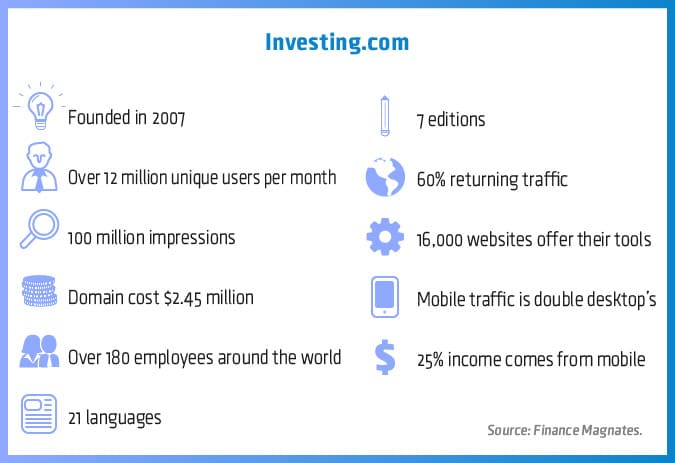

Investing.com is one of the most powerful brands in the Online Trading industry yet it’s not a broker. Within the world of financial websites, Investing.com ranks among the top five sites globally (according to Similar Web) and it’s the number 1 in a range of local markets. with 21 languages and 7 local editions, a mobile offering and apps, Investing.com offers real-time quotes, charts, directories, up-to-date financial news, technical analysis and financial tools.

The new world of online trading, fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Investing.com has been growing fast since being founded in 2007 under the ForexPros brand, it now reaches over 11.5 million unique users per month, while it employs over 180 people around the world. Starting as a Forex related site, it famously broke out of the FX niche after paying $2.45 million for the Investing.com domain. Finance Magnates sat down with the co-founder and CEO of the company, Dror Efrat, to hear where it is headed next:

Investing

"Due to our unique position in the industry we probably know the B2C market better than anyone out there, in terms of our performance rate and the positive proven results we’ve had in this field. At present the mobile world offers a very interesting prospect and we have valuable insights that can help a lot of players in the market - especially brokers.

Historically we started out as a small operation focusing only on forex, and we learned a lot about how to handle media, SEO, and conversions. We started building our platform with an emphasis on a multilingual offering – it’s not that no one offered multilingual at the time, brokers did, but for publishers this was indeed innovative.

Looking back at it, the fact that we were always a step or two ahead of the industry with regards to how we understood the development of the industry really helped us to stay at the cutting edge and grow. And within these steps the fact that we started with multilingual from the get-go was the key factor in how we got to be as big as we are today.

On the competition

If you look at the giants in the financial website world, they are divided into two main groups: content writers and content aggregators. Content is very hard to create at a high level in a multilingual fashion and on a global basis – you need a lot of local writers with local knowledge and the costs are very high. This makes it very hard to be a global player. For example, look at Dow Jones (owners of the Wall Street Journal and MarketWatch), they mainly write in English. It’s true that they have US, Australian and UK English editions but that’s as far as it goes. Business Insider is mainly English, Investopedia is mainly English and Seeking Alpha was not able to break out of the English bubble. CNBC is dipping its toes into the multilingual arena now that they have an Arabic site but it’s not peaking up .

So who did succeed in becoming multilingual? Not the content writers but content aggregators. Look at Yahoo! Finance, Google, MSN – they said we know technology, we know how to create a platform that receives data (text, images and video) in multiple languages. And they became global players by taking content from here and there and completely shocked the industry. They surpassed the traditional content writers and are now by far the biggest players in the world in terms of online traffic compared to the most widely known names. The reason for this is that the old established brands all came from the world of print publishing, and so they moved their content online – they do not look at it as online natives like us. They are looking to win the next Pulitzer prize or launch a new section on a subject they think shall interest readers. Yet we are looking at it in a technological fashion, in terms of traffic as an online business, we are also looking at monetization in a vastly different way.

Ten billion eyeballs

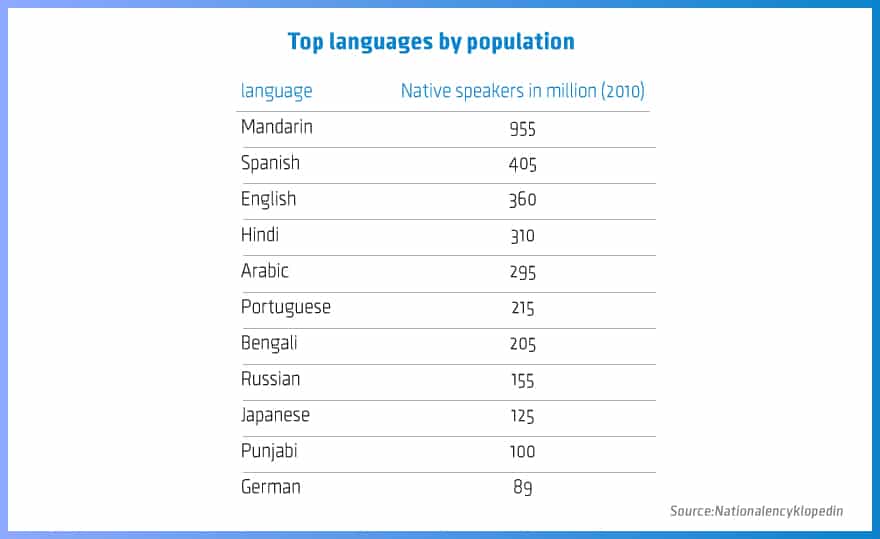

The fact that we operate on a global basis allows us to target a huge potential market of five billion potential users and not just the English worldwide audience. We calculate that less than 1% of the people in the world are interested in trading (and only 8% of our readers are women), but in general our potential audience is five billion.

At the beginning we developed sites for lesser spoken languages in Europe but given time we learned that we have better alternatives from a business point of view. For example, after eight years of operating in Finland we now have 5,000 sessions per day on the site, but after just over a year of operations in India our Indian edition now has over 55,000 sessions per day and the growth rates demonstrates that moving forward, it will be one of our biggest markets in just a year or two. In addition, we discovered that in developing countries, where our competition isn’t as fierce, the high-level tools that we’ve built (calendars, graphs, quotes and predictors) are helping to place our brand head and shoulders above the rest due to the lack of competing equivalents.

In Germany, the UK and the US there are respectable offerings and in France there are some solid platforms but as you leave the western world the competition offering is poorer. In the Russian language we are the largest platform, in Turkey we are the fourth biggest in the financial niche and growing fast.

So we looked at this and took a pause. We decided to focus on adding countries that meet these terms: tens of millions of potential users (rather than just millions) and preferably with hundreds of millions. So we started covering Indonesia, Malaysia, Brazil and India as well as China. China has presented license problems which meant we were not able to place servers there nor be ranked on Baidu but our lawyers tell us that we’re a couple of months away from getting our ICP license, a one that will allow us to operating fully in China. Currently it takes four minutes to load our Chinese language site on the mainland which is a non-starter for real time quotes, for example.

Another thing that we did is create local editions but there was a danger that it would negatively affect our SEO rankings. Through our triumphant efforts we’ve become experts, ensuring that our English-language local editions in the US, the UK, Australia, India, and South Africa are not considered as duplicate content by Google.

On dependence on Google SEO

It’s a dependence that isn’t comfortable. It’s a bit disturbing and if you don’t know what you’re doing it is a punishing system. On the other hand, if you operate carefully you can hope to minimize your risk, and if you know how to successfully play around with it, it has a lot of benefits. So the coin has two sides and you always hope for the best.

Mobile

Thanks to the multilingual approach and the local editions, I believe that we have a lot more space to grow. We only began to enter some markets with local editions in the last year and half so we have only just scratched the surface, and the growth factors are so great that the market potential ahead of us is insanely big. Who knows us in the US? India? China? I talk to people in lots of countries and people never heard of us. In Russia we are well known, in Turkey, Spain and Italy we are known, but in the rest of the world we are nowhere to be found - and from a growth point of view this is our biggest advantage.

This is even more the case in the mobile segment where, if you look at apps, there are simply no multilingual players other than Investing.com, which truly amazes me. Though it is no secret that mobile is taking over quickly, none of the biggest players are fully there - even Google, MSN and Bloomberg have only two or three language apps. We have our entire arsenal of languages as apps. We have 21 languages (and another one in development) and way more than the 7 local editions over the web because in the apps the SEO rules of the web do not apply.

As a result, we are the only player in town that is playing a truly global multilingual game. As such we can get partnerships with mobile carriers and mobile producers as well as tablet and laptop makers like no other player can. These partnerships will greatly help our growth as they potentially bring millions of downloads rapidly and millions of users that will not need to download it at all. This is similar to the partnership that Apple has with Yahoo, where you can see financial news and quotes over a widget directly on the iPhone without downloading anything. The deals are in the works so I can’t name names, but I will say that our soon to come partners are among the top ten producers globally and they chose us because we are the only ones that can offer a solution covering most of the world languages.

Stats and goals

in our case, content (news + analysis combined) generates 6% of our traffic, the rest relates to the many tools and quotes we offer – this is exactly what we wanted people to use us for – to be the working office for the trader. 60% of the Investing.com traffic is returning traffic, which means that people are initially referred to us by Google, referring sites or a friend but then they come back every day, which is a sign that we are doing a good job. Our goal now is to improve on areas where others are offering better services, such as content that we didn’t have originally, and now our goal is to aggregate content that will be just as good as other aggregators’ in terms of both quality and quantity. Video is another goal, now in its infancy for us. Video is a big thing on mobile - I watch a lot of videos on my mobile because it’s easy and convenient and kills time when you are travelling – so this is a segment we have to be in. This is true for revenues but also for user experience – people like it.

If you look for example at our entrance to the world of stocks, it was costly (connecting with exchanges) and painful (changing technology) and it took us three years to build the infrastructure and it’s still an insignificant part of our operations – but it’s an engine that will drive us forward.

Mobile in our case (apps + mobile sites) generate for us double the number of page views than desktop, even though we released the Android apps less than three years ago and the iOS less than two years ago. For comparison, our desktop offering is nine years old now. Though mobile is already leading the way and growing faster, I believe that users will always continue to use the desktop solution, because the trader finds his phone too small to be the hub of his working office. Mail opening has grown to 60%-70% on mobile and 50% of trading for some brokers is already done on mobile as more brokers as of late have manage to generate and to convert new customers over that platform.

Investing.com is the only light in the darkness of mobile forex publishing

Generally speaking, if you are not on mobile you will not be a player going forward. I look at players in our industry, publishers, and they are not there. Most of the financial sites are not really there and specifically in forex it’s complete darkness – in terms of the level and the depth of the products, the level of seriousness (or lack of it). Some platforms are done well but generally speaking I am amazed by how forex is lagging so far behind, and how no one realizes that this is where the world is moving towards, and moving fast.

I analyzed why it happens and I came to the conclusion that publishers have not found a way to make money on mobile. It’s very hard to make money on mobile - banners don’t work so well and mobile banner CPM rates are relatively low if compared to the desktop. Only recently but increasingly changing is the broker’s ability to convert customers on mobile. Some brokers by now have a decent mobile operation and marketing abilities and they have learned how to work with the play stores. So historically publishers asked themselves, “Why do I need to make this multimillion dollar investment when I can’t make money from it?”. We have said from day one that we will find a successful way to make money on mobile - if everyone (readers and traders) is using it, there must be a way to make it happen. Just look at Facebook - it was not financially successful until it cracked how to make money on mobile, and from that moment it really took off big time. Most of Facebook’s income is from mobile according to its financial reports.

A few months ago we discovered a major breakthrough for our industry in terms of how to economically generate live accounts on mobile for brokers. We added a ‘trade now’ button to our mobile apps that sends the traffic directly to download a broker app from the play store and finally everyone is being rewarded.

Already 25% of our income is generated from mobile activity and quickly growing. I estimate that it will reach 50% within the next two years. This is a very beneficial revenue stream for us so to get to this point after such heavy investment of money, time, effort and patience it is very satisfying. No other publisher was willing to make this investment, so now it seems that our leading position is riding high.

As far as publishers go, the mobile environment is a complete game changer in terms of global player’s dominancy.

With the desktop platform we entered a mature market place, yet we found our niche and we have grown, more so than any other player in the world. If our growth rates continue on the same level, within two to three years we’ll probably be the biggest in the world, bigger than Yahoo! Finance.

Looking for a strategic investor?

By definition, we are looking for a strategic partner. As far as I am concerned, the partner can enter with a small percentage of ownership if they want to. Why? Where is our problem? When you look globally we are huge, but in the U.S. we’re not well known. If you’re not known in the U.S your brand recognition will never reach it’s true potential around the world. The power of a U.S. brand partnership will give us access to more attractive deals with higher value advertising partners. With years of hard work and perseverance we could establish our brand in the U.S under our own steam, but alongside a strategic partner with a strong presence in the U.S, this shortcut will provide a significant acceleration of our brand recognition and business development in the U.S. as well as globally.

Such high value deals are starting to happen for us but it’s much harder without a strong US brand. The re-branding that we did was a business masterstroke – as under the ForexPros brand we could not get through the door. Today, presenting ourselves as Investing.om, we’re taken seriously and our old name no longer hinders wider business relationships.

There are a small number of players that could be a match for us as a strategic partner. It’s not an easy ask to find someone that is right for us, but we are doing well regardless.

Next moves

A mega master affiliation system and entering into the personal finance arena are two new and imminent significant profit centers that we’re focusing on. And so moving forwards we will turn our great marketing machine not only towards brokers but also towards credit cards and insurance. Once we reach high volumes in different countries this will generate a lot of revenue pretty fast. We have been working on the master affiliation for the past two years and it’s now showing some initial results.

If we send traffic to our Investing-Deals.com site (Investing-deals is our site for traffic associated with our master affiliation operation), we get a 50% higher rate of conversions than when sending the same traffic directly to a single broker’s landing page. Investing-Deals.com offers a directory of brokers which we have an affiliation partnership with and being geolocation sensitive it gives you brokers that operate in your country, as well as links to our Investing.com content sites. It projects greater reliability because it offers options, people like it more and it accelerates our growth rate.

Throughout the years we’ve had 16,000 sites that took tools from us on the basis of an Iframe (100 million impressions), with a ‘take action’ button that we can direct towards Investing-deals. For our affiliates this is a better deal because of the higher conversion rates; the brokers will get more traffic and we will earn from the added traffic that will reach Investing.com through Investing-deal.com so everyone will be satisfied.

Tomorrow we could use it for credit cards and then all affiliates that know how to work with credit cards can direct their traffic to Investing-deals as well.

We are now A/B testing and in just a few months everything will be optimized. In a year from now it will be a killer machine with real-time data mining for determining best performance for making money."