It’s been merely a year and a half after the banking crisis in Cyprus engulfed the FX industry based on the small island bridging Europe with the Middle East. Since then local FX brokers and all companies related to finance have gone through a set of difficulties in maintaining confidence in their operations.

While many brokers based on the island resorted to switching their focus on to their FCA licenses and underlined that no customer funds were being held on the island, but with major global banks instead, these efforts might have to continue.

The Troika bailout and the European Central Bank’s Liquidity programs have stabilized the banking system in Cyprus, but major challenges remain. The Executive Board of the International Monetary Fund (IMF) concluded its surveillance program in the country (also called Article IV Consultation) and has outlined that the local government and the island’s financial system are still facing substantial challenges going forward.

With Cyprus being heavily dependent on Russian capital even before the crisis hit, the local economy took another blow this year from the escalation of geopolitical tensions between Russia and Ukraine, leading to another bout of challenges for the island economy addicted to Russian money.

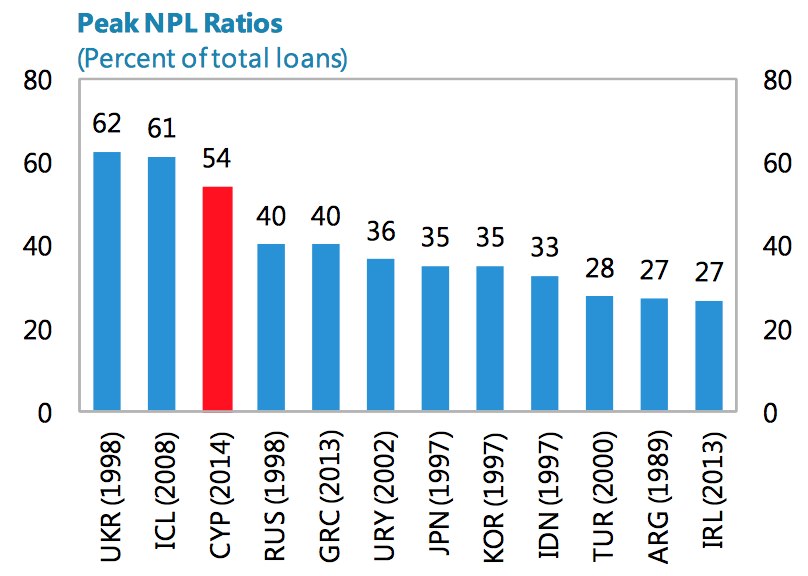

The IMF’s board commended the efforts of the Cypriot government to liberalize domestic payment flows, consolidate public finances and engage in structural reforms, however they outlined the excessive level of non-performing loans (NPLs) which are stifling the economy. At the end of June, those stood at 54% of total loans and summed up to 143% of GDP.

Peak Share of Non Performing Loans in Cyprus, Source: IMF, Leaven and Valencia 2013

The IMF highlighted the need for an effective and fair foreclosure regime, complemented by reforms of the legal-insolvency framework that facilitate debt restructuring and preserve the payment culture. In other words, bringing the two parties to the table for negotiations has to be facilitated if Cyprus is to address the rapidly deteriorating NPLs.

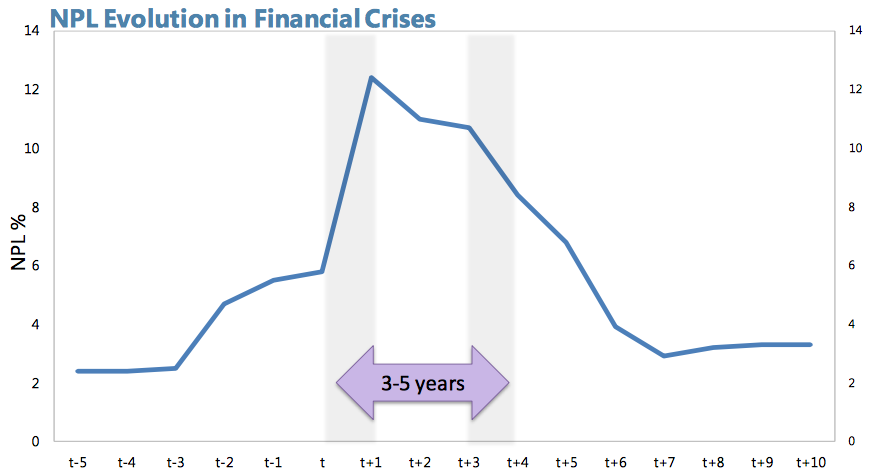

NPL Evolution In Financial Crises, Sources: EBRD & IMF

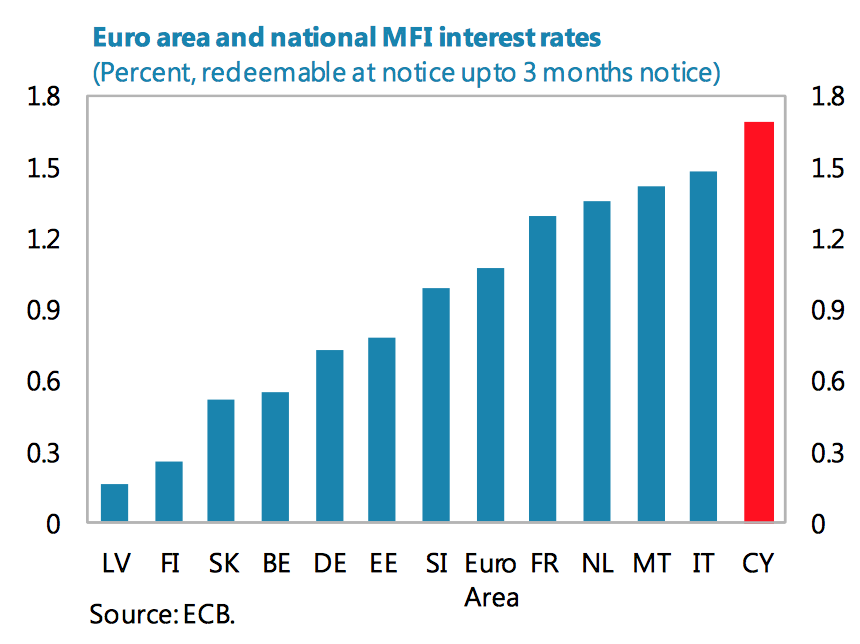

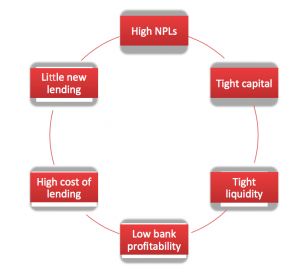

Companies in Cyprus are likely to face difficulties in obtaining cheap enough financing at a time when interest rates around the globe are at all-time lows due to the big share of NPLs in the banking system. This is resulting in an ever revolving conundrum which makes it increasingly difficult for local companies to operate.

Euro Area and National MFI Interest Rates, Source: ECB

On the plus side, many companies from the FX industry have already come to the island well financed and are not required to look for loans once they set foot on the island, so the IMF's concerns might not be relevant to foreign Exchange businesses coming to get established in Cyprus due to attractive tax rates and relatively cheap labor force.

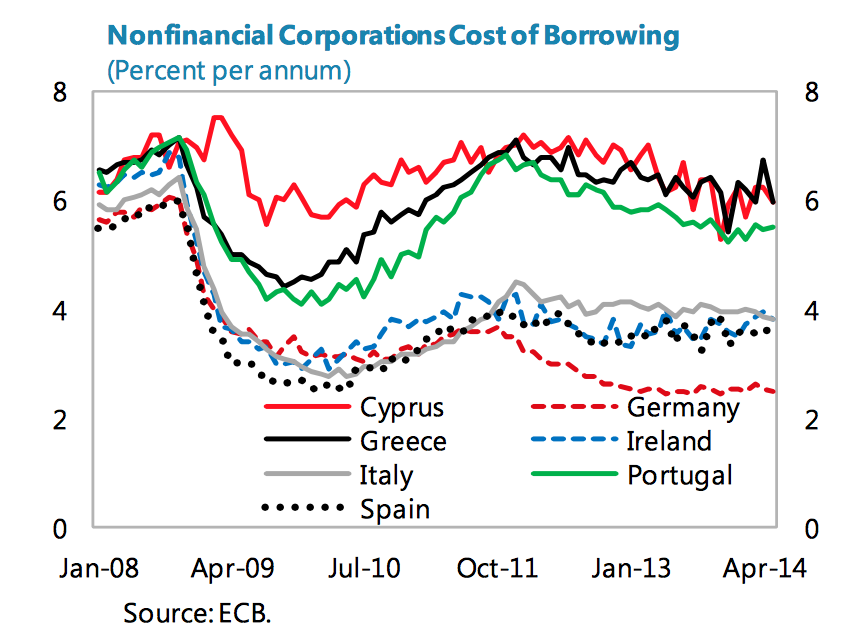

As we can see below, non-bank corporations in Cyprus have a very tough time finding cheap financing these days.

Non-financial corporations borrowing rates across EU, annual %, Source: ECB

NPLs Cycle

Addressing this issue is highlighted in the IMF’s country report issued in tandem with the results of the surveillance program, “while progress has been made to stabilize the banking sector, addressing NPLs resolutely will be key to banks’ long-term viability and the resumption of credit and growth.”

“The cross-country experience suggests that this takes time, but also resolve to ensure that incentives are in place to facilitate the workout of NPLs. The reform of the legal regime for foreclosures and insolvency is a critical element,” the report concluded.