The Black Monday in China, has been followed up by flash crashes in the U.S. and an unprecedented set of daily moves in equity indices. With the diversification of the bulk of the industry away from foreign exchange, a number of brokers have seen massive increases in trading volumes.

While some brokers have experienced their largest trading volumes in a single day ever, the state of client accounts has been wildly fluctuating. According to some firms from within the industry they have seen some customers multiplying their accounts up to 10 times, while others have lost substantial parts of their deposits or their whole balances.

As the turmoil continues we can’t say whether the most volatile part of this cycle is over. Chinese shares have continued to fluctuate wildly on Tuesday and Wednesday, even after the People’s Bank of China has cut rates and reserve requirement ratios, and the market appeared to be stabilizing for a time.

Wednesday appears to be a comparatively quiet day so far, but volatility persists as doubts about the ability of Chinese fiscal and monetary authorities to steer the second largest economy in the world continue growing.

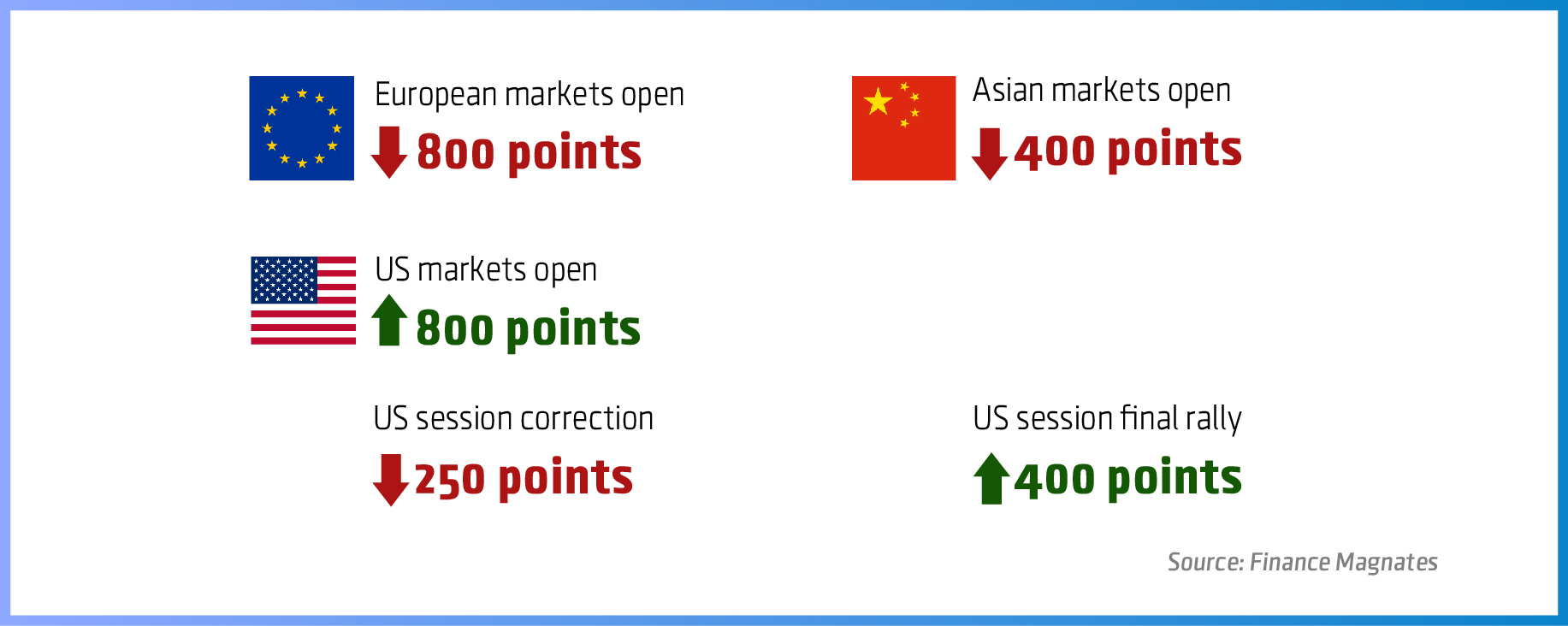

DJIA e-mini futures daily moves on Monday

What the industry has experienced on Monday could remain in history books, as the Dow Jones Industrial Average (DJIA) e-mini futures fluctuated over 4500 points during the day with massive volatility driving huge volumes across multiple asset classes. In contrast to the SNB turmoil in January, foreign exchange remained the most stable sector of the financial markets (as normally is the case).

Retail and institutional brokers performance

Commenting on the market developments several sources from the industry stated that they have seen their best day for the year, and for some it was their best day ever. Indeed, if we look from a historic perspective such massive volatility has been last observed during the great financial crisis of 2008 when it has become customary to see global stock indices fluctuating up or down over 5 per cent.

While some clients have managed to grow their accounts up to 10 times, others who have been performing solidly throughout the year have lost everything. With financial markets remaining a zero sum game, this should be the expected outcome. In fact if there was anything unexpected about these past couple of days its the timing.

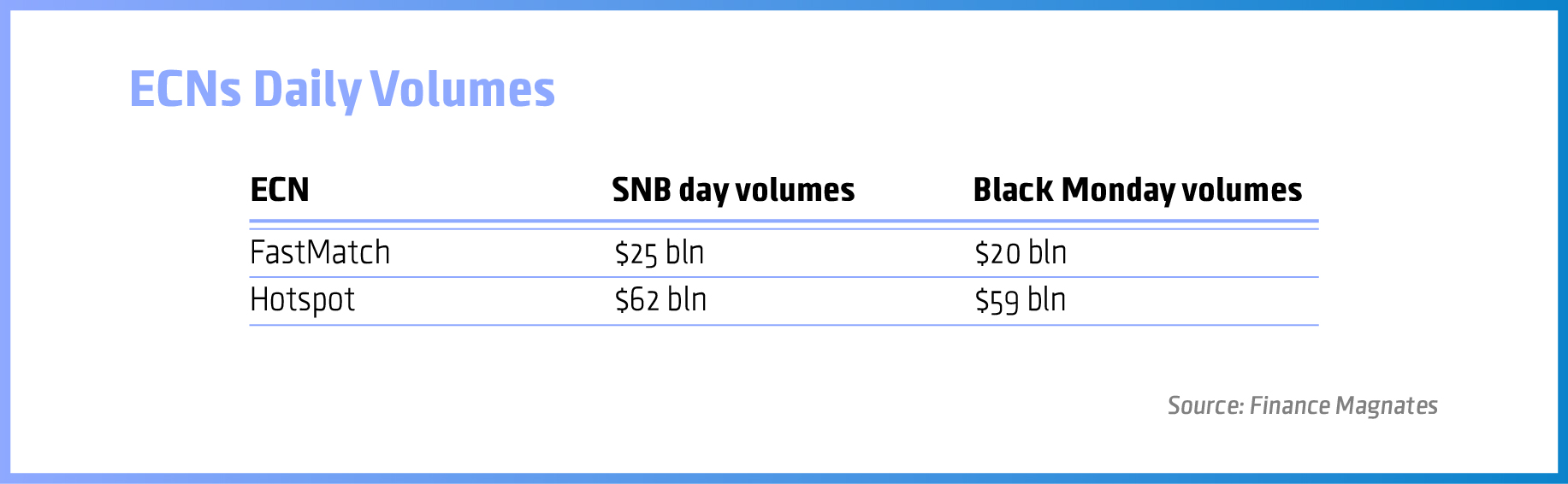

ECNs daily volumes comparison

The typical summer lull which normally settles in in July and August is normally constraining volumes. However this time its different - FastMatch registered its second best day for the year at just below $20 billion, while BATS owned Hotspot registered over $59 billion in transactions yesterday. Such figures can only be compared to the 15th of January, the day when the Swiss National Bank dropped the floor under the Swiss franc and induced industry losses of up to $1 billion.

How did the market turmoil happen?

A variety of factors have been affecting global stock markets, but the prevailing opinion around the industry is that Chinese economic woes are the primary reason for the global stock market collapse. According to John Murray who is Global Head of Sales and Business Development at London based City Credit Capital, the slowdown is primarily based on a real estate bubble.

Commenting on the matter he explained, “Real estate sales are like an addictive drug to an economy, every person involved in a real estate transaction, except the buyer, wants the price to go higher. The moment the purchase is complete, the buyer joins the rest of the team and wants the price to go higher. This in turn results in a “positive” for the economy, while in the meantime all participants are willingly making it a little more addicted to the real estate drug.”

“China’s manufacturing is slowing, the purchasing of the consumer is slowing and they are over leveraged on credit. The correction is needed and will come soon. The growth cannot continue at the pace we’ve seen and now the market is spoiled on the positive numbers,” he added.

The CEO of Frankfurt based social Trading Platform United Signals, Daniel Shäfer elaborated on the market turmoil, “The slump of the Chinese stock market and the massive Yuan devaluation have plunged the stock markets into a huge chaos worldwide. On Monday the German DAX dropped temporarily nearly eight percent, the Dow Jones lost more than six percent. Thereby the DAX has lost 20 percent of its high in April this year.”

“The main reason for the crash at the stock markets is not weak economic data. The markets are in total groggy because of increasing interventions by governments and central banks as well as lack of Liquidity from banks due to stricter regulation. The thought of the Lehman collapse turmoil also leads to enormous nervousness among market participants,” mr Shäfer concluded.

Is global markets volatility here to stay?

Several indicators which are tracking volatility have hit alarming levels. The VIX index, which is measuring the volatility of the S&P500 has spiked higher to levels unseen since the post Lehman Brothers turmoil, while the VVIX, which is measuring the volatility of the VIX index has hit an all time high.

The VVIX traded as high as 150, which is substantially higher than in all turbulent times in previous years.

Some analysts have expressed certainty that volatility is here to stay, especially as further news about the state of the global economy start flowing in. Traders are looking actively at the major pairs since emerging markets currencies are still not attractive enough in terms of liquidity and spreads.

At the same time Chinese authorities are expressing some hopes, as the head of the PBOC research bureau Lu Lei said that the move of the central bank to reform the yuan central parity mechanism (read “devalue the renminbi”) will have an impact on the liquidity of the financial system and yesterday’s move by the monetary authorities on China should be sufficient to alleviate any pressure.

We are yet to see if that will indeed be the case, as Chinese stocks have fallen another 1.3 per cent on Wednesday completely reversing overnight gains.