It was exactly one year ago when the Indian currency had been diving in free fall, leaving an even more impoverished middle class and decades long governance model in question. At the time, the Indian Rupee (INR) depreciated 27% between March and August, putting even more pressure on households.

The resulting decline in growth, which was attributed to the drastic decrease in purchasing power has pushed the government to impose unprecedented restrictions on gold imports to prevent an already deteriorating balance of Payments from blowing up even further.

This May, the newly elected prime minister, controversial Hindu nationalist Narendra Modi, swept into power pledging a long needed reform to the policy ways of New Delhi. In the run up to the election the local currency hit its highest level against the US dollar (USD/INR) since June 2013, paving the way for what was about to come.

USD/INR Chart August 2014, Source: NetDania

On August 15th, the prime minister delivered his first Independence Day speech. Confident from his landslide victory, he said, "The economics of the world have changed and, therefore, we will have to act accordingly. The government has taken many decisions recently, made some announcements about the budget and I call upon the world and call upon the Indians to spread the word that if we have to provide more and more employment to the youth, we will have to promote the manufacturing sector. If we have to develop a balance between imports and exports, we will have to strengthen the manufacturing sector."

Will Modi Succeed in His Pledge, and Will India Be Able to Shake off the Weight of Its Balance of Payments Balance?

According to Deutsche Bank’s Global Strategist, Sanjeev Sanyal, the country is going through a serious reform. In a recent publication of the Project Syndicate, he writes, "Modi means encouraging domestic entrepreneurs to manufacture goods for export and inviting the world’s top companies to relocate production to India."

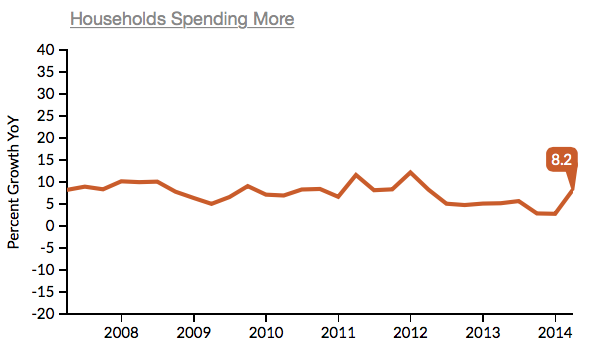

Household Spending in India, Source: Bloomberg

He proceeds with outlining that this effort is important, because India’s economy and exports are dominated by services, which have grown steadily relative to overall output, now accounting for almost 60% of GDP. By contrast, the industrial sector’s share of GDP has remained unchanged at around 26% for the last three decades (the manufacturing segment is even smaller, at 14.9% of GDP).

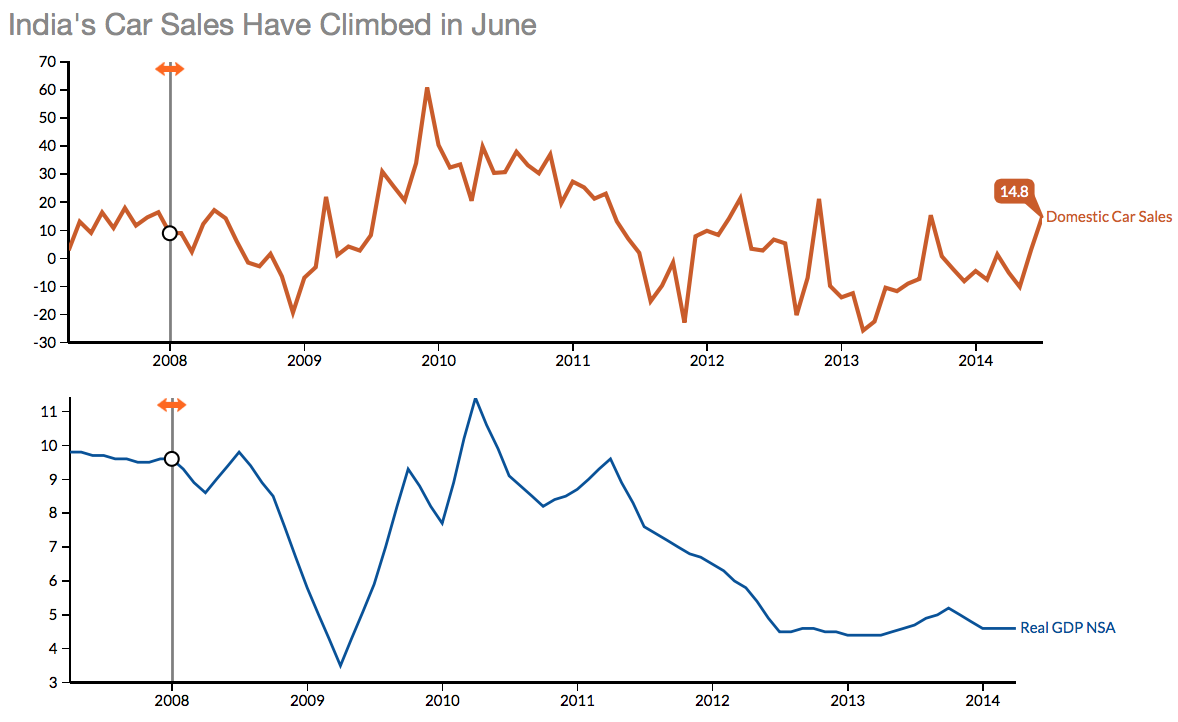

India's Car Sales vs. Real GDP, Source: Bloomberg

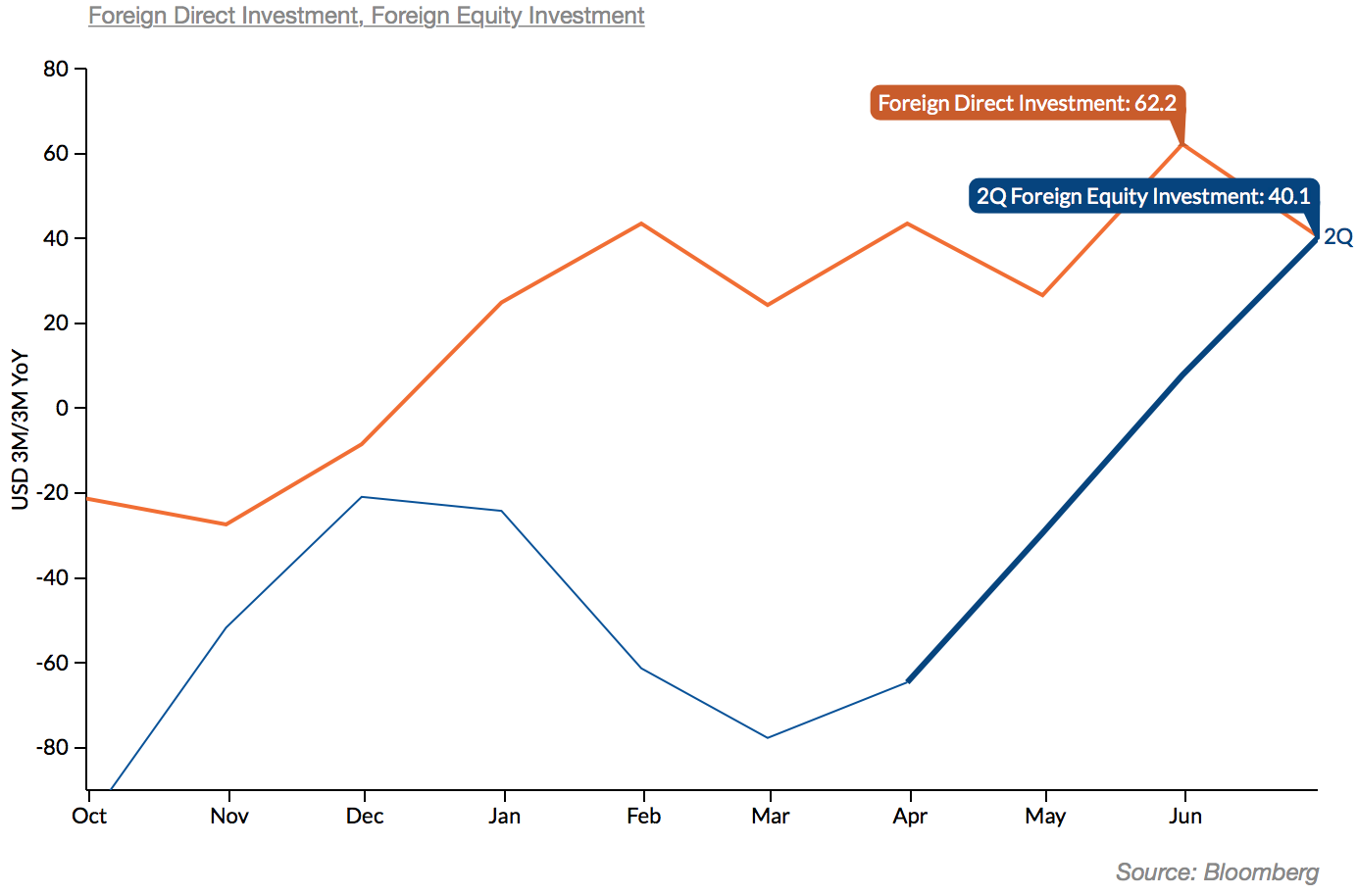

Bloomberg economist, Tamara Henderson agrees, stating in a recent analysis, "India’s GDP growth has stagnated near levels seen during the global financial crisis. However, a marked improvement in sentiment after May elections may lift GDP in the second quarter. Behind the expectation of higher GDP growth are pickups in private consumption and foreign investment."

Record Indian Rupee Trading Volumes in Singapore

Conciding with this outlook is the record interest in trading the Indian Rupee on the Singapore Exchange (SGX). Following yesterday, the Reserve Bank of India (RBI) published its 2013-14 Annual Report, INR futures trading marked a daily record of 10,846 lots, which amounted to over US$350 million in notional value traded.

Market participants were seen in both August 2014 and September 2014 expiry contracts, with the institutional client pool broadening to include banks, proprietary trading firms, hedge funds and asset management companies. The open interest on the biggest FX marketplace in Asia has also grown to 3,076 contracts or approximately US$100 million notional as of 22 August, 2014.

According to a reserach report by Citigroup, "With a cumulative trade deficit (April-July) at $45.3 billion, we maintain our view of a FY15 deficit at $142 billion. Consequently, we expect the FY15 current account deficit to be contained at $39.3 billion or 1.9 per cent of GDP."

Is India to Become the New China?

Colgate Palmolive's Senior Vice President of Investor Relations, Bina Thompson, recently stated during the company's second quarter earnings call, "While organic sales growth in Asia slowed from the first quarter pace, this quarter was compared to the strongest quarter of last year, which saw organic sales growth at a very strong 13%. Macroeconomic factors in China affected our results. And some categories were slowing, in fact that did happen. However, we continued to see strong growth in our other countries in the region, such as India.”

Foreign Direct Investment and Foreign Equity Investment in India, Source: Bloomberg

Whirlpool's CEO, Jeff Fettig, stated, “Our Asia industry forecast is flat for the full year with China being down for the year and India being up. Overall, we remain very confident in the underlying fundamentals of our business and have multiple opportunities to achieve profitable growth.” So is India becoming the new China? There is lots of data supporting such a possiblity provided that Modi continues with brisk reformist policies. Challenges will remain - the country's ailing infrastructure desperately needs investment and despite its tight budget policies Modi may well turn to investment in infrastructure to provide an even better environment for investors. And investors will come and are already there - Amazon is already having a look at the country. The company's CFO, Thomas Szkutak, stated during the latest earnings call, “We're investing in a lot of different areas, including geographic expansion. Certainly in India we're investing very heavily. We're seeing some very positive results there.” Deutsche Bank's Sanyal concludes in his piece, "When Modi’s emphasis on export-led manufacturing is viewed in the context of his government’s focus on heavy infrastructure projects – ranging from power generation to railways – it becomes clear that his growth model, with its mass deployment of labor and capital in industry, looks similar to East Asian countries’ strategy." Buckle up, a new era for India's economy might have already started, bringing to the currency trader's fray another major currency which is much more dependent on market flows than the Chinese yuan.