To Read Global FX Market Regulation – a Big Dream That Requires Even Bigger Ambition | Part 1 click here

Top-tier banks have demonstrated an insatiable urge to circumvent legislation and anti-competitive safeguards including regulatory oversight in a variety of ways, including manipulating prices in most major asset classes. The assumption that additional regulation in the form of a 'co-ordinated global FX policy' will therefore stop collusion amongst the largest FX market participants is probably wishful thinking.

The 'MiFID II' directives introduced in 2011 and updated in April this year attempt to deal with OTC markets, but there is no specific mention of spot FX. In any case, MiFID II is more so about aligning organizational requirements rather than policing the FX market.

The European Market Infrastructure Regulation (EMIR) is another scheme designed to standardize reporting and clearing in the FX market. However, both MiFID and EMIR focus on larger firms, which means smaller firms can continue offering trading services without being fully compliant with the new regulations.

Unless an authority of some description stipulates that all FX brokers must meet EMIR/MiFID standards or be prevented from operating, the new rules will only add a layer of bureaucracy, fail to necessarily stop collusion, not necessarily make the FX market more transparent and not necessarily protect retail customers. The only likely effect is tougher conditions for smaller brokers to obtain a perceived 'stamp of authenticity' and encourage consolidation within the FX industry.

Undesired Effects

Global regulation of the FX market could reduce the 80% market share top-tier banks hold in terms of FX volumes, but fundamentally, those that transact the most FX business (banks) will always have an opportunity to ‘fix’ benchmark prices from which other financial instruments are derived because they are the de-facto market makers. Regulation cannot stop market abuse but only redistribute its source.

The LIBOR, ISDAfix and FX (amongst many other) manipulation cases demonstrate that given enough market share, large firms tend to form cartels and 'oligopolise' amongst themselves, because this reduces operational costs, raises revenues and keeps barriers to market entry high for new participants.

The root of the problem is incentives rather than opportunity i.e. regulation will never take away people's ability to cheat, it may only take away the incentive to do so. Given the lack of criminal proceedings relating to any given market abuse inquiry, it seems the incentive not to manipulate a particular market is outweighed by the incentive to do so - this would explain why almost all asset classes have experienced multiple cases of market manipulation emanating from banks. If the only penalties are relatively small fines and individual bans, banks are more inclined to continue manipulative practices seeing as the rewards are incredibly lucrative.

Forex Magnates' research shows the Financial Conduct Authority (FCA) is close to a financial settlement with several banks, including Barclays, Citigroup, JPMorgan Chase, UBS, RBS and HSBC regarding FX market manipulation – the settlement could set a precedent for other regulatory authorities to follow and would underline the toothless nature of regulatory regimes around the world. Asking for the same regulatory structure to on-board FX into its scope is a recipe for disaster.

Banking Union

The Banking Union project was launched in 2012, with legislative proposals for the creation of a Single Supervisory Mechanism (SSM).

Political agreement on the establishment of the SSM was reached in early 2013 and the legislative text was formally adopted by the European Council and the European Parliament later in the year. The new SSM system is due to enter into force in early November 2014, unless the ECB requests that the entry into operation be further delayed.

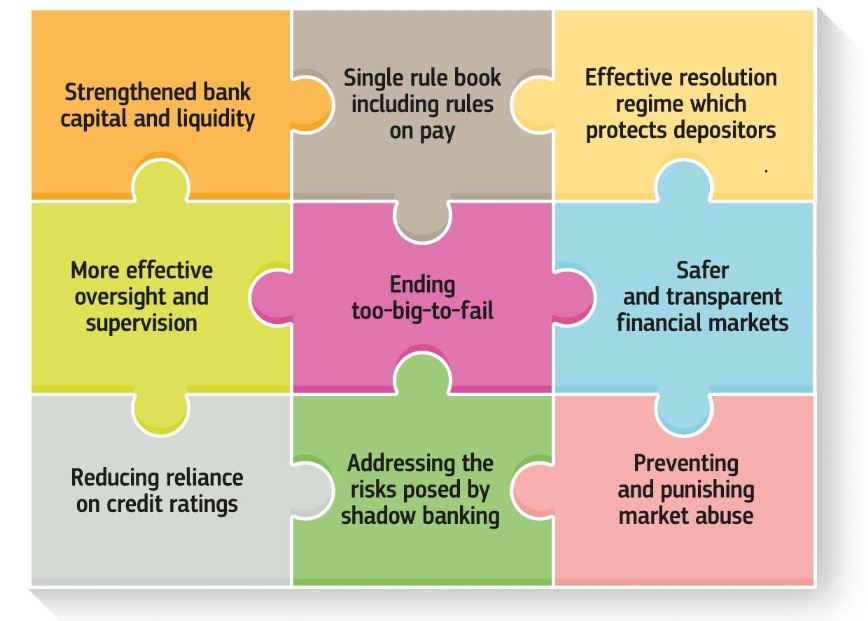

Banking Union Intentions | Source: European Commission

The new supervisory system will initially apply to the 17 Eurozone countries and all other EU countries have the possibility to join the system if they wish to do so. The ECB will be entrusted with direct supervision over 'significant' institutions within the Eurozone and the SSM system will comprise of the ECB and national supervisory authorities.

Earlier this year, European legislators established the Single Resolution Mechanism (SRM) which will activate on January 1st, 2015, and Single Resolution Fund (SRF) due to start operations in 2016, with an 8-year build up period.

Jean-Claude Juncker, EU Commission President

Plans for a banking union in Europe are going ahead on schedule as evidenced by the recent EU Commission restructuring being led by Jean-Claude Juncker, a staunch federalist who is very likely to support any plans that centralize decision-making. If a banking union goes ahead, regulation over the whole of Europe will fall under one regulatory agency and could potentially pave the way for a single currency, as first thought by John Maynard Keynes when he proposed such plans at Bretton Woods in 1944.

Times have changed but love of Keynesian motifs has not. Judging by the gravitation towards Keynesian policy by all major economies in the G20 and their respective central banks, we may see a fresh attempt to introduce a Clearing Union backed by a single currency in the foreseeable future.

One-Size-Fits-All

Different depths and scopes of regulation around the world hamper standardization. Having a single global regulator for a market that has multiple national jurisdictions is difficult enough, but when nations have different sized markets and also have different legislation in terms of how various financial instruments apply to different entities, this means that global FX regulation is likely to be undermined by national legislation and jurisdictional wrangles for years into the future.

One clear example of this is the self-regulatory model of financial regulation. Some countries may not be suitable for self-regulation because of specific factors such as high corruption rates or incompatible political stance of the ruling government. Therefore, a self-regulatory model cannot apply to all regions. Also, countries differ on how they see and define various financial market entities such as SPVs, holding companies, trading venues and brokerages. Having the same definitions across the globe require all financial markets to be similarly matched in terms of sophistication - but that is simply not the case.

The Timeline

First and foremost, most market participants want to see the outcome of FX market manipulation inquiries ongoing around the globe. If referring to past cases of market manipulation, rather speedy settlements are likely to be reached.

The G20 Summit in Brisbane scheduled for November 15th-16th, 2014, could provide developments, but any specific FX market legislation or re-classification is only likely to take place after lengthy consultations and other factors play out.

Over the next few years, if regulators attract the attention of politicians building momentum for an election push, there may well be wholesale changes as to how financial markets and their specific 'asset classes' are regulated.

The Here and Now

Mifid II is expected to be implemented next year and a European Banking Union is earmarked for 2015/2016 - subject to market developments of course. Regulators continue to struggle to even define their jurisdiction/scope while market participants invent ever more ingenious ways to become undefinable.

Does the benefit of becoming OTFs or MTFs under Mifid II (higher trust level, higher volume) outweigh the higher costs (higher capital requirement)? For the time being, some brokers with enough order flow to afford Mifid II, will go ahead and implement the necessary requirements and possibly become better run businesses as a result. However, brokers who are starting up or operating on a relatively smaller size, simply cannot afford to implement costly solutions to problems they don't have.

Mifid II, EMIR and their own respective national rules make global financial market regulation a patchwork at best. Making the whole exercise more difficult is the technology factor that allows business to be conducted remotely and with no geographical restrictions.

The FX market has enough trouble regulating itself on a national level. For the FX market to be globally regulated is simply unfathomable at this stage. In the meantime, central banks such as the Bank of England and ECB are taking an increasingly influential role in supervising financial markets with special powers to intervene or assist significant institutions - the same institutions that happen to be the largest providers and intermediaries of FX Liquidity . The role played by central banks is often underestimated when it comes to regulatory matters, but that could all change as their market influence grows.

Worst Case Scenario

If markets falter and financial firms go on the brink again, this time bailouts will probably not suffice simply because central bank balance sheets are overblown and this time its sovereign nations will need bailing out, not just banks. A repeat of the financial market turbulence first seen in 2008 would be a lot harder to mitigate and more expensive. In financial markets' history, the most influential and market impacting legislation tends to be implemented in the midst of an emergency or following a significant market event that shocks market participants into a state of emergency.

It may just require something of that magnitude for global regulation of the FX market to even be attempted, let alone become a reality.