For the past few years the Israel Securities Authority (ISA) has set out to bring FX and CFD trading in the country under its control, with specific legislation on the industry. This May, Forex Magnates reported that the legislation is expected to be completed in about three months and now seems it is indeed the case.

On Sunday, the Securities Subcommittee of the Israeli Knesset passed new regulations that are now only waiting for the final approval of the full committee.

These are the main new aspects of the new regulation:

1. Licensing - Brokers will now need to apply to the ISA for a licence to operate in Israel.

2. Reporting - Brokers will now need to file reports to the ISA to insure client funds.

3. Leverage - 5% for high risk financial product, 2.5% for medium risk and 1% for low risk.

4. Conflict of Interests - Brokers will now no longer be able to represent a client unless they explain their counterposition to the client. Brokers will not be able to offer advice on any product that they offer.

5. Client Funds - Customers' money will need to be held in 3rd-party trust accounts, segregated from company funds. Brokers will not be able to use a client's money without his/her approval.

6. Client Reports - Brokers will now need to present clients with biweekly and monthly reports about all their activity including deposits, trades, commissions, charges and interest.

7. Client Adequacy Verification - Brokers will now need to make sure that the client is eligible and fully understands the financial mechanism they operate, and to verify that the client is not a minor and is sufficiently competent. Additionally, the firm needs to document the entire procedure.

Interview with the Chairman

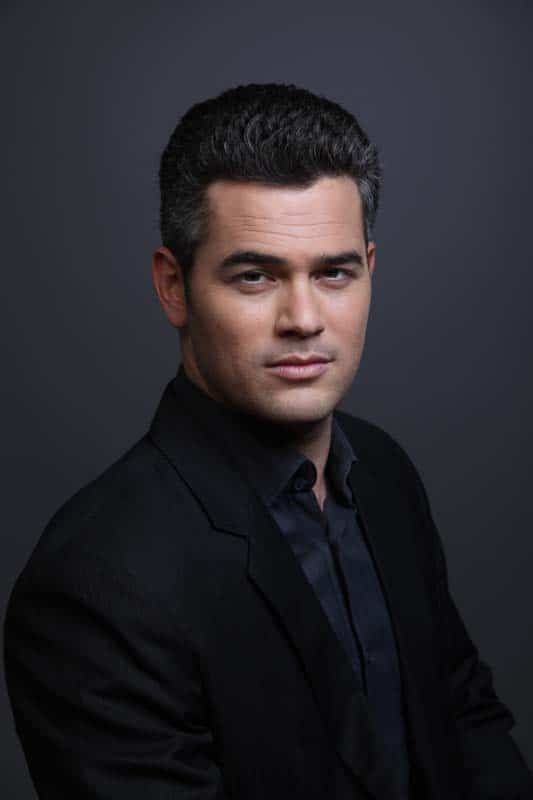

Boaz Toporovsky, Chairman of the Securities Sub Committee, Knesset

Boaz Toporovsky, Member of Knesset and Chairman of the Securities Subcommittee of the Israeli Parliament, is at the helm of the regulation process on Trade Arenas (as FX and CFD brokerages are officially called by the Knesset). Before Sunday's primary approval, he spoke with us exclusively on the subject of the upcoming Forex Regulations.

Please describe the progress in the legislative process on Trade Arenas regulations.

The legislation has been around since 2010, but did not come into effect because of the delays in preparing the regulations. There was a need to discuss the regulations a long time ago and that is exactly what we have being doing for the past year in the subcommittee. We are supposed to finish the work on the regulations really in the next few weeks and after that approve the final version in the finance committee. I predict we will finish the process by the end of the current session of the Knesset, meaning by the start of August.

What restrictions on the Trade Arenas do you expect will be introduced?

For the first time ever, the Trade Arenas will come under the supervision of the Israeli Securities Authority. The Trade Arenas will have minimum capital requirements and regulations that will safeguard the clients’ funds and the fairness of trading. There will also be a certain leverage limitation.

We heard fears about a 25:1 maximum leverage limitation on FX, what do you expect?

There will be a maximum leverage limitation of up to 100 to 1.

Does the committee have any concerns that following the new harsh regulations the Israeli Trade Arenas won’t be able to survive the competition with foreign FX brokers?

The committee and myself do our utmost to balance between the need to ensure fair trading and protecting client funds, and on the other side minimum bureaucracy and costs for the arenas as a result of that. In most of the world there are regulations and we tried not to burden the local industry more than is common in the rest of the world in general and in nearby Europe in particular.

What protection will be given to Israeli traders in case they choose to operate with foreign trade arenas?

The protection will be given by the local regulations of the trade arena they will operate with. The purpose of the regulations is not to protect Israeli traders in the case of trading with foreign arenas but to guarantee the Israeli public that the arenas in Israel are safe and fair.

Isn’t there a danger that as a result of the regulation Israeli traders will choose to operate with foreign arenas?

Trade arenas from abroad will not be able to legally solicit Israeli citizens to operate with them. Israeli traders will have a high level of certainty about the protection and fairness of the Israeli trade arenas, a fact that will encourage them to invest in the country.

Different elements within the state’s establishment refer to the trade arenas as gambling, scams or even as a danger to the public. How do you as the Chairman of the Securities Sub Committee perceive the Forex industry in Israel?

As chairman of the committee it is none of my concern. The role of the committee is to take care of the proposed regulations to the Israeli trade arenas. It was already determined by the legislature in 2010 that the field needs to be sorted out therefore it must be done.

Different countries, such as Cyprus and the UK, invest in developing the Forex industry with supporting legislation to attract foreign investors’ money and to create jobs. Israel is already a leading country in FX technology development. In your eyes, can the State of Israel not benefit from encouraging the local Forex industry?

Of course Israel can benefit from this. Serious regulation is a prerequisite for developing a strong and reliable industry based on clear rules and the trust of the market, I believe that it is not possible to develop this industry in the right way before it is sorted out.

Will any restrictions be placed on currency trading or currency options trading on the banks in Israel? What is the difference between the Forex industry and retail FX trading with the banks?

Discussions on this subject at the committee have taken place more than once. In the discussions, the representatives of the Banking Supervision Department (of the Bank of Israel) explained the different limitations on this subject with the banks and the related regulation in the banking system. We at the committee were convinced of the trust, certainty and fairness that exists in the banking system in this field.

Will the recent reports in the Israeli media about what goes on at the FX trading desks of the banks (high pressure tactics, conflicts of interests and manipulating price quotes) lead to new discussions on regulating the banks?

I have discussed what was published in the newspaper with the Banking Supervisor and he has assured me this is not how things are. According to his official written answer (once received), I will decide how to proceed with this.