees is based on the value of the products that can be made from them. This is dictated by size (height and diameter), species and quality of the trees.

Product classes are generally expressed in terms of diameter measured at breast height (DBH).

Pulpwood: 6-9” DBH. Pulpwood trees are chipped into small pieces, chemically treated and made into paper. Pulpwood is measured in tons or standard cords.

Superpulp

This is an unofficial designation used to describe pulpwood-sized pine trees from which one 2 x 4 board could be cut. Superpulp is more valuable than regular pulpwood, but markets for this product are not always available. Another name for superpulp is “canterwood.”

Palletwood

This is an unofficial designation for low-quality hardwood timber that is not good enough for lumber, but can be sawed into slats for pallet-making. Palletwood is sometimes called “skrag.”

Chip-n-saw

10-13” DBH. By using a combination of techniques, these mid-sized trees produce chips for pulpwood as well as small-dimension lumber. Chip-n-saw is measured in tons or standard cords. Value is heavily dependent on tree quality.

Sawtimber

14”+ DBH. Trees are cut into lumber. Waste material is converted into chips for fuel or paper production. Sawtimber is measured in tons or board feet. Value is heavily dependent on tree quality.

Veneer

16”+ DBH. By means of a large lathe, the tree is converted into continuous sheets of thin wood. This is used in the manufacture of plywood and furniture, depending on the type of tree. Veneer is measured in tons or board feet. Value is heavily dependent on tree quality.

Timber, like any other commodity, experiences price fluctuation according to the laws of supply and demand; prices may vary significantly from one part of the state to another. The price paid for any product class also varies according to quality.

Terminology complicates understanding of timber value. In SC, there are two accepted, quantifiable standards for measuring pulpwood and chip-n-saw: standard cords and tons. A standard cord is a stack of wood measuring 4’ x 4’ x 8’ (128 cubic feet); A ton is 2,000 pounds of raw wood, including bark.

Lumber Market

The standardization of lumber in the US can be directly traced back to the first and second World Wars. While logging had endured for centuries, it was not until World War I that standard lumber sizes were instituted. The significant amount of lumber that was required during World War II solidified the acceptance of standardized sizes because it provided an efficient way for mills and lumber purchasers to meet each other's needs while being separated by thousands of miles.

Although lumber has many versatile uses, it is constantly subjected to changing consumer interests, shifts in manufacturing facilities and housing downturns. This leaves the industry in a constant state of panic because it is forced to be reactionary to various factors outside of its control.

To protect the lumber industry from the volatile price swings that this uncertainty brings, the Chicago Mercantile Exchange (CME) developed the first lumber commodities contract in 1969.

The price of lumber is influenced by the following factors:

The number of new homes under construction at any time impacts the need for lumber. In 1999, hardwood production was 12.6 billion board feet; By 2005, it had dropped to 10.7 billion board feet.

Traditionally, lumber has been treated with pesticides to repel insects and fungus. Unfortunately, these pesticides are considered harmful to humans and the environment, yet switching to alternatives or eliminating the pesticides altogether could potentially increase costs, either by way of lost lumber or via more expensive alternatives.

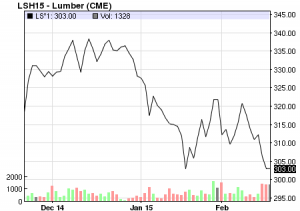

Lumber chart 3 Months Source: NASDAQ

The US is faced with a growing number of manufacturing plants overseas that are in need of raw logs, as opposed to finished lumber. Unfinished wood is less valuable than finished wood and commands a cheaper price in the marketplace. This Leads to a loss of jobs in the finished lumber sector and a shrinking of the logging-to-lumber industry.

Logging has always played an active role in environmental debate. Cutting down large swathes of forests has irreversibly altered various species, ecosystems and plants. The long-term consequences of this cannot be foreseen, particularly in a world that is increasingly affected by global warming. It has been estimated that deforestation is responsible for 17% of annual global carbon, a level higher than that of emissions from transportation.

US loggers have experienced difficulty competing directly with Canadian wood. Both countries have fought for decades to find equal footing regarding lumber pricing and subsidies.

Because various Canadian governments own timber land, a prevailing assumption is that an unfair advantage exists in sale prices compared to the privately owned timber lands in the US. Both parties have made multiple agreements to resolve this issue, but it may take some time before a sufficient arrangement can be found.

Read the previous articles in this series:

Commodities Corner (part 1): Intro

Commodities Corner (part 2): Cotton

Commodities Corner (part 3): Aluminium

Commodities Corner (part 4): Coffee

This article is part of the Forex Magnates Community project. If you wish to become a guest contributor, please apply here: UGC Form.