While the European Central Bank's (ECB) President, Mario Draghi, continues speaking, the main outcome from the press conference is quite positive for the euro bulls. They seem to be in control for now as the pressure over the US dollar increased following Draghi's remarks that the central bank is refraining from additional easing steps for now.

With increased market expectations that the ECB is going to engage in a US style quantitative easing, including government bonds, the central bank's President said that various options for quantitative easing (QE) were discussed but the ECB refrained from announcing new measures today.

However, the door was left open for future easing steps, "Early next year the Governing Council will reassess the monetary stimulus achieved, the expansion of the balance sheet and the outlook for price developments."

ECB Staff Projections Downgraded

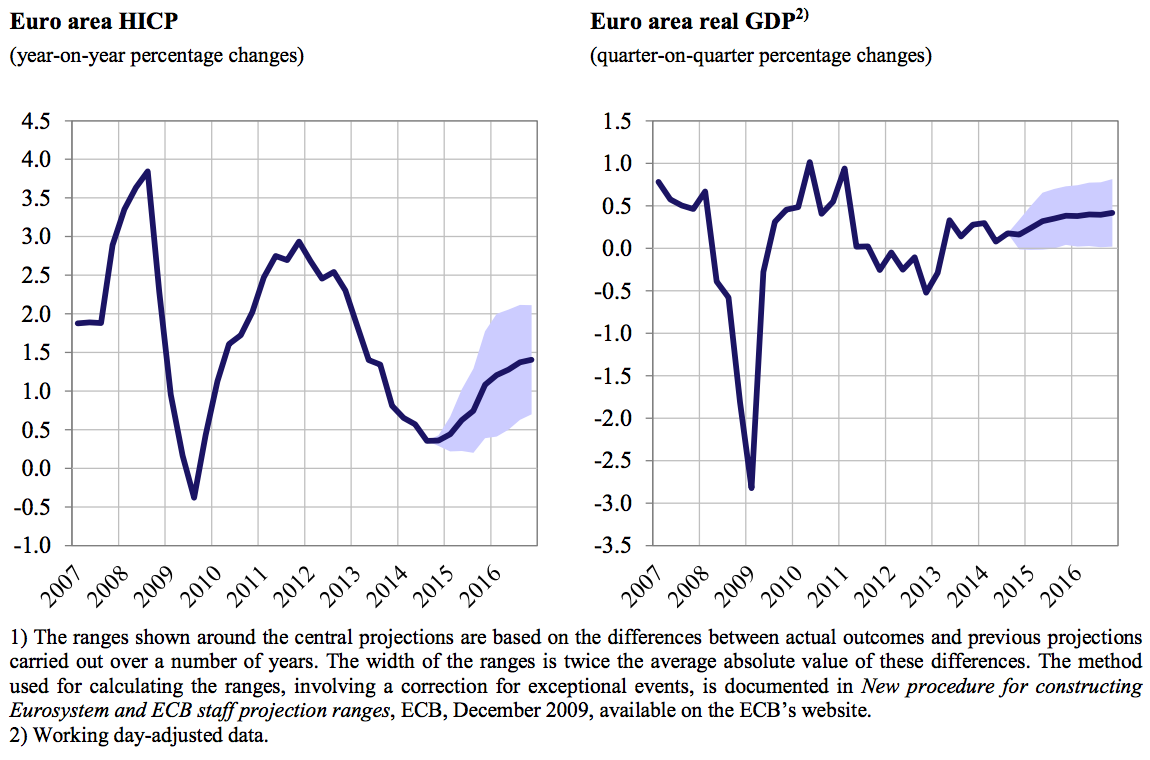

The new set of ECB staff projections has been released and the expectations for growth and inflation have both ticked lower. Annual real GDP was forecasted to increase by 0.8% in 2014, 1.0% in 2015 and 1.5% in 2016. They represented substantial downward revisions from the numbers announced in September 2014.

Draghi repeated his usual rhetoric about the lack of commitment by Euro Zone governments for structural reform saying, "Insufficient progress in structural reforms in euro area countries constitutes a key downward risk to the economic outlook."

When it came to inflation forecasts, the ECB's staff forecasted that the Euro Area's annual HICP inflation would drop to 0.5% in 2014, 0.7% in 2015 and 1.3% in 2016.

ECB Staff Macroeconomic Projections, Source: ECB

Euro Rally Unlikely to Hold in the Long Run

While the euro shot higher to 1.2400 after Draghi's remarks, his mention of the central bank purchasing all types of assets were discussed ("except for gold"), resulting in additional Volatility on the currency markets and the realization that the ECB's governing council is merely postponing the inevitable (and looking for legal ways to avoid the prohibition of the direct government monetary financing clause in the ECB's treaty).

Draghi reiterated, "The ECB can't violate the Maastricht treaty, so no monetary financing is possible." He also expressed his views during the Q&A session on other central banks' success rate with unconventional monetary policy measures saying, "Quantitative easing has been successful in the U.S. and the UK, however its impact in Japan has been harder to assess."

Summing up Draghi's remarks, we can conclude that while in the short run the European currency could rebound somewhat, the long-term outlook for the euro doesn't look good provided that the FED manages to start hiking rates next year, while the ECB does everything within its mandate to lead the FX market to a lower euro (despite never admitting it publicly).