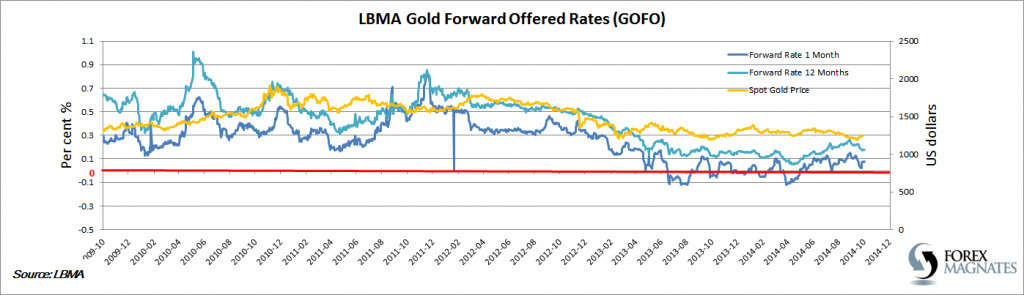

Benchmark forward gold rates continue to hover just above zero after falling in and out of negative rates for much of the past 18 months. With spot gold prices dominating the attention of CFD traders, the underlying fundamental factors that drive gold demand are now most noticeable in the physical gold bullion market on which the derivatives parade of CFD/futures/forward products is based. What Are GOFO (Gold Forward Offered Rates)? These are rates at which owners of gold are prepared to lend on a swap against US dollars. Quotes are provided in 1, 2, 3, 6 and 12 month time frames. The GOFO setters are the market-making members of the the London Bullion Market Association (LBMA): The Bank of Nova Scotia–ScotiaMocatta, Barclays Bank Plc, Deutsche Bank AG, HSBC Bank USA London Branch, Goldman Sachs, JP Morgan Chase Bank, Société Générale and UBS AG. Each day all contributors submit their own specific rates to the LBMA. These rates are averaged across all contributors for each time frame and published at 11:00 GMT. It’s worth bearing in mind that the procedure for setting daily GOFO rates is eerily similar to how Libor rates are set each day. Eyebrow raising similarities with LIBOR aside (and most other benchmark rates), normally GOFO rates are positive, indicating gold serves as collateral for loans against paper fiat US dollars, hence the low interest rate. Occasionally, normality becomes abnormality with rates going negative and can serve as a useful indicator of gold market dislocations. GOFO rates are an indicator of Liquidity and counterparty/collateral physical availability stress in the gold market. Negative GOFO rates indicate that investors prefer to hold physical gold rather than US dollars and consequently are indicative of a perceived shortage in the wider market. Rates Today The 3 month GOFO rate fell below zero for the first time since 1999 in mid 2013 and has since remained below zero for several weeks at a time. This phenomenon is usually closely associated to, and parallels with 'backwardation' - a common term used in futures markets indicating that the price of gold for future delivery is lower than the current Spot price. In other words, gold tomorrow is worth less than gold today.

'Backwardation' in spot/futures pricing in tandem with negative GOFO rates suggests a market disconnect between paper prices and physical prices as the spot price of gold has been falling (despite fiat currency debasement) while the physical price has been rising (despite it being a time of seasonal demand weakness). The rush in to physical gold continues unabated, regardless of the speculative spot market staying weak. In fact, it’s highly likely that the hullabaloo in the spot/futures/options markets is exacerbating the rise in demand for physical gold.

The decoupling of the gold futures market from physical delivery indicates that demand for physical delivery now outweighs supply and growing. The effect has intensified in recent months removing doubts that the phenomenon is a statistical anomaly of some sort, but rather is an indication of an over-leveraged market that is due for a correction, or in other words a ‘re-connect’.

Down the Rabbit Hole

Paper/physical gold market dislocations could also point to a much broader and more pervasive problem in financial markets in general - a broad lack of confidence in the fiat monetary system being ravaged by central banks around the globe. The US dollar and the Federal Reserve stand at the forefront of investor discontent. Demand for gold is outstripping its supply while the major bullion banks try to artificially cap futures (paper) prices.

Confidence in the paper gold market has been dented to a large extent which helps to explain the growing trend of individuals turning to physical gold for investment (and trading) purposes. The understanding that gold is a much more stable store-of-value than fiat money is mushrooming among all investor types, which is leading to an increasing demand for direct physical gold transaction platforms.

Is the paper gold market becoming ‘untrustworthy’? If the spot price of gold is no longer reflecting its true value, there is little investors can do about it aside from invest in physical gold directly.