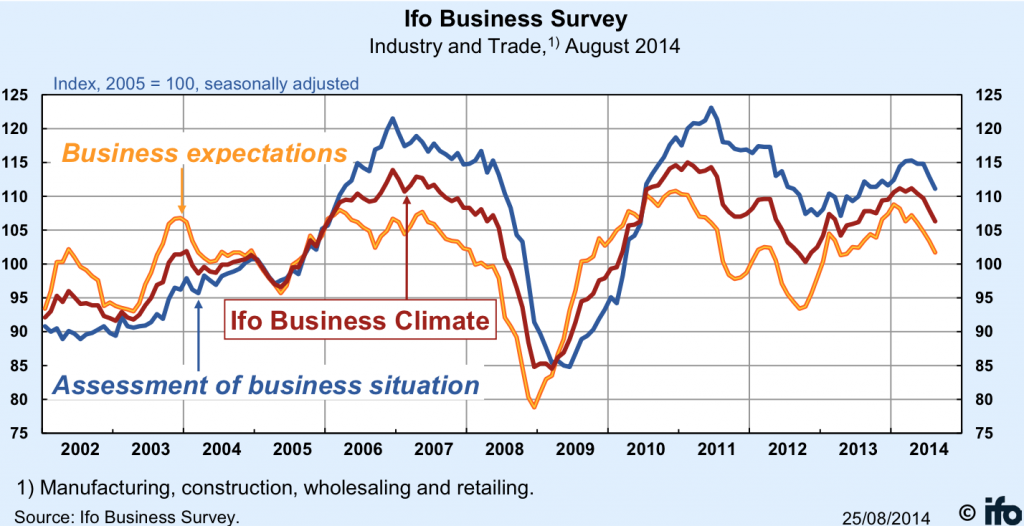

The monthly German IFO Institute Business Climate Survey, published every month to provide an assessment of the state of the German economy, has declined for a forth month running, with its crucial expectations component peaking out earlier this year in April.

Following the release at 08:00 GMT, the Forex market has reacted by selling the euro at a new 11-month low against the US dollar around 1.3183. Since then prices have recovered tentatively, still trading sharply lower than Friday’s closing level around 1.3240.

The Ifo Business Climate Index survey is based on the responses of about 7,000 companies in manufacturing, construction, wholesaling and retailing. The headline Ifo Business Climate component came out at 106.3.

The forward looking expectations component of the survey was reported at 101.7, last seen at these levels in May 2013, just after the confidence in the Euro Zone’s recovery evaporated following the implosion of the banking crisis in Cyprus.

According to the Investment Banking Division of German Commerzbank AG, Corporates & Markets, “The optimistic economic outlook of the ECB, which expects a fairly strong growth rate of 1.7% for the euro area in 2015 is crumbling. Our forecast which comes with some downside risk, is only for 1.2%.”

Ifo Business Survey Chart August 2014, Source: IFO Institute

The chart above shows that the recent decline is about as steep as back in 2012, when bond markets across the continent were rapidly deteriorating forcing the European Central Bank’s president to deliver his famous “whatever it takes” speech.

Mario Draghi committed back then, “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”

Draghi’s Lowflation Conundrum

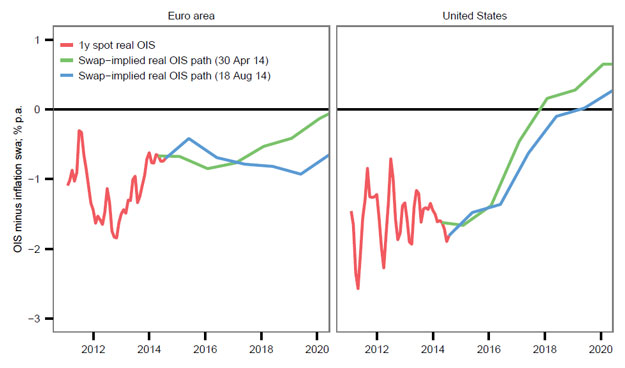

According to Draghi’s Jackson Hole comments, the ECB is now preparing to deliver the action, following up on the promise. He stated during his speech, "Inflation expectations exhibited significant declines at all horizons. The 5year/5year swap rate declined by 15 basis points to just below 2% — this is the metric that we usually use for defining medium term inflation."

Since Mr. Draghi's monetary policy-setting team at the ECB is using it, it only makes sense for forex traders to pay closer attention to this figure. He also presented a chart of real interest rates paths for the Euro Zone and the ECB going forward.

Real Interest Rate Paths Euro Area US, Source: ECB

Head of strategy at ING Investment Management, Valentijn Van Nieuwenhuijzen, stated to CNBC this morning that according to his reading of the Draghi speech in Jackson Hole, “sovereign quantitative easing (QE) is getting closer.”

Barclay’s Philippe Goudin stated, “Draghi called for action on both demand and supply-side policies and urged European governments to deepen fiscal consolidation and speed up structural reforms.”

The notion of an increased likelihood of QE from the ECB is also supported by the stock markets opening in Europe higher by about 1% from Friday’s European closing levels. Commerzbank Corporates & Markets stated, “The probability for broad based bond purchases has increased.”

French Government Collapses

In another major development affecting the FX market over the weekend, members of the French government, Economic Minister Montebourg and Education Minister Hamon, criticized austerity polices, blaming them on Germany.

Consequently, Prime Minister Valls said that he would dissolve the current government. Austerity measures which are deemed necessary by French President, Francois Hollande, have allegedly impeded France’s stagnant economy from recovering, according to Valls.

The euro is currently trading around 1.3203 after weaker than expected New Home Sales data from the US. Meanwhile, the S&P 500 index surpassed 2,000 points for the first time in its history in the expectation that the ECB will introduce QE.