The stories that have made the most impact in the Forex industry this past week, judging by their popularity with our readers, involved the first-ever planned IPO by a binary options broker and the repercussions of political volatility on the currency markets. Many brokers have also reported great results for October this week, but that will be covered separately.

Chinese TV Targets Forex yet Again

Viewers gather around the vandalized booth.

The Shanghai TV Channel, part of the powerful Shanghai Media Group and one of the most viewed channels in the all-important financial hub, aired a two-minute segment after reportedly receiving multiple complaints from the public about several brands.

The broadcast presented traders who were attending the 12th Shanghai International Money Fair, an industry event in which personal investors account for roughly a third of the visitors.

Protesters claiming to have lost millions of RMB worth in trades were interviewed, accusing their brokers of manipulating them into incurring massive losses. One of them, confiding that he had personally lost a million RMB, burst into tears on camera. The demonstrators were also seen hanging warning signs showing the websites of brands they had traded with.

Anyoption Plans a LSE AIM IPO Valued at £150 Million

Binary options broker, Anyoption, is planning to publicly list its shares for trading on the London Stock Exchange Alternative Investment Market (LSE AIM) in order to raise about £30 million for acquisitions of online advertising companies in the US, EU, Australia and Japan.

Following up on Forex Magnates' exclusive report from April, it was discovered during the week that the broker had already hired the services of a British investment group, Shore Capital, specializing in access to the London capital markets. Anyoption is set to file a letter of intent to the LSE AIM in December for a £140-£160 million IPO and plans the listing for February 2015.

Central Banks Increasing Market Interventions

The Central Bank of Russia announced on Wednesday that it would now limit the size of its interventions to $350 million a day. The bank confirmed that it will continue to shift the rouble corridor by 5 kopecks after each tranche of $350mln is completed. The bank has been incredibly active in managing the rate at which roubles are exchanged for US dollars, euros, yuan and gold, in response to extreme selling pressure following a destabilising conflict in the Ukraine and resulting sanctions in tandem with lower oil prices.

A day before the Russian announcement, Forex Magnates reviewed how the Bank of Japan's intervention had led to the yen losing a third of its value. One conclusion being that the volatility which we have recently seen spike higher across the foreign exchange markets was very likely to stay with us for a long time. Opportunities provided by the rising economic imbalances between major economies have triggered a new round of US dollar strength.

Is This the Future of Retail Trading Platforms?

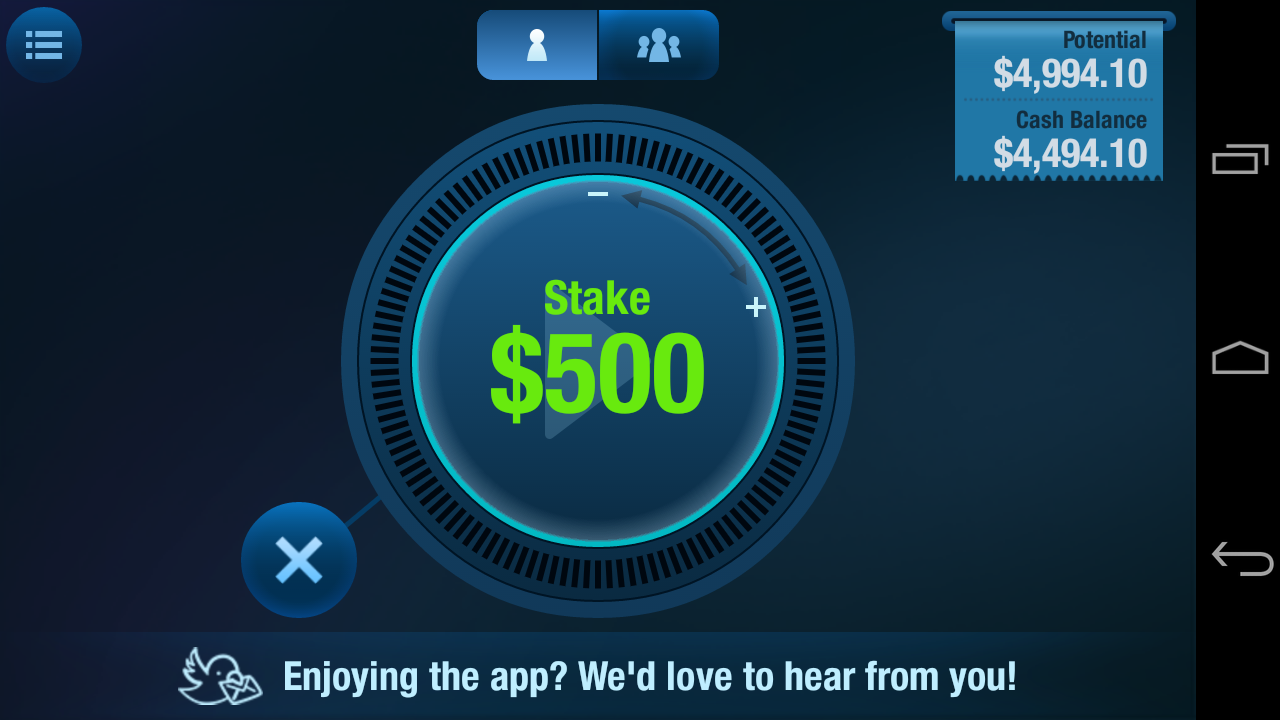

On Thursday, Forex Magnates took a look at Flick-a-Trade, a gaming/trading app. The app features charting and real-time pricing of major forex pairs, commodities and equity index products. To play, users enter the duration they want to play; from one minute and up. Unlike regular trading, Flick-a-Trade offers a multi-player setting allowing users to play against others to see who the best short-term trader is.

The future though, according to Cygnecode’s developers, is the roll out of the product as both a gaming and trading app. The company plans partnering with an authorized FCA broker as well as with a regulated UK gaming company. As a trading app, the mobile platform can be connected to a broker’s Liquidity and customer accounts.

Admiral Markets Takes MT4 to the Modern Age

Admiral Markets "Supreme" Trade Terminal

On Monday, we revealed that Admiral Markets has revamped its custom MT4 “Supreme Edition.” The broker stated that the standard MT4 trading terminal is probably the best platform of its kind, but when one navigates away from the terminal for extended information and services – the choice of supplementary features is so large, you are left with the impression that most of them should have been available from the start.

The broker explained that they have implemented over 60 enhancements of the MT4 build for its MetaTrader 4 Supreme Edition, a version assembled with the help of bright IT specialists and demanding day traders. Among the more eye-catching features of the custom edition offered by Admiral Markets is a one click trading mini terminal, a trade Terminal for multiple monitors and an automatic alarm manager.