Moving into the crowded inter-bank spot FX trading space, London-based multilateral trading facility (MTF), LMAX, has launched LMAX Interbank. LMAX Interbank is leveraging the firms’ existing matching technology that is currently used in its LMAX Exchange product.

As opposed to an ECN which aggregates Liquidity quotes from multiple sources on one trading venue, exchange matching platforms are order based. As a result, orders provided by both market makers and traders are entered into one central matching book. Once included, orders are firm and can’t be rejected. For traders, this provides three main benefits; Liquidity Aggregation , higher execution rates, and the ability to cross orders with other traders.

With an exchange based system, multiple bids/offers provided at one price point are aggregated into one order; thereby providing a seamless method to execute a transaction from multiple parties simultaneously. Additionally, as opposed to ‘quote’ based venues which provide liquidity providers with ‘last look’ abilities, orders on exchanges are firm which removes rejections rates. However, with these benefits may come wider spreads. As liquidity providers typically price to their worst client, participants typically offer wider spreads to defend themselves from toxic order flow; traders seeking to take advantage of arbitrage opportunities.

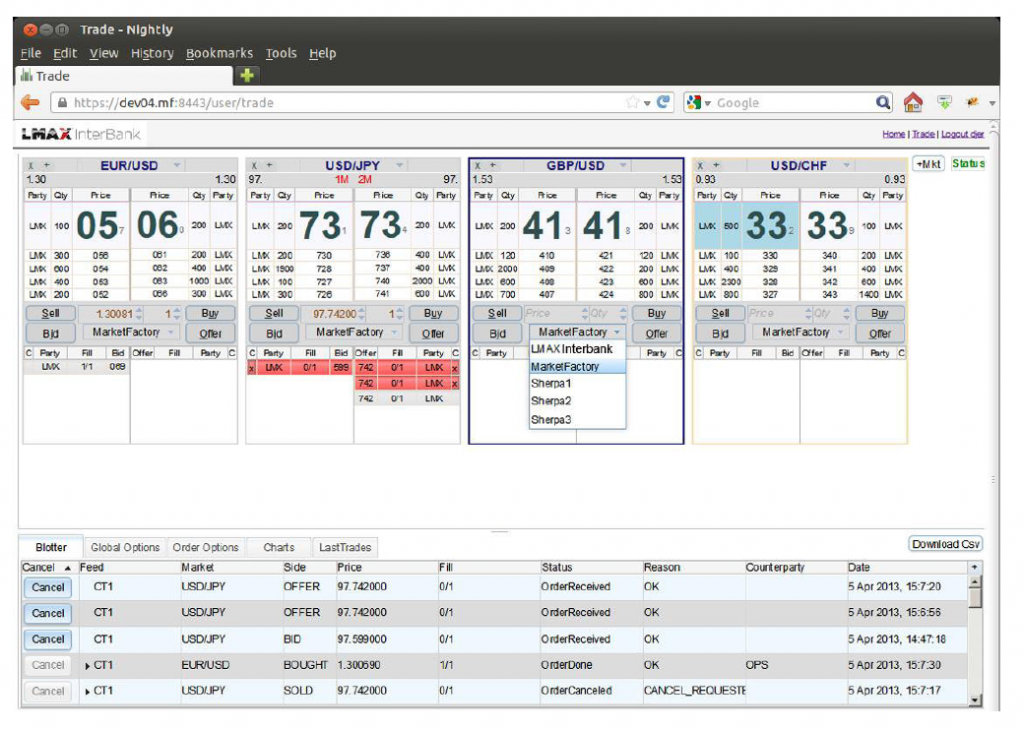

LMAX Interbank MarketFactory Web GUI

Targeting institutional traders, trading conditions at LMAX Interbank are similar to those at leading FX ECNs. This includes minimum size orders of 1,000,000 units, FIX Protocol connections, and multiple bank participants. Acting as the central counterparty to trades is Rabobank. In addition, LMAX Interbank is providing a Pre-Trade risk solution. The product allows participants to set limits on their maximum settlement exposure. Orders sent that break the limits are automatically rejected by the system. According to LMAX, the Interbank exchange will provide users with average execution times of 1.5ms, with no fixed costs.

Connecting to the exchange, LMAX Interbank is providing both an API and Web based solution. The Web based interface is being supplied by MarketFactory, known for its liquidity aggregation systems. Additional partners include Thomson Reuters Dealing Aggregator, First Derivatives, smartTrade, and Broadway Technology. The venue also connects with post-trade solutions providers Traiana, MarkitServ, DealHub, and the firms’ proprietary LMAX DropCopy.

We reached out to LMAX for further comments, but the firm is currently in their ‘quiet period’ in anticipation of their official public launch of the exchange. Overall, the launch of LMAX Interbank marks an extension of their business model which had until now been focused on providing liquidity to the retail market. However, in an interview with CEO David Mercer following the firm’s management buyout in December 2012, he mentioned “that they are working to increase their work with broker dealers either as the sole STP liquidity source or part of an aggregated feed”.