The European Securities and Markets Authority (ESMA) has published its first report for 2015 outlining the latest developments across financial markets. The study encompasses data collected from July till December of 2015 and highlights the trends, risks and vulnerabilities on the European Union’s securities markets.

An oil supply glut and slowing major emerging markets' growth led to high Volatility in commodities, while the prospects for a European Central Bank led the quantitative easing program in tandem with increasingly hawkish expectations regarding the monetary policy course of the U.S. Federal Reserve, which led to very high volatility across the currency markets.

As market conditions in Europe remain tense, the report outlines high asset valuations, stable asset prices over time, albeit with increasing short-term price volatility across key markets.

The main factors bringing uncertainty to the market are related to the low interest rate environment, public debt policies of EU Member States, strong gyrations in exchange rates and commodity markets, and the existing and prospective political and geopolitical risks in the vicinity of the EU.

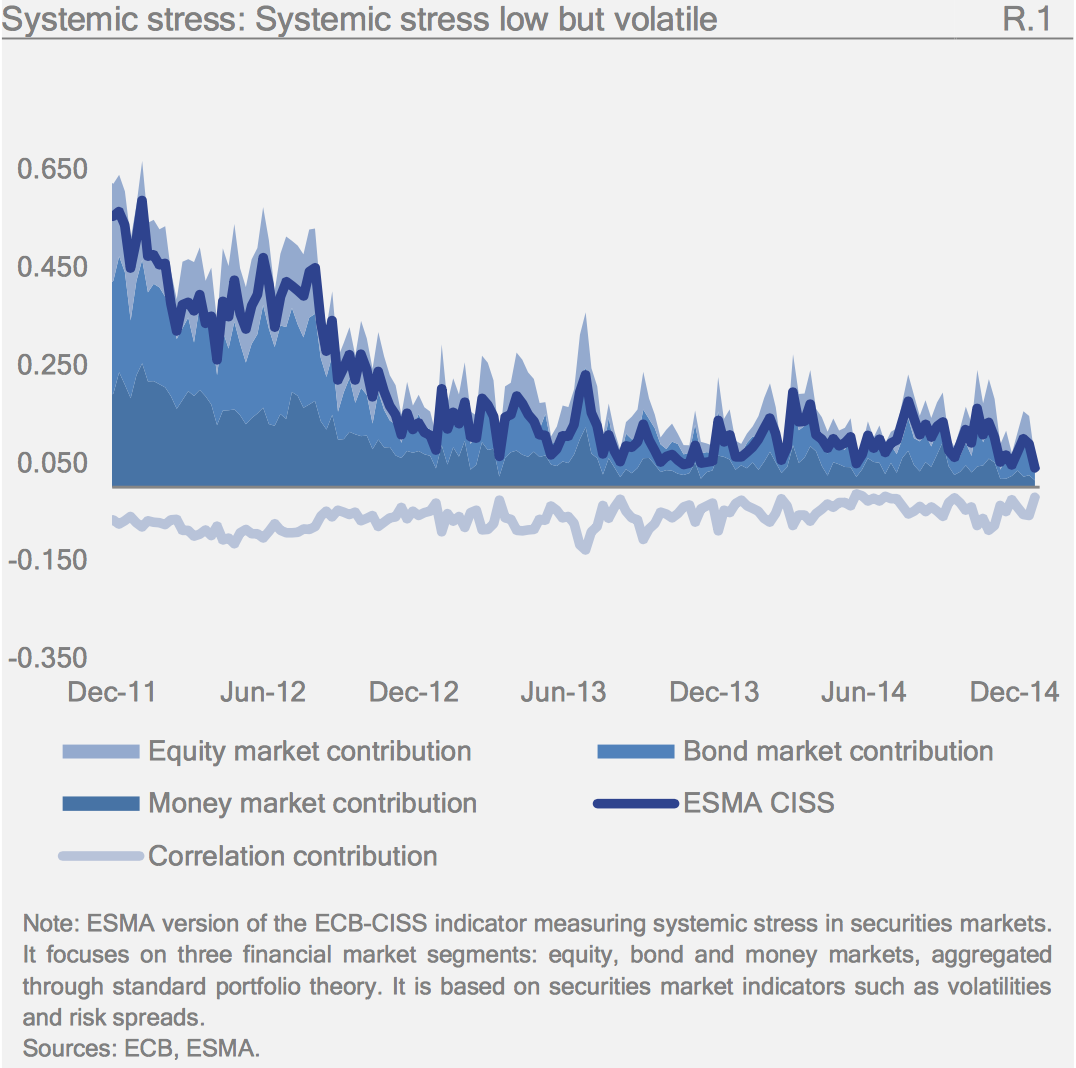

As can be seen below, the overall level of systemic risk has been gradually declining primarily due to the contributions of the ECB to market stability stemming from the introduction of quantitative easing.

Systemic Stress, Sources: ECB, ESMA

The ESMA highlighted increased levels of Liquidity and market risk, whilst contagion and credit risks remained at elevated levels.

Speaking about future vulnerabilities, the ESMA outlined that fund investments in loans have been a growing trend for the past couple of years as Assets under Management multiplied five times within two years creating a big exposure to the loan market.

The hedge fund industry represented another point of risk focus for the European regulatory body.

As part of its ongoing market surveillance, ESMA will update its report semi-annually, complemented by its quarterly Risk Dashboard.

Below is a copy of the full report by the ESMA for the second half of 2014.