FXCM wasn’t the only broker seeing their stock crater last year. But, the company was the poster child for what was a terrible year to be investing in the online Forex trading sector. Even after shares of FXCM tripled last month, they still ended down nearly 90% for 2015 following the broker’s post-SNB Liquidity crisis.

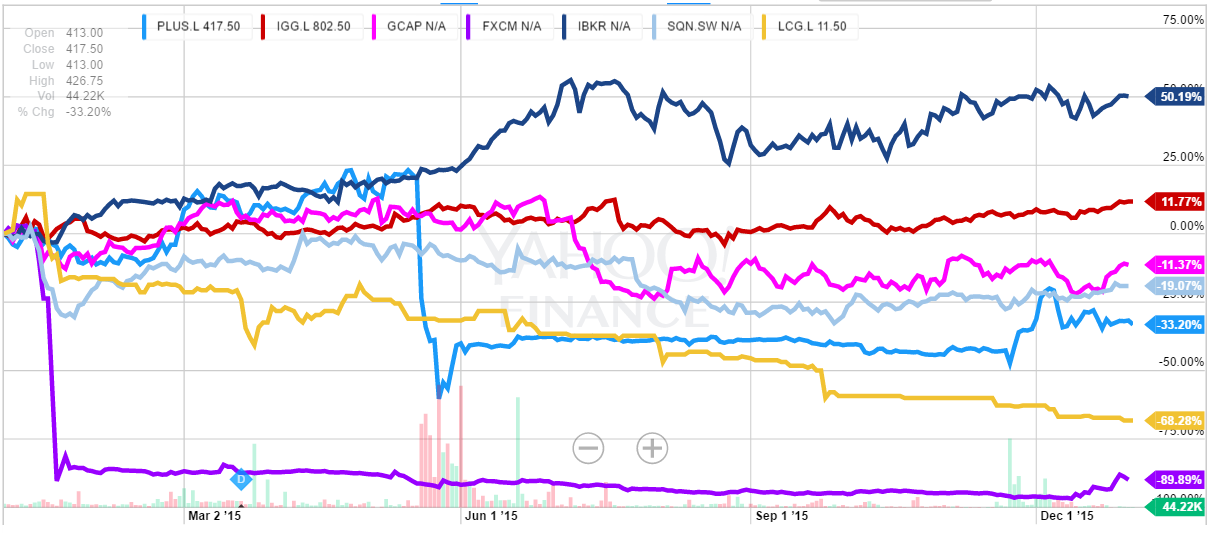

As seen in the chart below, the only publicly traded broker among the major brokers that have a focus on online forex and CFD trading that closed higher in 2015 was IG Group (IGG.L). Despite their longtime CEO Tim Howkins retiring during 2015 which prompted management changes, IG shares hit an all-time high last year as they rose nearly 12%.

Besides IG Group, Interactive Brokers rose 50% - the latter falls more in the category of online broker than forex broker, but is worth being included for the sake of comparison. The shares of the remaining retail forex brokers saw their stock tumble in an year of overall industry volatility.

So what will it take for companies to see a rebound? Below are our questions for 2016 that brokers will need to answer, starting from the worst to best performer.

FXCM (FXCM.N $16.73) – Forgetting all of the Leucadia debt baggage and how that will affect its future, the question of 2016 is the one Finance Magnates was asking at the beginning of 2015. At the time, we wanted to know whether its new low spread model would in fact be profitable for FXCM. Over 2015 the answer was no, with the first nine months revealing retail revenues per million (RPM) dollars traded of $56 against the approximately $65 that it would need to be profitable. For 2016, FXCM will have to prove that greater CFD trading and marketing making will improve RPM.

London Capital Group (LCG.L £0.115) - It’s fair to say that the London Capital Group (LCG) turnaround just isn’t happening. After becoming controlled by Charles-Henri Sabet in 2014, shares tumbled 68% in 2015. After revenues fell continuously from £34.5 million in 2010 to £22.7 in 2014, they continued to disintegrate with the broker reporting £5.3 million in revenues for the first six months of 2015. For 2016, the big question is whether the broker will be able to stop its bleeding and find a market that it can be successful in, be that white labels, direct to consumer or as a technology and liquidity provider.

Plus500 (PLUS.L £4.175) – The broker probably wants to forget about the roller coaster that was 2015 with shares moving all over the place due to compliance issues and a failed acquisition. In the end, shares fell 33.2% over 2015. For 2016, the big question is cost per acquisition (CPA). This number has steadily risen, with the broker needing to show shareholders that changes to its compliance process and any negativity associated to its brand from last year won’t affect the long term profitability of company.

Swissquote (SQN.SW CHF25.25) – Along with other brokers on this list, the big even for Swissquote last year was the SNB triggered Swiss franc crisis. The volatility and client losses led the firm to set aside CHF25 million in loss provisions to cover the damage. Beyond that event, the other story was a decline in the firm’s forex related business. After seeing volumes peak to over $100 billion in monthly trading during Q4 2014, they have since subsided. The question for Swissquote is whether this is something that is fixable, or the result of the positive trends that followed its 2013 acquisition of MIG Bank having disappeared.

GAIN Capital (GCAP.N $8.11) – After seeing its shares fall 11.4% in 2015, GAIN Capital’s question for 2016 is whether it can grow without acquisitions. The broker has been the most active in the industry of late, purchasing GFT in 2013 and City Index in 2015. But after the initial shot in the arm, volume and account growth has dissipated. So far, initial results following the City Index acquisition don’t appear encouraging with November’s retail volumes having fallen below pre-City Index metrics.

IG Group (IGG.L £8.025) Just off their all-time high of £8.135, shares of IG Group saw a positive 2015. However, a new year means a clean slate. Part of IG’s plans for 2016 is making a bet in the growing Middle East and Asian markets and stockbrokering. In terms of the former, it received a Dubai financial license in the second half of 2015. As such, in 2016 it will be out trying to prove that it can continue to grow its fast growing ‘rest of world’ (ROW) business region to counteract slow activity in Australia and mainland Europe.