After a busy year expanding its global footprint, the IntercontinentalExchange Group, recently renamed to reflect its mega acquisition of the NYSE Euronext entity – which has since merged into its new Group structure, today announced record volumes for 2013 in its futures business with December ADV up 16%.

The dual-headquartered group, reported from one of its head offices in Atlanta, that daily volumes were higher for both its December monthly metrics and Q4, which increased 16% and 6% respectively – when compared to the same period in 2012. Full-year 2013 volumes reached a record 852 million contracts, up 1% from the previous year.

According to the official press release, ICE will report one consolidated segment for the last quarter of 2013 (Q4), and Euronext will be reported as a separate segment beginning in Q1 2014. Additionally, with regards to post-Merger reporting, ICE expects it will classify certain of NYXT's business lines to discontinued operations in the company's financial statements beginning in Q1 2014, as it had previously announced plans to transition away from certain business lines.

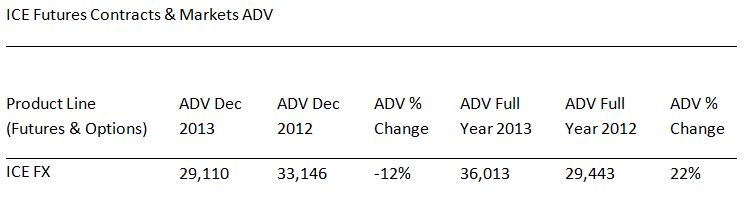

ICE FX products including futures and options for the U.S. Dollar Index and foreign Exchange , had December ADV drop by 12% in December when comparing year-over-year (YoY), while full-year 2013 volumes of 36,013 was up 22% from 2012 full-year totals of 29,443. An excerpt from the official press release shows ADV for its ICE FX products line.

Source: ICE

In the upcoming January volumes release next month, ICE volumes will include the legacy NYSE Euronext businesses and will be distributed on the third business day of the month, as per the press release, and ICE will report fourth quarter and full-year 2013 results on February 11. Shares of ICE on the NYSE are trading up nearly nine-tenths of a percent in this morning's trading session in NY, around time of publication.