It’s been less than four months since the European Securities and Markets Authority (ESMA), a regulatory body whose name is likely to send shivers down the spines of retail brokers, announced its new restrictions on contracts-for-differences (CFDs) and binary options.

By now, most people in the retail industry are familiar with the regulation but, for those of you who have been living under a rock, ESMA’s edicts are still worth going over. Beware, this makes for scintillating stuff.

Binary options are out. Gone. Kaput. Finito. ESMA has decided to prohibit the marketing, distribution, and sale of them. This is understandable given that the behaviour of certain market players has led many to believe that the antonym of ‘scrupulous’ is in fact ‘binary options broker.’

Less understandable, at least from the perspective of many in the industry, are ESMA’s restrictions on CFDs trading. From the 1st of August of this year, brokers will only be allowed to provide clients with leverage of 30:1 on CFDs in major currency pairs, 20:1 in indices, non-major currency pairs, and gold and 2:1 in Cryptocurrencies .

Having read the regulations, and recovered from their initial shock, some brokers have decided they won’t be able to remain in business if they stay in the Old Continent. As a result, many are moving offshore or shutting up shop altogether.

Finance Magnates

The regulation isn’t just a problem for smaller players either. Though they predict a return to profitability in the next year, IG Group, one of the largest firms in the retail broking space, admitted in its most recent financial report that the new regulations are likely to cause a slump in its revenues.

Aside from fleeing Europe and settling in, to put it kindly, a more broker-friendly country somewhere out in the Pacific or the midst of the Caribbean, brokers do have another means of limiting the impact of the regulation - reclassification.

ESMA’s regulation only applies to retail traders. That means if a broker’s client decides to reclassify as a professional trader, none of the leverage restrictions will apply to him.

After extensive research and conversations with a number of leading brokers, Finance Magnates has found that, though it will drastically reshape the industry, ESMA’s regulation may not hurt some broker’s revenues as much it would first appear.

Bringing in the pros

Two weeks ago, Plus500, one of the leaders in the CFDs retail trading market, released a trading update for investors. The firm was positive, stating that it looks set to have a stellar performance in Q2 of the current fiscal year.

Contained within the statement was another interesting piece of information. The CFD broker noted that of its current client-base, 12 percent would likely be able to reclassify as Elective Professional Clients (EPCs).

Significantly, the traders that made up that 12 percent were responsible for bringing in 75 percent of Plus500’s revenues. The implications of this were made clear by the firm itself.

“The Board believes,” said the broker’s statement, “that the Group's EPC offering puts it in a strong position to maintain revenue from those customers following the implementation of the new ESMA rules.”

Not alone

Plus500 isn’t the only firm to have a small segment of its clientele providing it with the bulk of its revenue. Finance Magnates spoke to a number of brokers who suggested that a similar proportion of their traders were providing the overwhelming majority of their cash flow.

Graeme Watkins, CEO, Valutrades

“The industry has a sort of 90/10 rule,” said Valutraders CEO Graeme Watkins, “where we say that 10 percent of your clients generate 90 percent of your revenue. I would say that almost all brokers, invariably, will generate most of their revenue from the top end of their business.”

Two other firms that Finance Magnates spoke to, OctaFX and InterTrader, agreed. Though they did not reveal their own numbers, both stated that brokers could expect approximately 20 percent of clients to generate 80 percent of revenue.

In a recent announcement, IG Group also noted that 3800 of its clients, who are classified as professional, had contributed 35 percent of its leveraged trading revenue in the previous quarter. The firm added that it is now sifting through 15,000 applications from retail clients who want to be reclassified as professional traders.

Similarly, in its gargantuan annual report, CMC Markets stated that it “is in the process of reviewing client requests to be treated as elective professional clients.” The firm added that it has a “strategy of attracting and retaining high value and professional clients to mitigate some of the impact [of the ESMA regulation].”

Our keen-eyed readers will have realised that most of the above figures fit neatly with the Pareto principle. This is the idea that approximately 20 percent of a group engaging in a particular activity, whether it be paying taxes, owning land or committing crimes, will be responsible for 80 percent of that activity.

The difference in this case is that, ideally for brokers, their top 20 percent of traders will no longer be subject to the same rules as the other 80 percent. How easy that will be to implement is dependent on a number of factors.

Terms and conditions apply

In order to reclassify a client as a professional, brokers have to jump through a number of regulatory hoops. Clients must first state, in writing, that they wish to be classified as a professional.

A broker receiving such a request must then clearly indicate to the client that they will lose all regulatory protections and compensation rights. After this, the client must state in writing, in a new document, that he is aware of the consequences of losing such protections.

Finance Magnates

Simple, right? Except the process doesn’t end here. After this, a broker must give the client a test that demonstrates he is capable of making his own investment decisions and has an understanding of the risks involved. How this test is designed seems be at the discretion of the broker.

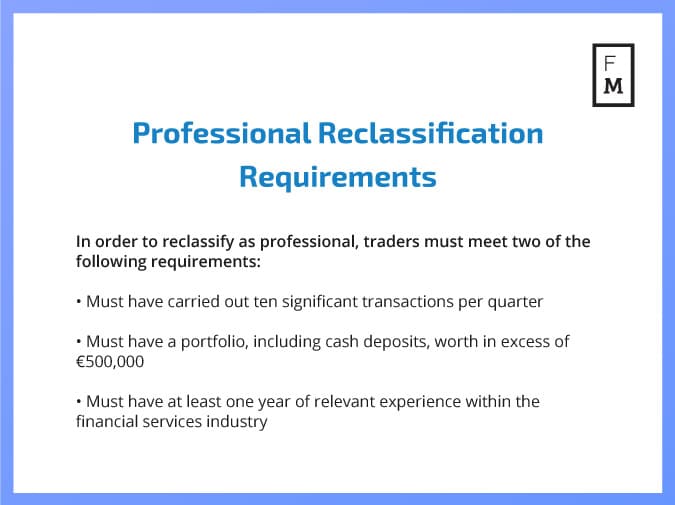

Over the course of this test, a prospective client must also satisfy two of three conditions. If they do not make an average of 10 trades of “significant size” per quarter, clients must have a portfolio worth €500,000 ($586,000) and over a year’s worth of experience in the financial sector.

These rules leave some wiggle room for unscrupulous behaviour- how large is a trade of “significant size” for instance? - and some brokers already appear to be taking advantage of the them.

“We’ve heard that a number of brokers are trawling through LinkedIn, finding clients with some tenuous connection to finance, and telling them they should reclassify.” Said Watkins. Others have noted a similar pattern but don’t think the trend is likely to last.

“In the past, the FCA hasn’t taken long to respond to new regulation.” Said Christian Rolando, founder of Lugano Associates, a London-based regulatory consultant to brokers, “at some stage they’ll come looking and, if brokers aren’t behaving appropriately, they'll consider enforcement action.”

Changing tactics

Regardless of any backhanded methods, many brokers are quite open about the fact that they will be encouraging their clients to reclassify as professional.

“We won’t only encourage the most vital traders which are eligible for reclassification,” said George Pantzis, a manager in OctaFX’s research division, to Finance Magnates, “but will also enable them to become more professional by signing up to our educational course and by joining a trading academy.”

Other firms aren’t being quite as explicit as Pantzis but the moves they are making still imply they are taking similar steps. As noted, IG Group and CMC Markets are both going through client requests to reclassify as professional.

CMC Markets has even released a new service to cater to a more high-end clientele. In April, the broker launched CMC Pro, a new service designed to maintain a client-base that trades with high leverage.

Another broker, InterTrader, has done the same thing. At the beginning of July, the broker confirmed that it was going to start providing a professional service to traders.

“The trading world is changing and we’re changing with it.” Said the firm’s CEO, Shai Hefetz, “Our advanced Trading Platform is tailored to serious traders who demand serious trading tools.”

Professionalisation

“There is often a misconception that the market is highly saturated, but this is not the case at all,” ActivTrades’ CEO Alex Pusco told Finance Magnates this June, “we are just at the beginning.”

There seem to be two meanings to the this statement, one is true and the other is not. The retail industry is not just beginning, as most people reading this article are aware, it has been around for decades.

On the other hand, we may indeed be at the beginning of a new stage within the lifecycle of the retail trading industry. In fact, the changes we are seeing may mean it is no longer even appropriate to refer to the industry as ‘retail.’

The behaviour of brokers so far indicates that ESMA’s regulation has pushed them into focusing on wealthier, professional clients. This is illustrated by their focus on developing professional products over the past six months and their encouraging of specific, revenue-generating clients to reclassify as professional.

Many in the industry have predicted that ESMA’s regulation will push out the smaller, less professional brokers but the same could be true for brokers’ clients. If those brokers no longer devote any energy to maintaining or onboarding clients that don’t qualify as professional traders, the number of truly 'retail' clients may shrink dramatically.

That would mean we are left with only large brokers and professional traders. Is that still the retail industry? Perhaps, but certainly not as we once knew it.