With Twitter set to trade today on the NYSE, during its imminent Initial Public Offering (IPO) under ticker symbol TWTR, it will be interesting how new technologies will set to change the way firms use Twitter for business. Today, Forex Magnates shares an exclusive story about FSwire, an innovative company with a potentially game-changing solution to help financial services filter out the vast amounts of noise common in social networks, which have become a place of increasing importance and intertwined with everyday life.

Some say we are living in the “age of information”, which may have reached “information overload”, or TMI (Too Much Information), an acronym commonly reserved for use in response to excess information shared in social media settings and electronic communications.

After several years in startup mode, and having optimized a well-structured and highly sophisticated business model, FSwire (short for Financial Services Wire), has emerged as a leading contender that can extract valuable real-time information from social networks like Twitter, and deliver tailored data in ways that relate to affecting the value of underlying assets and not just discussions taking place about them.

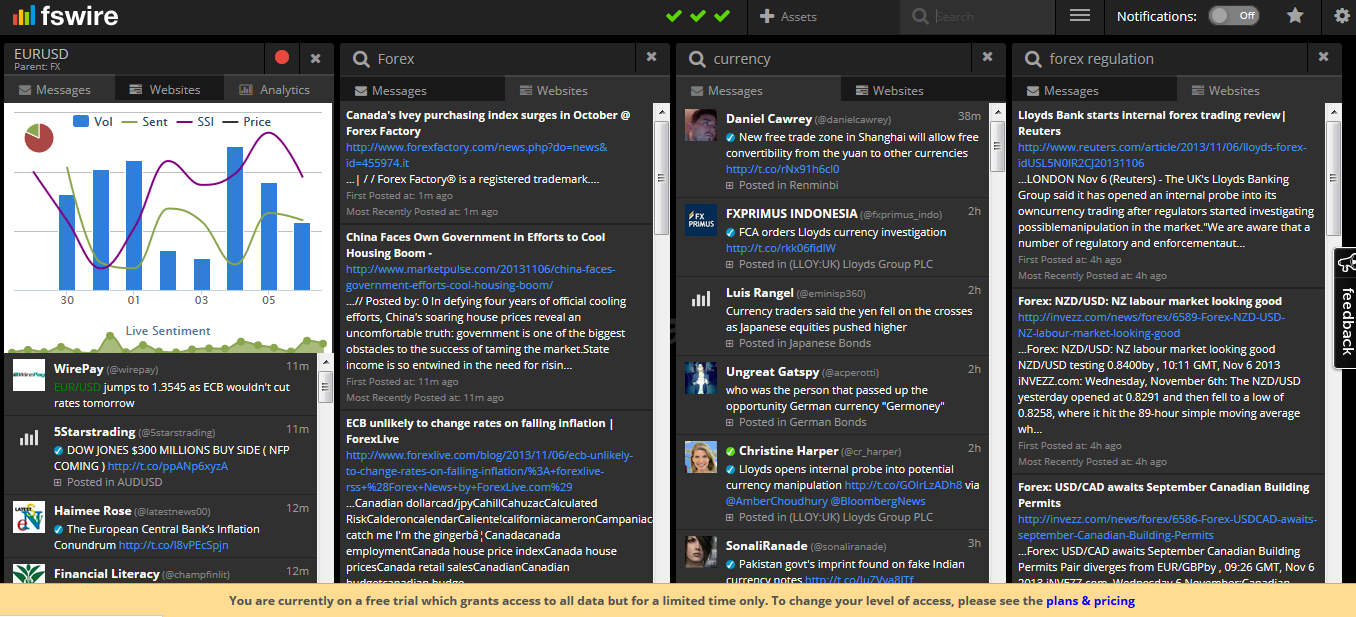

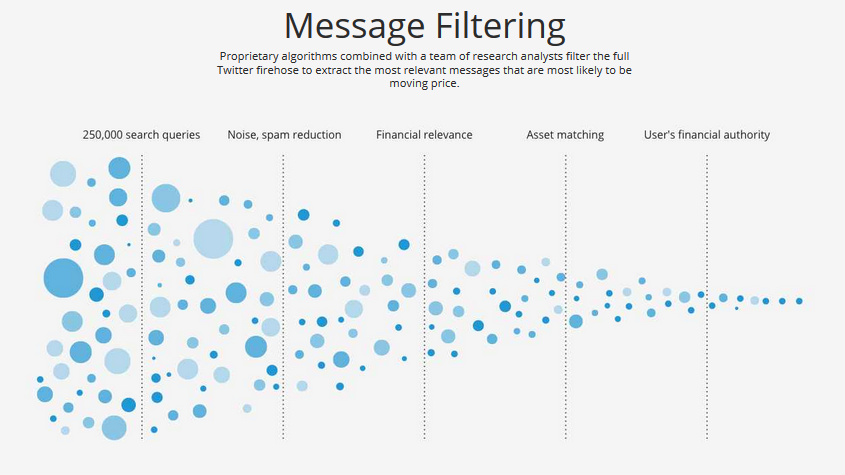

This is no easy task, as social networks are typically full of noise that is incredibly challenging to filter with regards to finding source information that drives and creates the noise, as well as having the source data relate to underlying search criteria. In other words, searching Forex on Twitter may return more opinions about the topic from traders or non-source users talking about price action, than actually sources of news that impact the price of say - the Euro currency (relative to other currencies) and originators of news pertaining to affect it.

Source: fswire.com Filter Diagram Example

Solving the Growing Challenge of Too Much Information

As we enter the age of information overload, and the ability to extract meaningful information from vast amounts of data becomes increasingly complex, the importance of extracting valuable information from breaking news into the hands of key decision- makers is becoming ever more important, especially in financial services where such information can equate to profits and losses across the asset class spectrum.

Source: FSWIRE BLOG

A 2013 IDC report, estimated that the world generates 1 quintillion bytes of data per day, yet we are only able to analyze less than 1% of this information regardless of vertical. The challenge with huge networks such as Twitter, that contain vast amounts of newly created data from moment-to-moment, and the number of key words that would be needed to be simultaneously searched for across a vast library of underlying asset-classes, would require not only immense computational resources, but a dynamic system that can execute these filtering operations in parallel, and effectively and simultaneously filtering out the noise from the collective perception of market sentiment reflected in Twitters' network post-by-post.

In an exclusive interview with Forex Magnates, FSwire’s founders explained to us some of the key advantages that differentiate the powerful capabilities of the technology that they have developed, and how the service is like a filter over Twitter and optimized for financial services.

Forex Magnates' Exclusive Insight with FSWire's Founders

Cynan Rhodes, one of the co-founders at FSwire, said to us in the exclusive interview that, "Reality is rapidly beginning to catch up to the hype of 'trading from social,'”and added, "Social data should be a part of an overall strategy and not be relied upon as a single data source.”

Clive Shirley, Co-Founder, FSwire

During the interview with Forex Magnates, Clive Shirley, one of FSwire's other co-founders emphasized the value for foreign Exchange participants using the service and said, "Cashtags add little value for FX traders. There is more value to be found in tracking the underlying macro economic data discussed within social."

Source: FSwire.com

Cashtags which are similiar to Hashtags, that use the # symbol, instead use the $ symbol in order to tag asset related keywords, such as $EURUSD or $EURO as well as equities or other instruments such as $GOLD.

Companies like Stocktwits, and other developers applying these cashtags as a gateway to more information or trading capabilities through 3rd party poviders, have been catering to their use, which according to FSwire is mostly retail and chatter specific. That is, discussions surrounding a news event that affects an underlying asset, rather than tagging the keyword to the event itself, or originator of the news as discussed previously.

Cynan Rhodes, Co-Founder, FSWIRE

Mr. Shirley further explained that these trendy tags are less popular outside of the U.S., as can been seen in his above quote, and are not as important as tracking the underlying macroeconomic data that affects the prices of these securities.

This included how the company has built an extensive taxonomy database of over 250,000 words that relate to the news affecting underlying assets rather than linking to discussion about the assets.

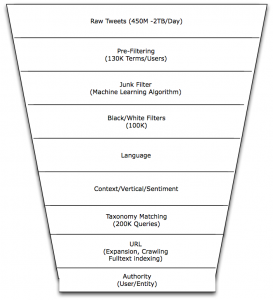

Therefore, when a search is performed for a specific asset class or any keyword or search term (operator), there are about 6,000 queries made through Twitters firehose (entire raw unfiltered feed) using the library of words that correlate to underlying news affecting assets. The company literally tracks thousands and thousands of search terms and is able to perform computationally intensive filtering across an extensive database of asset classes and all the related taxonomy that affects them.

Twitter IPO and Effects in New Gathering

With Twitter set to launch their initial public offering (IPO) and become a publicly traded company, the company’s business and its perceived and actual value will become of increasing interest and the subject of considerable analysis. According to information regarding the Twitter Firehose, which is a term that describes the raw unfiltered content of the entire network, there are over 450M tweets per day (310K tweets per minute or 5.1K tweets per second – on average) that are pushed through the twitter eco-system composed of any type of message content.

FSWIRE Web interface

Each tweet that may contain up to 140 characters, can include embedded links to other information sources, including web-pages and media, and altogether these can equate to around 1 terabyte (TB) of message data, yet each message is augmented with a slew of additional content, such as information about the author, location, tags and other information that increases the data size to around 2 TB per day (2.1-2.3 MB/Sec) delivered as a stream of JSON structured data.

To process this requires an effective and efficient mechanism for filtering the useful content - generally using text processing methodologies which are computationally intensive, and subsequently require content to be structured into a taxonomy fit for its business purpose.

Mr. Rhodes further explained to us, "Twitter's IPO is changing how Twitter charges for data, allowing FX funds to gain access to comprehensive, financially relevant data in a cost efficient manner for the first time."

Complex Event Processing and Co-Located Twitter Feed Filtered Results

In FSwire, search results are returned as messages and Twitter users are verified across any corresponding LinkedIn profiles in an effort to enrich the source of the data. The 250,000 queries across Twitter that are made in response to a search being performed, in the example above, uses the substantial taxonomy to return relevant information in the form of messages.

Source: FSWIRE

The compliance aspects of social networks being prevented in certain workplaces has been thought about, and FSwire resolved this challenge by providing a read-only version of the filtered Twitter results which do not allow re-tweets or replies, or messages or posts to be made to Twitter through FSwire. This is a key aspect of the scalability of the solution, as it requires no IT changes with regards to IT policies that may prevent accessing social media sites where posting certain information from the workplace may be prohibited.

According to people close to the company, FSwire is holding talks with major exchanges and companies with regards to offering its API of the FSwire services and other custom solutions, and co-locating in close proximity to exchanges and data-centers that provide fast access and internet connectivity via direct fiber to exchange data and news information. The firm is building a global sales team that already has presence in multiple continents and focused almost entirely on offering the solution to financial services' companies (as opposed to retail direct).

In reviewing the FSwire demo account, via its website, we were able to easily sign-up via Linkedin's (or Twitter) login button and experiment with searching for FX related keywords like, Foreign Exchange, EUR, EURUSD, Currency, Forex,etc.. and saw that the quality of the search results were indeed filtered and more relevant for use by a financial services professional (let alone investor or trader). An example can be seen in the screen shot below: