IEX has announced that it has secured

$75 million of funding from venture capitalists and investors. The rapidly growing equity trading venue, made famous by Michael Lewis in his latest book 'Flash Boys', plans to expand its operations by registering as a US securities exchange registered with the Securities and Exchange Commission (SEC) later this year.

If IEX’s application is successful, the venue will be granted the same regulatory status as the New York Stock Exchange (NYSE). IEX has been operating since October 2013 and has experienced sharp increases in daily trading volumes as a result of mushrooming client participation boosted by persistent media coverage. Prominent brokers such as Saxo Bank, Interactive Brokers and TradeStation have all connected to IEX at various stages this year.

A New Dawn?

Brad Katsuyama, CEO and Co-Founder of IEX Group

IEX claims to stand out from the crowd because of its prime focus on ‘fairness’ and providing a level playing field for all investors by removing the speed advantage gained by High-Frequency Traders (HFTs). IEX features a built-in 350 microsecond delay in its order system and uses a flat fee structure rather than the rebate model applied by most public exchanges.

The company’s CEO and co-founder, Brad Katsuyama, made allegations against various US stock exchanges regarding market manipulation and price rigging earlier this year in a televised debate on CNBC.

During the debate Mr. Katsuyama confronted William O’Brien, President of BATS Global Markets (he has since left the firm), alleging that the BATS exchange purposefully prices and matches trades so as to disadvantage clients with slower connection speeds. Mr. Katsuyama said: “The markets are rigged, and you [William O’Brien/BATS] are part of the rigging."

Trouble in Paradise

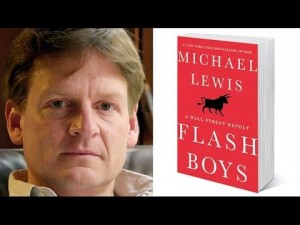

Michael Lewis, Author of 'Flash Boys'

Michael Lewis, the author of the book that has sparked the HFT debate across the globe, claims IEX and Mr. Katsuyama are “trying to solve a problem at the heart of Capitalism – the unfairness of public exchanges."

Mr. Katsuyama’s expressed his view saying, “It should be the markets' responsibility to fairly price trades between fast and slow traders,” and prevent the abuse of less informed and less technologically savvy investors.

“Our intention from day one was to challenge the status-quo by building a market that prioritizes the needs of traditional investors and issuer companies," said Mr. Katsuyama. "We are encouraged by our recent growth, which has been driven by both investors and their brokers. This additional capital enables us to build and operate a world-class stock exchange,” he added.

Since January this year, IEX has tripled its daily trading volumes with volumes exceeding 100 million shares per day in August. However, the trading venue continues to be classified as a ‘Dark Pool ,’ which means the venue is not included in all smart order routers, used by brokers to obtain the most competitive prices depending on which venue they are originating from.

Not There Yet

The $75 million capital raising included both existing and new investors, although broker-dealers were not allowed to participate to avoid conflicts of interest, according to IEX. Investors who participated included Spark Capital, Bain Capital Ventures, MassMutual Ventures, Massachusetts Mutual Life Insurance Company and Franklin Resources, Inc. Other participants included private investment firms, Cleveland Capital Management and TDF Ventures.

Spark Capital General Partner, Alex Finkelstein, will join IEX Group's Board of Directors as part of the financing. "We believe in IEX's vision of next-generation capital markets, and we're confident that the IEX team will successfully change the way that Wall Street operates for the better,” said Mr. Finkelstein.

"We feel extremely fortunate to bring together such an unprecedented and unique group of investors who believe in a common vision – to build a stock exchange in the best interests of companies and investors," said Mr. Katsuyama.

IEX Group's consortium of institutional investors also includes, The Capital Group, Brandes Investment Partners, Greenlight Capital, Senator Investment Group, Pershing Square Capital, Maverick Capital, Scoggin Capital Management, Belfer Management, Kistler Associates and Third Point Partners.