London based inter-dealer broker ICAP Plc, which operates in multiple financial markets and providing post trade risk mitigation and information services, announces H1 results for its 2013 fiscal year - for the first six months ending in September 30, 2013.

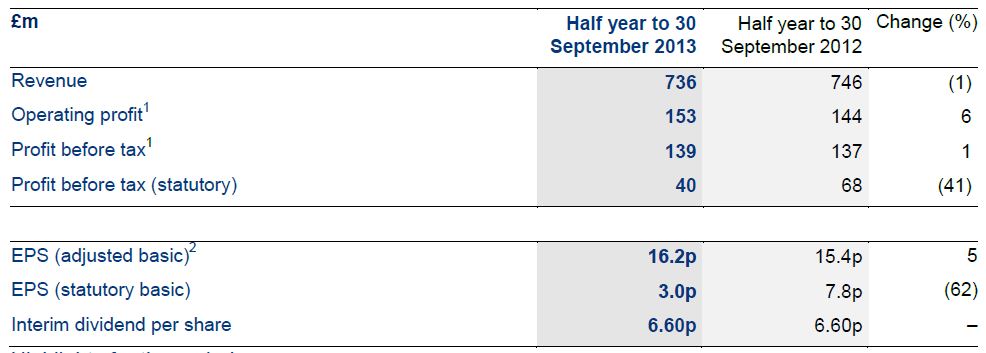

Revenue during the period was lower by £10 mln from £746 mln in H1 2012, to £736 mln in H1 2013 or a 1% drop Year-over-Year (YoY). Operating Profit managed to climb by 6% during the same period, up from £144 mln to £153 mln, an increase of £11 mln YoY.

Subsequently, profit before tax rose 1% from £137mln to £139 mln representing an increase of £2 mln, while on a statutory basis was reported as down 41% from £68 mln in H1 2012, to £40 mln in H1 2013, reflecting a change of £28 mln according to the announcement.

The interim dividend remained at 6.60 pence, even as Earnings Per Share (EPS) increase by 5% from 15.4 pence, to 16.2 pence YoY during the period - although on a statutory basis was 62% lower from 7.8 pence to 3.0 pence during that time. The 1% decrease in revenue was inline with a prior forecast, as covered by Forex Magnates in a previous article.

Source: ICAP

Highlights of the Fiscal Half-year Results Ending September 30, 2013:

- Group revenue at £736 million was marginally (1%) down on the prior year

- Operating profit at £153 million was 6% higher than the prior year reflecting the benefit of the continuing cost reduction programme

- Group operating profit1 margin increased by 2ppt to 21% (H1 2012/13 - 19%)

- Profit before tax1 (“PBT”) of £139 million was 1% higher than the prior year

- EPS (adjusted basic)2 up 5% to 16.2p; statutory EPS (basic) down 62% to 3.0p principally driven by settlement Payments and associated legal fees in connection with the Libor-related investigations

- Interim dividend payment to shareholders 6.60p per share (H1 2012/13 - 6.60p per share)

- Successful launch of ICAP‟s Swap Execution Facility (“SEF”) and the commercial launch of EBS Direct

Michael Spencer, Group CEO, ICAP

Commenting in the official press release, Michael Spencer, Group Chief Executive Officer of ICAP said, “We have made good progress despite the subdued market conditions over the summer and uncertainty created by the implementation of new financial markets regulations in the US. Notwithstanding the decline in revenue and the continued investment in the business, our operating margin has improved, demonstrating the positive impact of the cost saving initiatives implemented across the Group."

Mr. Spencer added regarding the new Swap Execution Facility (SEF) registration the company had setup,“The launch of our SEF in October 2013 was an important milestone and early signs are promising. We are working closely with our customers to help them through the transition to this new trading environment and are pleased with the positive feedback we have received so far. We have also strengthened the management team through the appointment of Laurent Paulhac as CEO of ICAP‟s SEF."

Mr. Spencer Concluded in the press release,“ICAP's portfolio of post trade assets continues to lead the market in offering innovative pre and post trade solutions to meet the new regulatory requirements. The number of customers using triResolve, TriOptima's reconciliation service, has more than doubled during the past year to over 500. Traiana's new real time service for monitoring and managing pre and post trade credit across trading venues, CreditLink, has become the market leading solution for pre-trade screening of transactions on SEFs."

Today's announcement follows the successful launch of EBS Direct, just yesterday, as the company aims to expand its staple EBS platform product which has had dwindling Foreign Exchange volumes as of recently. Shares of ICAP (Ticker IAP.L) on the London Stock Exchange are trading higher by nearly 5% (around the time of publication).