John Putmann II

ABOUT THE AUTHOR: John Putman II is a full-time trader and managing member at FX Analytics , a third-party research provider focused on exchange rate modeling, economic complexity, genetic programming and distributive computing.

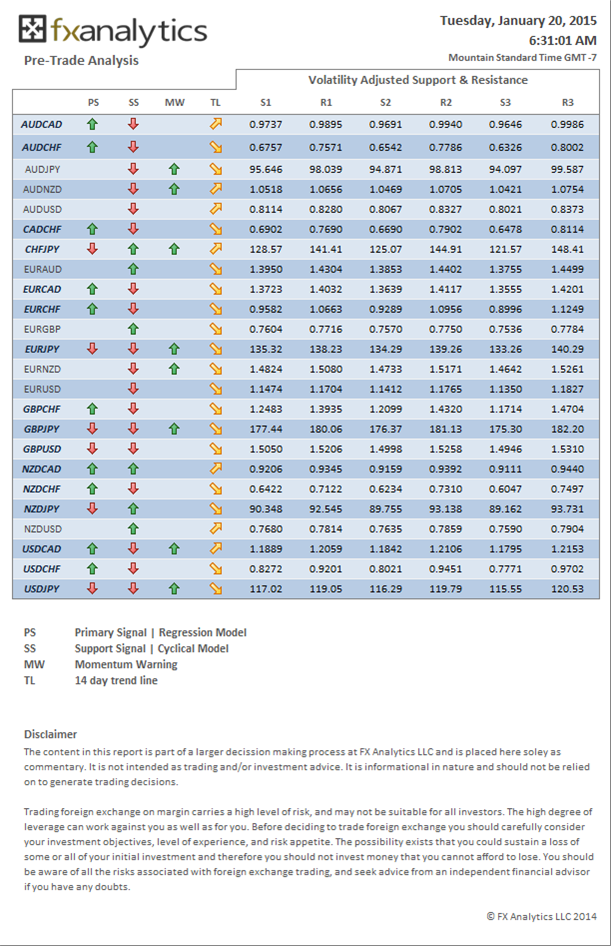

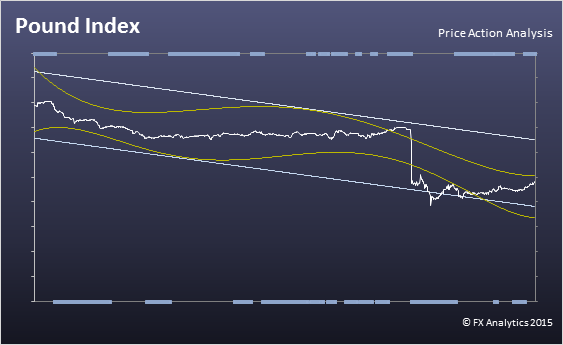

In early trading we saw the Aussie, Euro and Pound Indices all gain ground. The Kiwi weakened overall while the Swiss and Dollar remained relatively unchanged. The Pound Index is slowly approaching resistance which is a good thing as I’m on the wrong side of a GBP/JPY trade and can use all the help I can get, and the Kiwi is sitting at its macro support. These two may warrant further analysis as there may be potential setups in the underlying pairs. The balance of price action in the other exchange rates is relatively neutral.

January the 20th, 2015

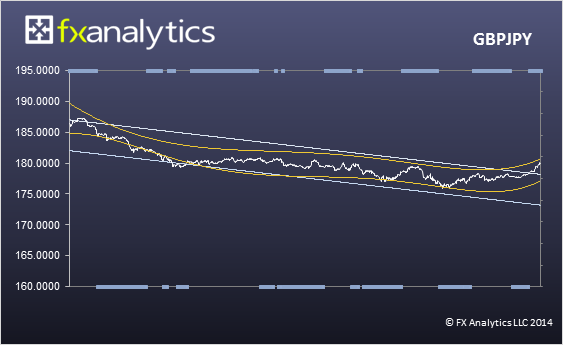

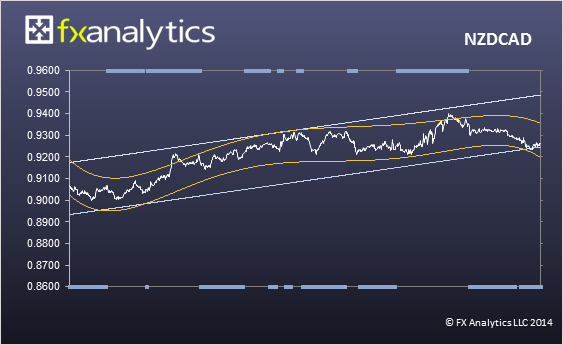

In the matrix this morning, there are 16 regression signals, six of which have cyclical support, but only two aren’t suffering from counter-momentum. Those will be put aside until this afternoon and then reevaluated. Of the two that are left, GBP/USD and NZD/CAD, the latter is of more interest to me at this time. I’m currently short the GBP/JPY, and taking a beating on it, and the correlation between that and the GBP/USD is just a little too high, I’d likely end up with unintended Leverage by adding it in. While the correlation between the GBP/JPY and the NZD/CAD is actually negative, getting long the NZD/CAD while short the GBP/JPY actually puts it in gear to a small degree. Difficult to squeeze out all the risk.

Pound Index

Kiwi Index

GBP/JPY

NZD/CAD

This article is part of the Forex Magnates Community project. If you wish to become a guest contributor, please get in touch with our Community Manager and UGC Editor Leah Grantz leahg@forexmagnates.com