The FXCM (NYSE:FXCM) international group of companies has notified its clients that the margin requirements for the following FXCM branches will be updated: FXCM LTD (UK), FXCM Australia and FXCM Markets. Trading accounts will be adjusted at market close today (Friday, June 26) for FXCM clients.

In its announcement about the margin requirements, FXCM only says this move is needed "due to recent price changes." However, many other brokers have already started talking publicly about the need to take protective measures ahead of a European showdown with the Greek government.

Yesterday, Alpari stated that due to the possibility of a Greek default and increased Volatility on currency pairs involving the euro, from June 29, 2015, temporary limits may be set across a range of trading conditions. Alpari warned its clients that should market conditions deteriorate, spreads could be increased and trading may be switched into “close only” mode.

Other brokers, such as IC Markets, sent out dire warnings to traders only today reminding them to check their exposure to euro pairs and their margin levels prior to market close. Clients were asked to ensure that they are not over leveraging and have sufficient free equity to withstand a market gap.

When the Swiss central bank caused massive unexpected volatility, some brokers saw hundreds of millions of dollars vanish in seconds, none more so than FXCM. With the pain felt on Black Thursday still experienced in the industry, brokers seem to take the Grexit danger of extreme volatility seriously this time.

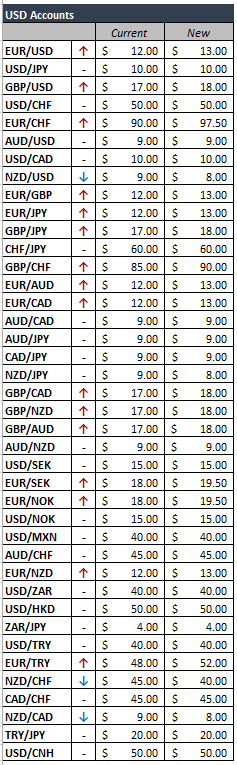

See the tables below to view the new margin requirements for FXCM USD-based accounts on 100:1 Leverage setting. Arrows indicate if the new margin is higher or lower than the minimum margin requirement prior to change on June 26, 2015. New margin requirements as of market close on Friday, 26 June:

Source: Dailyfx

No longer controlled by the FXCM group, Rakuten's FXCM Japan Securities notified its clients today that a number of margin requirements would change on market open of June 29. Among the changes, maintenance margin for EUR/USD, EUR/JPY and EUR/GBP increased from $480 to $520 per a $10,000 exposure.