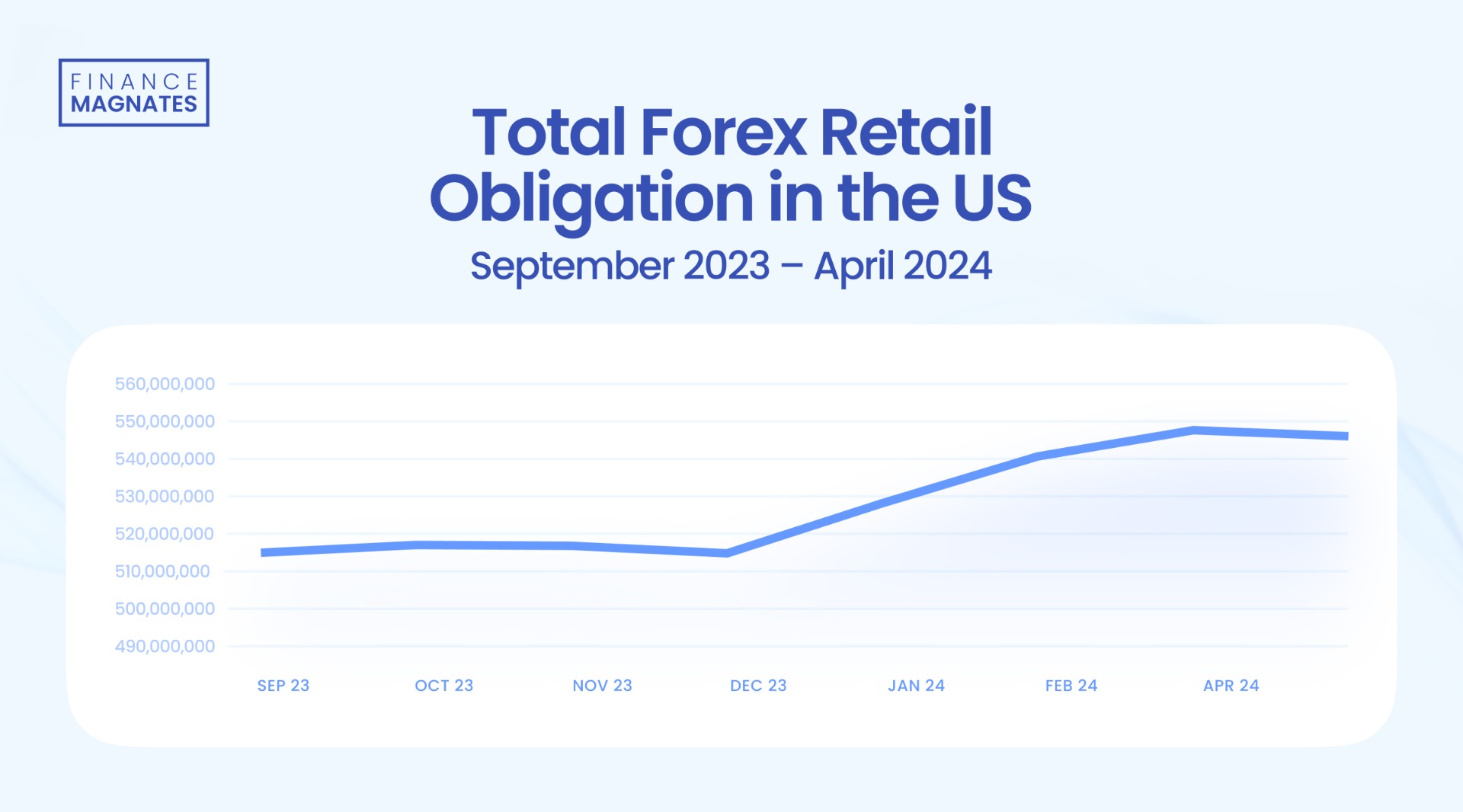

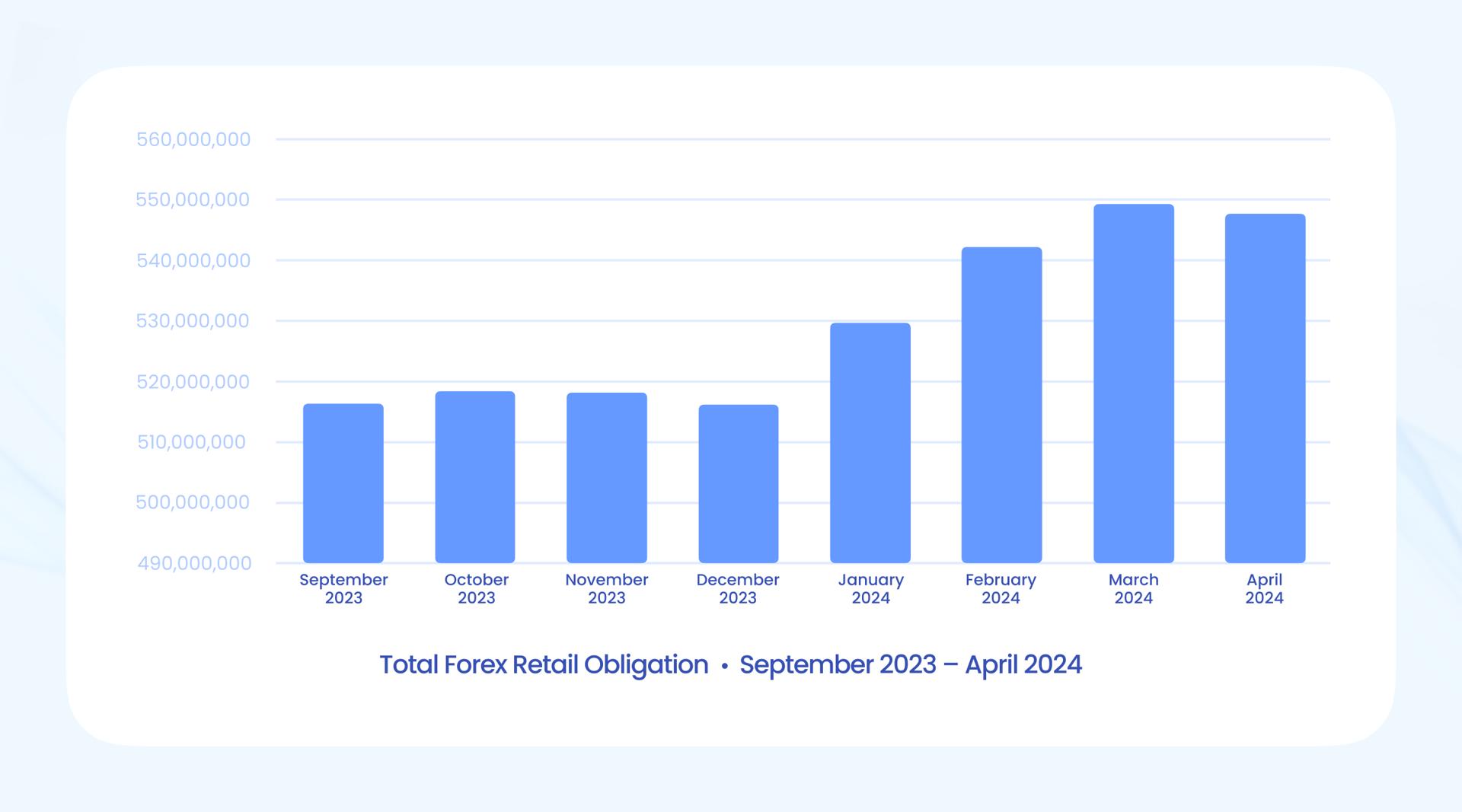

After four months of uninterrupted growth, retail investor Forex deposits in the US experienced a modest correction but still remained at multi-month highs. According to the latest data from the Commodity Futures Trading Commission (CFTC) for April 2024, the total value of client deposits was over $547 million, dropping by $1.6 million compared to the previous month.

Modest Correction in Total Forex Retail Obligations in the US

The exact value of Forex deposits in the US in April 2024 amounted to $547,759,474, shrinking by 0.3% from $549,389,183 in March. However, this does not change the fact that values still remain at the highest levels in over a year, and the marginal correction follows four months of continuous growth, maintaining a good streak.

Thus, it can be considered that deposits have been increasing in value since September 2023, when they hit a local low of around $516 million.

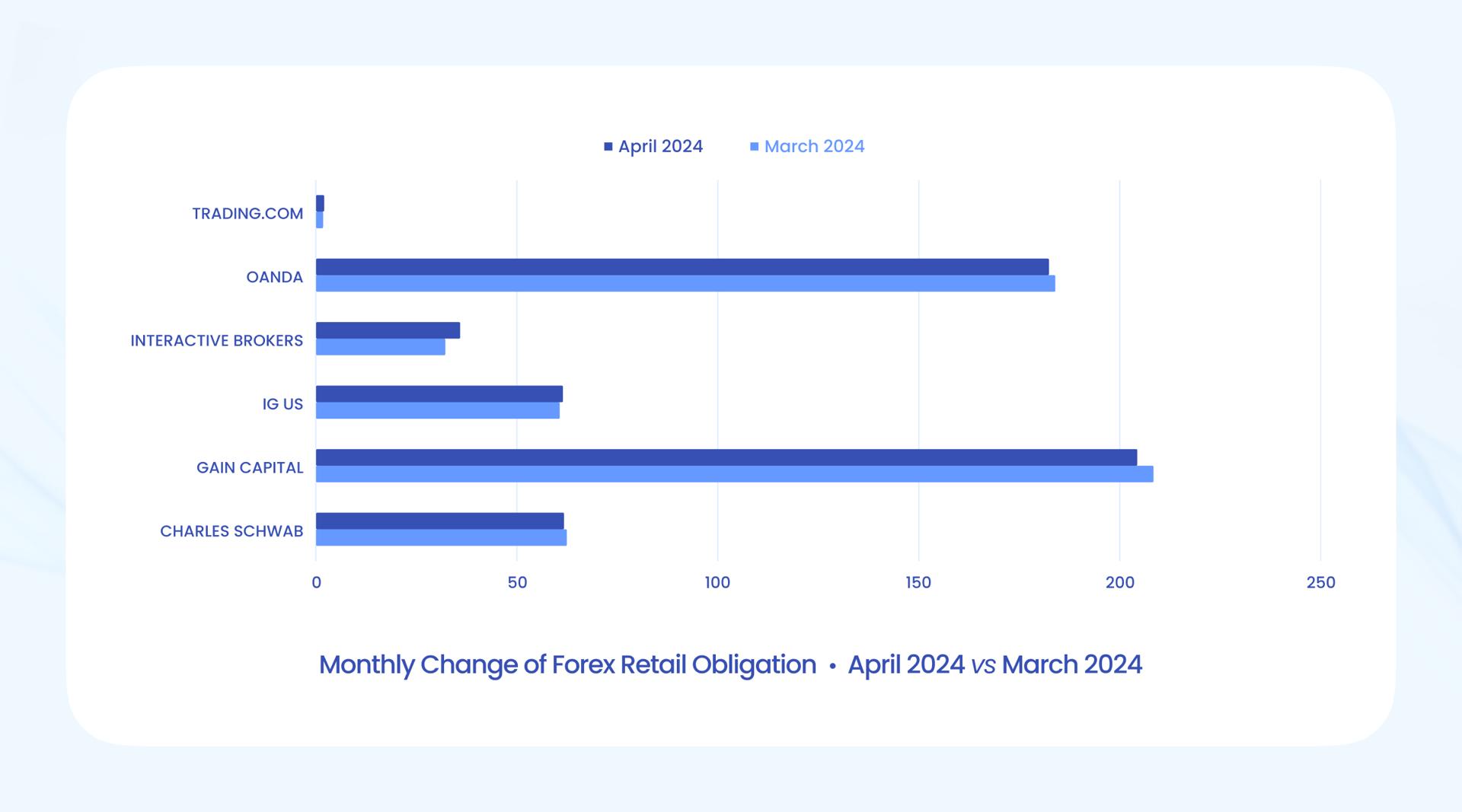

Consistently, as in previous months, Gain Capital led the tally with total deposits of $204.4 million, although it dropped nearly 2% compared to April. OANDA, ranking second, also recorded a loss of 0.9%, with its reported total forex retail obligations falling to $182.4 million.

Interactive Brokers, however, noted the highest percentage and nominal increase. Its FX deposits grew by $3.7 million (11.4%) from $32.2 million reported in March to $35.8 million reported in April 2024.

CFTC Regulatory Reporting Requirements

CFTC requires that Retail Foreign Exchange Dealers (RFEDs) and Futures Commission Merchants (FCMs) submit monthly financial status reports. These reports must include essential financial metrics such as adjusted net capital, client assets, and total retail forex commitments. Retail forex commitments encompass all assets held by FCMs or RFEDs for their clients, adjusted for any gains or losses.

Among the 62 registered RFEDs and FCMs, well-known entities like Charles Schwab, Gain Capital, IG, Interactive Brokers, OANDA, and Trading.com are obligated to publicly disclose their financial commitments.

According to a recent report by Finance Magnates, FCMs are investing heavily in front-end technologies to enhance operational efficiencies and remain competitive in the fiercely competitive derivatives market.