One of the leading leading execution and research brokers, the Investment Technology Group (ITG) (NYSE:ITG), announced the launch of an additional tool to compliment its ITG FX Trading Cost Index. The ITG FX Volatility Index (ITG FXVX) represents a daily benchmark forecasting FX volatility in the coming trading day by analyzing historical data and adjusting for implied volatility and recent FX volatility trends across deals and ECNs on the previous trading day.

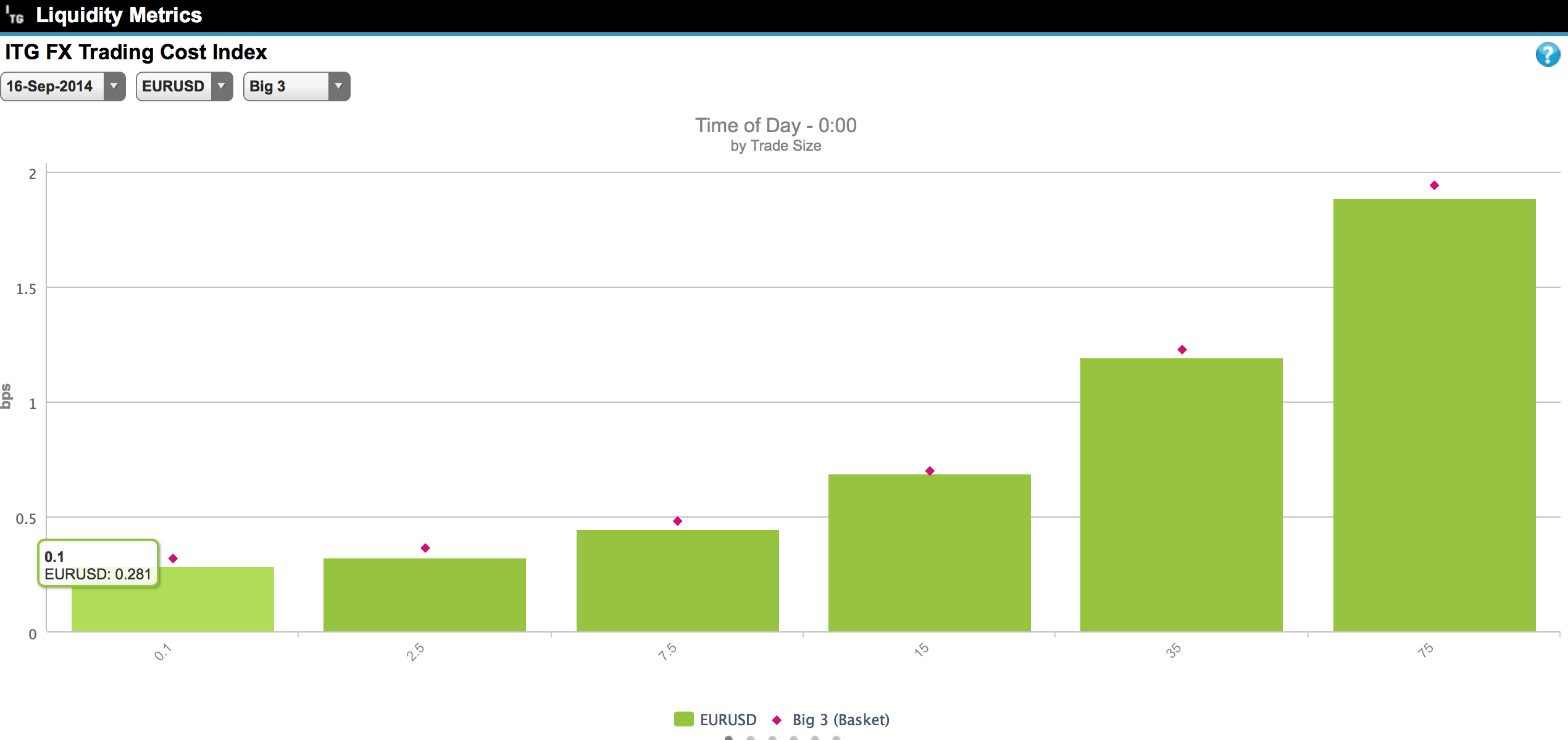

In addition the company has introduced a new set of FX aggregates to its existing ITG FX Trading Cost Index (ITG FXCX). There are now 5 currency aggregates - Asia Pacific, Big 3, Commonwealth, Emerging Markets and Europe with an increased number of 20 currency pairs.

The company’s Managing Director Ian Domowitz said that "The new ITG FX Volatility Cost Index, together with the enhanced ITG FX Trading Cost Index, enable foreign exchange traders to estimate trading costs and potential price slippage from volatility before placing trades.”

He added that "Both tools are available via a free web-based mobile app, offering an easily accessible reference tool for anyone seeking insight into FX trading.”

ITG FX Volatility Index

ITG started its effort with the intent to bring transparency into the FX market. Institutional investors and corporations which are dealing FX in large size have gotten the opportunity to gain access to some very useful data.

ITG FXCX brings to the table an attempt to provide the cost of Liquidity across multiple currency pairs for various deal sizes and times of day. For reasons related to being technologically able to calculate an index up to $75 million is enough for the first attempt to display to the industry a cost of liquidity from a variety of sources - both from ECNs and dealers.

The index is an estimate of the average cost of liquidity for predefined deal sizes and designated points in time. It comes from a calculation of actionable quotes (not indicative) and gathers data from a combination of 12 dealers and 5 ECNs according to information obtained by Forex Magnates.

The dealer community includes 6 of the largest banks that account for roughly 36% of FX market flows. ITX is also using a feed from an interbank broker-dealer and captures about 40% of the total ECN volumes in terms of the quotation screen.

ITG FX Trading Cost Index

Based on that information one can construct the analog of a limit order book for the FX market. The deal sizes at the top of the book are usually pretty small, but this can be constructed down to 12 to 17 price levels, which enables the construction of cost of liquidity for the various deal sizes.

With the addition of the ITG FXVX the information can be very useful to both traders and brokers - essentially to the whole FX market industry. Just recently we have seen record volumes in the first part of September and share prices of publicly listed brokers have started to recover after a dismal first half of 2014 which lead to weak quarterly earnings reports for major US listed companies FXCM and GAIN Capital.